- English (UK)

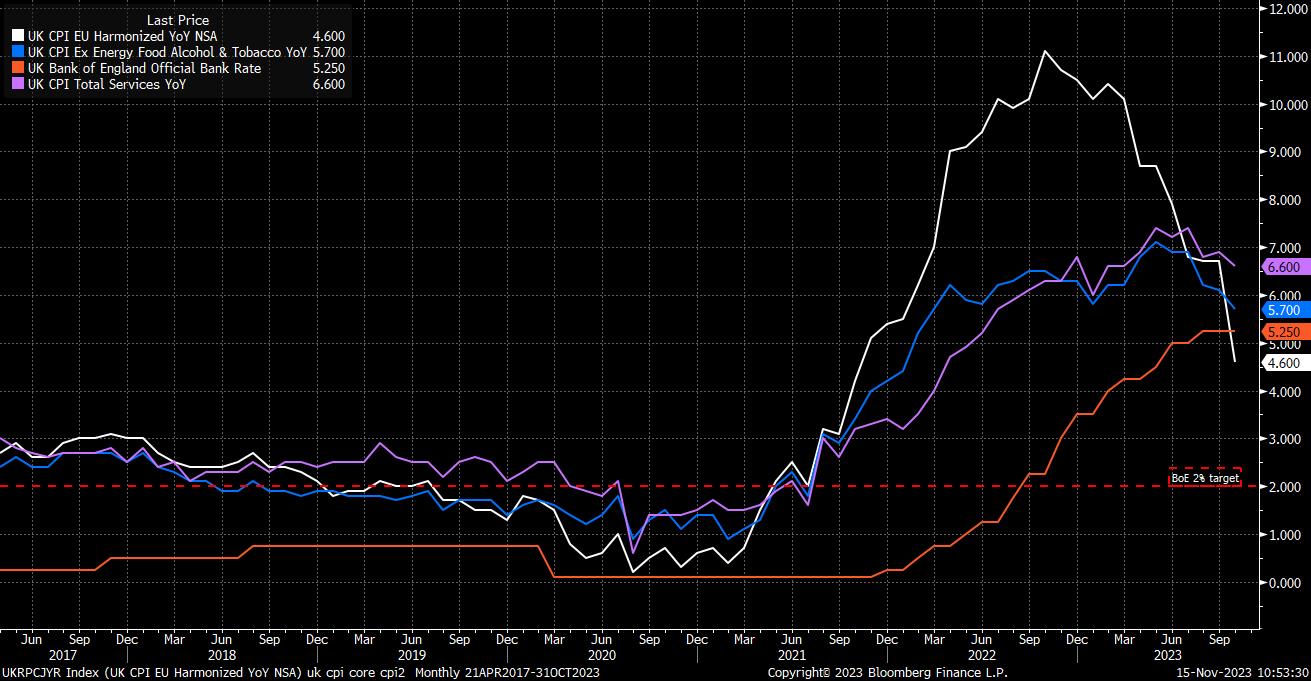

Most importantly, for policymakers at least, will be the October inflation data. Headline CPI fell to 4.6% YoY last month, a chunky fall from the 6.7% in September, with said decline being driven largely by a sizeable slowing in the pace of food inflation, in addition to the contribution made by the base effects of last year’s surge in energy prices skewing the figures somewhat. However, even without the base effect, the CPI reading was promising, with headline prices flat on a MoM basis.

Furthermore, the removal of the volatile food and energy components does little to change the overall picture of continued, and quickening disinflation. Core CPI rose by a cooler than expected 5.7% YoY last month, while the core services gauge, which the MPC watch closely, also undershot expectations, rising 6.6% on the year. All this combines to cement the idea that terminal Bank Rate has already been reached, and that the next move from the ‘Old Lady’, when it comes, will be a cut.

