- English (UK)

It is all FOMO, TINA and MOMO, but behind these factors is the bond market, and fixed income holds all the answers for all markets. Rather than put out a rant on what’s going on, I have put this short video together on the subject which I hope explains the fundamental reasons inspiring huge buying in equity markets and dictating flow in risk FX and commodities.

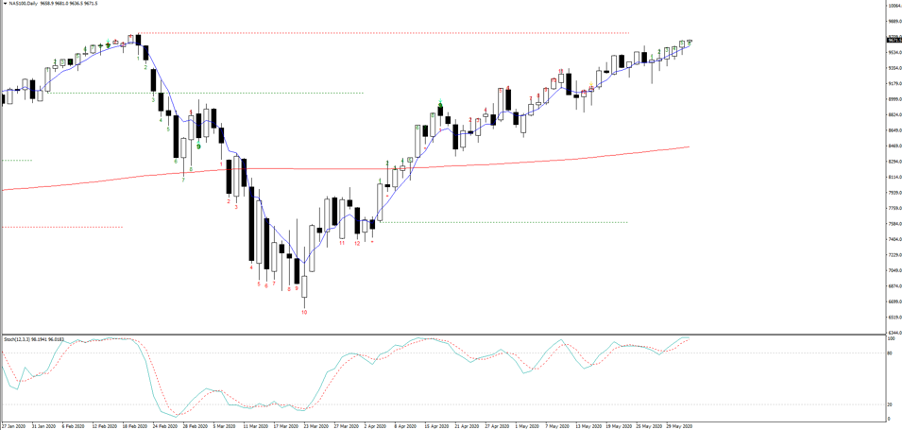

Daily chart of NAS100 – the all-time high a whisker away

I have covered a number of charts and looked at the technical set-up as well as the price action and hope they portray the fundamental narrative.

The bullish trend is obviously mature, but it is not over loved and regardless of the asset class or instrument I am not seeing euphoric conditions yet, which is bizarre given the moves.

Granted, we are going to start seeing profit-taking from various factions of the market participants but the trend followers, many who are making a killing in the market, will not get out until their rules dictate. These trends end and we see funds moving out of longs when the bond market sells off, and real yield moves higher. For me, that is key, as I feel it is for the USD. For those who missed my dive into the greenback.

I have taken profits in CADJPY ahead of tonight’s BoC meeting but will update any new ideas on Telegram or tomorrows note.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)