Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Few in the market would have guessed that a move to greater flexibility in the BoJ’s YCC policy, where they’ve offered the very loosest of guidance that they will allow the 10yr JGB some wriggle room above 0.50% but run a hard cap at 1% - would see the JPY resume its sell-off – but here we are.

The market has clearly learnt a lot here, and while flexible YCC is not the same as a full removal of the YCC band, the fact we’re above 143 and moving higher has shocked many in the market.

Positioning (solely in the weekly TFF/CFTC futures report) details that leveraged funds are net short 40k contracts of JPY futures. This has been the right position, and today's 1.6% YoY decline in Japan's real cash earnings YoY would have offered increased confidence to be short JPY – notably vs the USD and GBP.

The wage data justifies the BoJ’s constantly accommodative stance on monetary policy and that entrenched view that the risks to inflation are still seen lower.

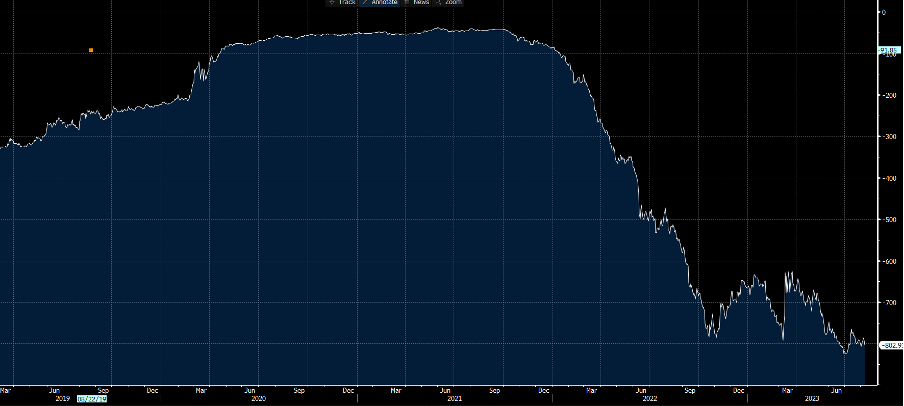

Carry is still a huge JPY negative - We can look at 12-month JPY forward points and see these at -805, which is as low as we’ve seen, ever. This is ‘carry’ in its purest form, and it is one of the biggest carrots driving the JPY.

Corporate treasury departments can lock in interest rate risk and buy USDJPY down at 135.61 in 12 months’ time if they wish.

Of course, this is set by relative interest rate and interest rate parity, and while we are sensing peak fed policy, we’re also far away from the BoJ moving away from zero interest policy.

What derails carry?

It seems if we are to truly see a sustained rally in the JPY, we will need to the appeal of carry stopped in its tracks – the factor that stops carry like no other is cross asset volatility and equity drawdown.

USDJPY 1-MONTH IMPLIED VOLATILITY

Looking at USDJPY's 1-month implied volatility, we see this falling below 10% and below the 15th percentile of the 12-month range. Unless implied volatility picks up sharply, it feels probable that the JPY finds sellers into any strength – that means the near-term risk of USDJPY above 144 and for a possible test of the 30 June high of 145.07.

As always, we manage risk and assess certainty. We are right to question if USDJPY volatility underprices this week's US CPI print, as we are the impact the Jackson Hole Symposium could have later in the month – the market is possibly too sanguine. However, for now, the market is calm and that means carry is alive and well.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.