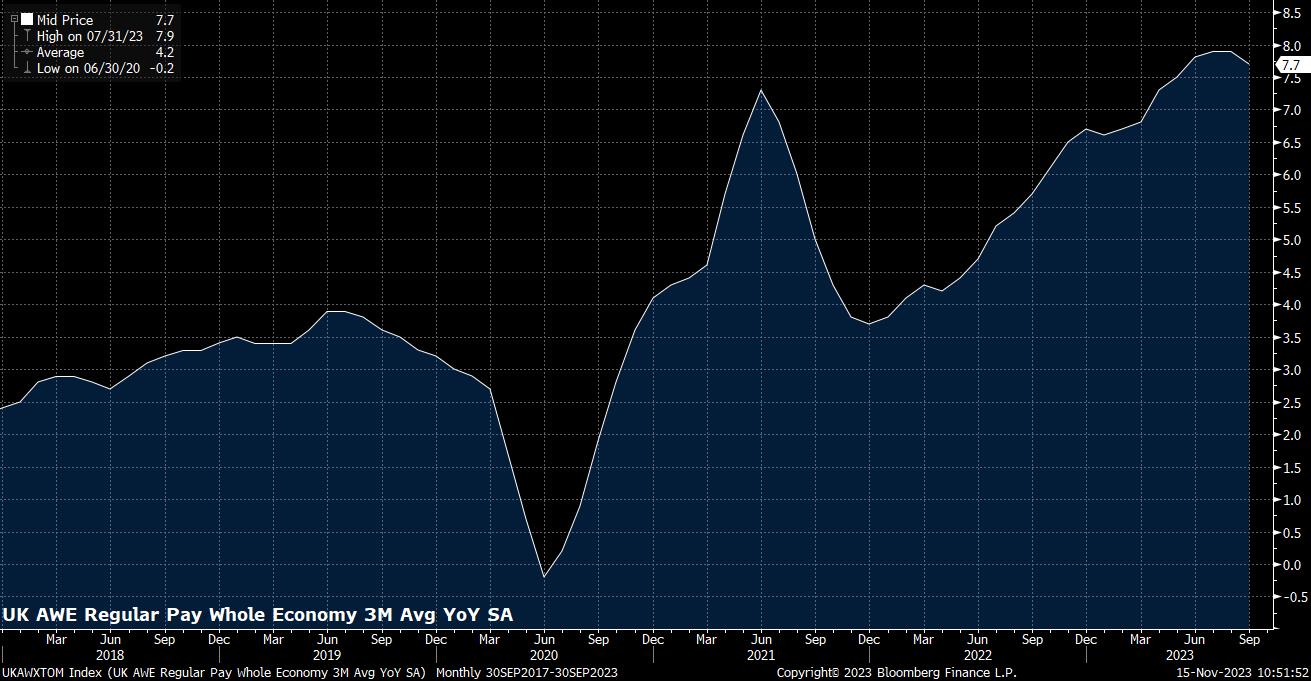

That said, the battle against inflation remains far from won, even if PM Sunak has achieved his objective of ‘halving inflation’ before the end of the year. Headline prices remain almost two-and-a-half times the MPC’s target, with core prices rising at an even faster rate. In addition, though having moderated a touch of late, the pace of earnings growth remains incompatible with the 2% inflation goal, with regular pay having risen by 7.7% on an annual basis in the three months to September.

Earnings growth does continue to moderate, however, with that pace being the slowest such increase since May, while the pace also still able to be, largely, explained away owing to substantial one-off payments made to a number of public sector workers over the summer. Hence, there is reason for cautious optimism from policymakers here, even if a degree of real earnings growth is a longer-run positive for the economy.

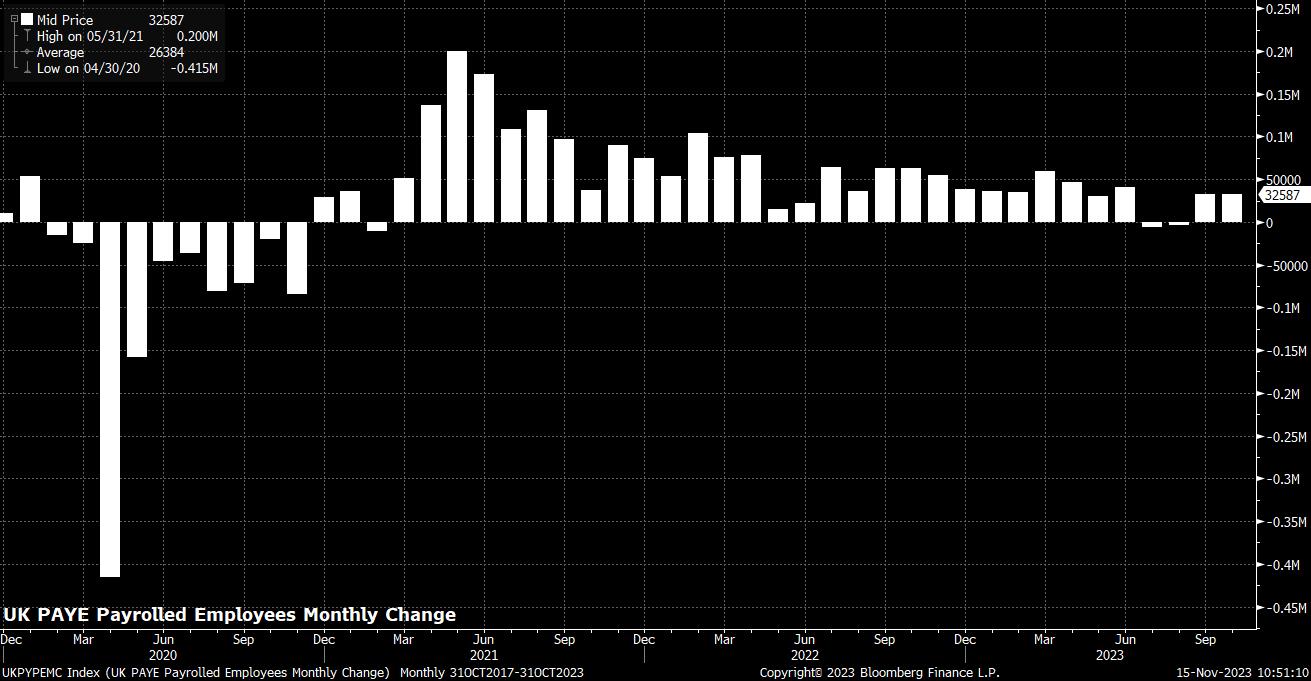

More reasons for cautious optimism can be found in other areas of the UK jobs data, though with the caveat that due to low survey response rates the ONS have begun to use an ‘experimental’ method to calculate the data, raising questions over its accuracy.

