- English (UK)

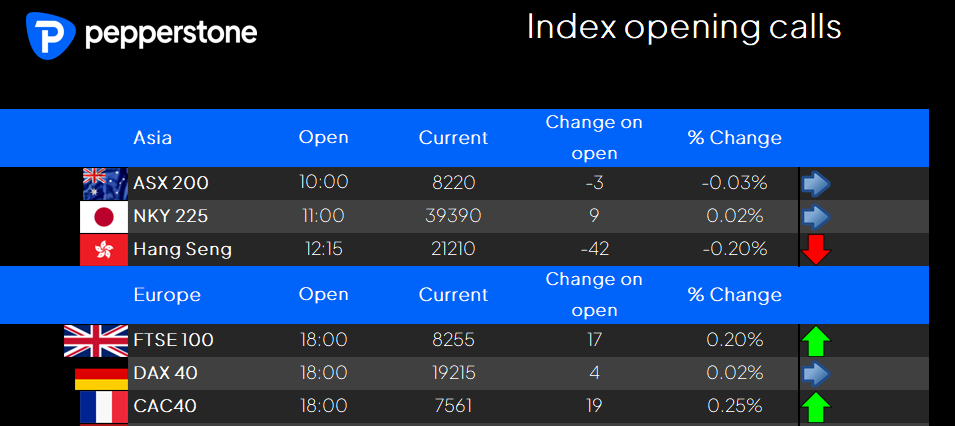

Any sanguine open for the HK50 and CHINAH is unlikely to last long, as these markets remain volatile, and one can assume that will again be the case through trade today.

US data did get some focus from traders, and promoted some initial intraday volatility, with US core CPI coming in modestly hotter than the analysts’ consensus at 0.3% m/m (3.3% y/y), although the market was positioned for this upside surprise, guided by where CPI fixings were implying. At the same time, US initial jobless claims jumped higher to 258k, and while this rise occurred in some of the Southeastern states affected by Hurricane Helene, we did see a 19k rise in claims in states such as Ohio and Michigan that weren’t weather impacted. So, in all, it was a messy result for the market to digest.

The net effect of the data was an initial move lower in US 2yr Treasuries, which, in turn, modestly weighed on the USD, while also bringing out sellers in S&P500 futures. Comments from NY Fed president Williams that he is “increasingly confident inflation is getting under control” was somewhat reassuring for risk, although there was some offsetting factor from Fed member Bostic’s remarks in the WSJ that he is “keeping the door open to skipping a rate cut in November” – a factor that won’t surprise too many who observe the Fed’s recent dots.

The US 2yr closed 6bp lower at 3.95%, with US interest rate swaps pricing around 20bp of cuts for the November meeting, and 44bp of cuts for December. The flow-on effect into the USD shows a mixed picture on the day, with USDCHF and USDJPY tracking 0.5% lower, with USDJPY shorts now wanting to see a break of Tuesday’s pivot low of 147.35.

EURUSD saw good selling flow through most of US trade, with the ECB’s minutes detailing increased concern on the EU’s economic outlook, although that won’t suspire given the comments of late from ECB speakers. France’s budget for 2025 (E41.3b in spending cuts, E19.3b in tax hikes) targeting a 5% deficit wasn’t overly market-moving – either way, the move lower into 1.0900 was met with solid support and EURUSD settled out the day unchanged. High beta/risk FX has outperformed, with the ZAR, NZD and AUD finding some love, with commodity markets offering tailwinds with iron ore futures +1.7% in the overnight session, copper +1.1%, with gold and crude working to the upside.

Crude (+3.1%) has been the standout market for those who gravitate towards intraday movement, with Brent crude and gasoline futures having a solid intraday trend day, with one-way buying flow seen from the start of US trade. Defiant rhetoric from Israel’s Defence Minister keeps the market on edge for retaliation, and traders – while increasingly fatigued from watching headlines – know that breaking news that could ramp up the probability of an Iranian crude output being disturbed is still very much in play. One could argue that the gold market is finding support for this dynamic.

As we look towards the final session, traders once again consider the possibility of gapping risk driven by weekend news flow. Geopolitical headlines remain a threat, and we also hear from China’s MOF on Saturday, where we expect further colour on fiscal rollout, although expectations for real substance will remain in check, as we all saw how sky-high expectations into the NDRC’s press conference earlier this week resulted in some extreme unwinds of long positioning.

Certainly, the MoF’s presser could be enough of a catalyst that many short the HK50, CN50 or CHINAH indices, copper, and AUD will continue to cover positions into that risk.

US PPI is also due, and the outcome here will galvanise expectations for the core PCE inflation print due on 31 October. Equity and US index traders will have JP Morgan, and to a lesser extent Wells Fargo and Blackrock on their radar, with earnings dropping in pre-market trade. The options market sees an implied move in JPM on the day of -/+3.4%, which suggests some upbeat movement in this well-held name, and longs will want compelling guidance that pushes price back above $220.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.