Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Perhaps the simplest, albeit a little crude, way to gauge longer-run market trends is to gauge where the greenback trades against G10 peers in relation to key moving averages. EUR/USD, for instance, now trades above both the 100- and 200-day moving averages for the first time since late-summer.

_Daily_16_2023-11-16_13-04-09.jpg)

Things aren’t, however, quite that simple. Elsewhere in G10 FX, having notched its worst day in a year against a basket of peers, the greenback has shown some tentative signs of recovery, with that decline being followed by consolidation, rather than deepening losses.

The dollar index (DXY) has managed to hold above its own 100-day moving average, while also keeping its head above the psychologically important 104 handle, even if price does continue to trade close to its lowest levels since September. Meanwhile, cable rejected the briefest of forays above the 1.25 figure, as both the AUD and the NZD have retreated back under 0.65 and 0.60 respectively, though disappointing Chinese housing figures are also playing a role here.

_2023-11-16_13-06-14.jpg)

It appears, then, that all may not be lost just yet for USD bulls. One must, therefore, question the factors that are driving the USD, and where the balance of risk lies.

Rates, clearly, remain a key driver of the buck, though any bullish impetus looks unlikely to come from the fixed income space for now. Markets are clearly of the belief that the FOMC’s hiking cycle is now over, with OIS pricing no chance of any further tightening, leading to a high likelihood that Treasuries, particularly at the long-end, are unlikely to re-test the cycle high yields seen in mid-October. While further selling can’t be ruled out, particularly with the long side likely rather crowded, yields do seem likely to continue heading lower from here, as disinflation continues into 2024, and the strong economic momentum exhibited by the US economy for much of this year somewhat fades.

It is, however, important to recognise that, while pricing no further tightening, money markets do price an aggressive pace of easing from the middle of next year onwards, with around 100bp of cuts priced by next December. This is a pace that the FOMC are likely a little uncomfortable with, given that maintaining tight financial conditions is seen as essential in returning inflation back to the 2% target over a reasonable timeframe.

This does pose a rather tricky communications problem for policymakers, as markets look ahead to the December FOMC meeting. The statement is likely to be tweaked to reflect the inevitable, that further hikes are off the table, though the Committee will need to do this while, yet again, trying to drum home the ‘higher for longer’ message. As such, the ‘dot plot’ is unlikely to pencil in any more than the currently foreseen 50bp of cuts for 2024, though more explicit pushback is likely to be required in order to drive the dollar sustainably higher.

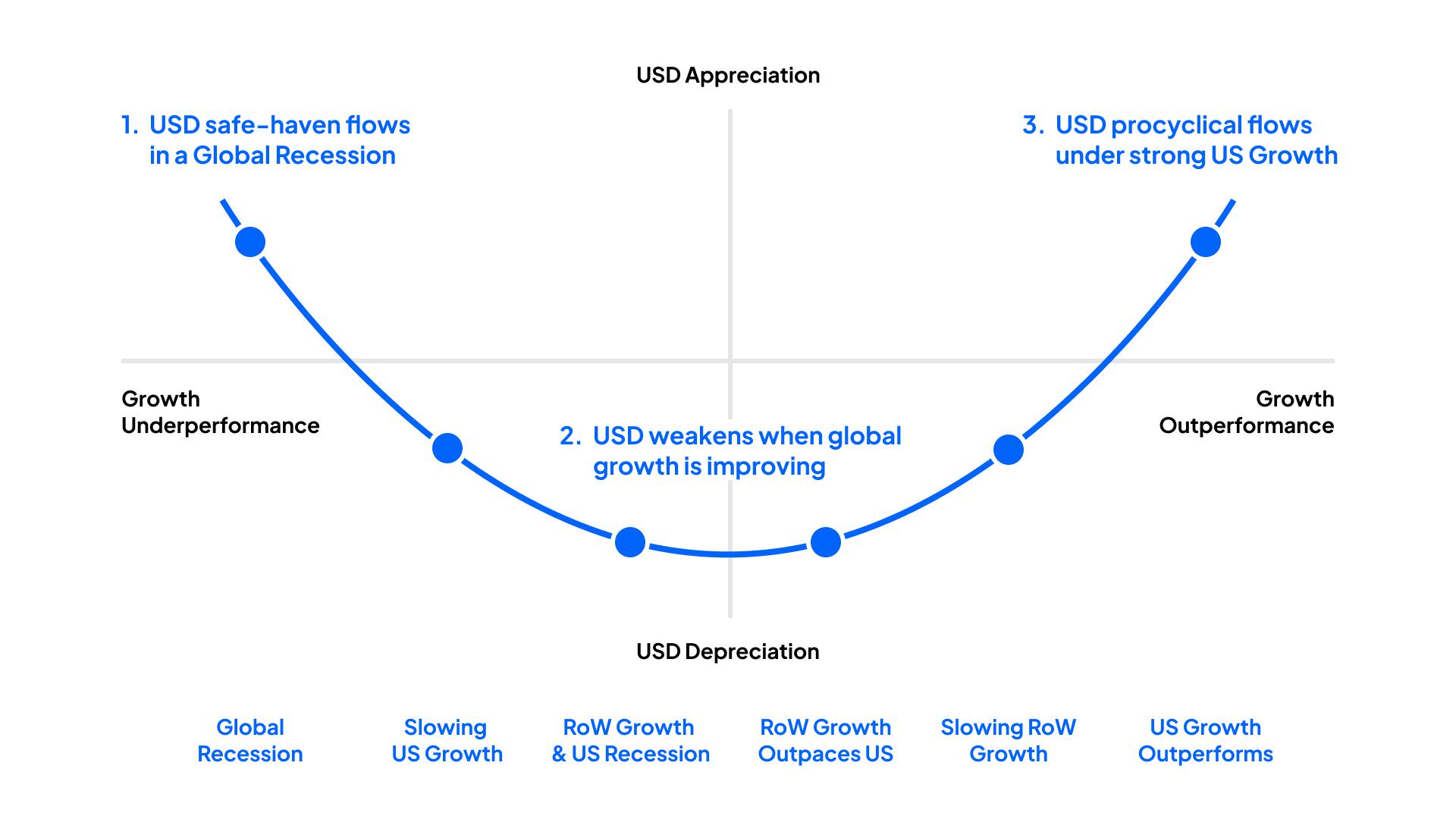

Consequently, with policy differentials no longer looking as favourable for the greenback, and growth continuing to slow, we appear to be moving towards an environment where markets reside in the middle of the ‘dollar smile’, a stage where the USD tends to struggle against its DM peers, as policy and growth divergences narrow in favour of the RoW, and as haven demand dissipates.

Such an environment, however, should be a positive for riskier assets, such as equities. The S&P continues to enjoy a positive week, consolidating the recent advance north of 4,500. Things appear to be setting up well for a rally into year-end, with seasonal trends remaining favourable, and the usual round of pre-Christmas portfolio manager window dressing yet to commence en masse.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.