In any case, unemployment – as per the new calculation – held steady at 4.2% in September, marginally below expectations, while the total number of payrolled employees unexpectedly rose by 33k last month, coupled with a surprising +43k upward revision to the prior month’s figure. Thus, the recent softening in the labour market may not be as dramatic as had been feared at the November MPC, though recent PMI surveys are somewhat at odds with the ONS data, showing employment continuing to contract in both the manufacturing and services sectors.

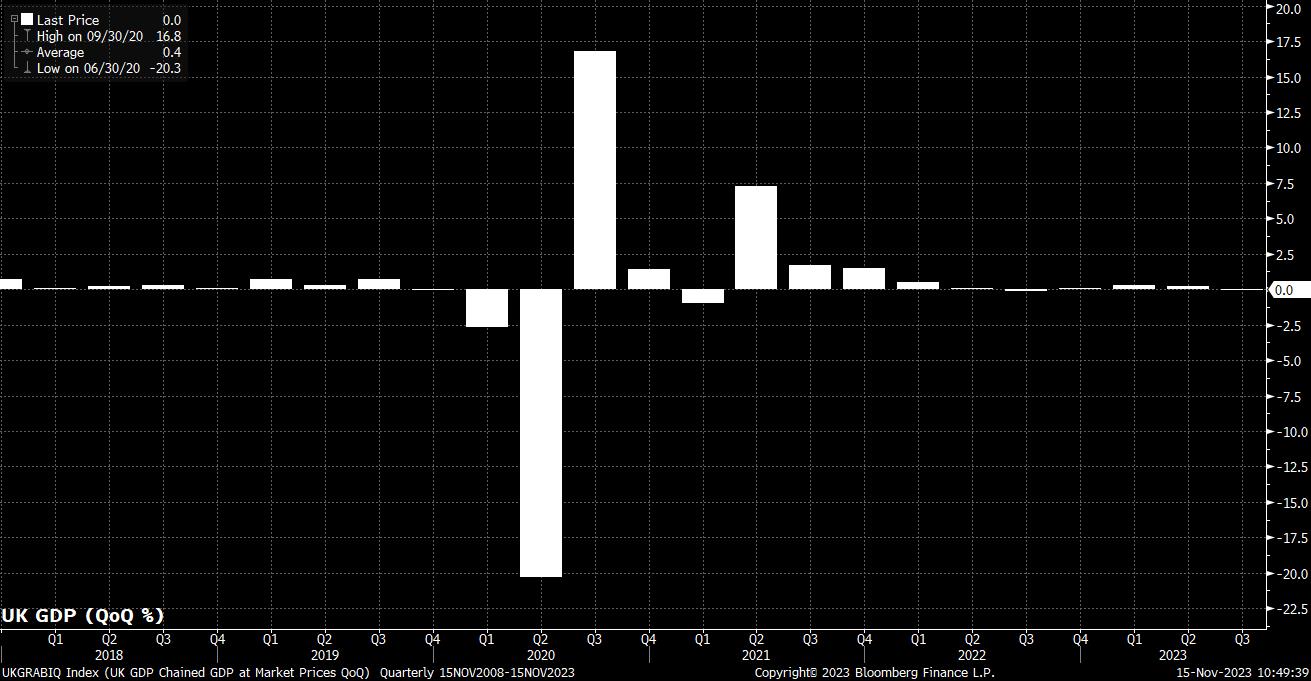

The recent GDP report also provides some reason for positivity, with the economy performing a touch better than expected, albeit while growth remains anaemic at best.

Data showed the economy grew by 0.2% MoM in September, following a downwardly revised 0.1% pace in August. This was enough to outweigh the chunky 0.6% MoM fall in output recorded at the start of the summer in July, leading to the economy having stagnated during the third quarter.

This, however, likely represents a delay to the eventual contraction that the UK economy seems set to experience, rather than said contraction being avoided altogether. Risks facing UK Plc. remain clearly tilted to the downside, with only around half of the impact of the BoE’s tightening to date having fed through to the economy, remortgaging set to continue through the winter, and geopolitical tensions continuing to linger.

As such, while recent data has been positive, and largely better than expected, it still feels too early to give the ‘all clear’. Similar could be said about the outlook for the GBP, with cable having rallied – in, admittedly, a largely USD-driven move after cooler than expected CPI figures Stateside – towards the 1.25 handle, taking spot to its highest since mid-September.

_2023-11-15_10-46-18.jpg)

Said rally, while thus far stalling at the 1.25 handle, has taken price back above the 200-day moving average, a level that was tested, then rejected, earlier in the month, giving the bulls back a degree of control. To the upside, while the 1.25 figure stands as psychological resistance, the 100-day moving average at 1.2515 may pose a tougher test; a break above opens the door to a test of the 1.26 handle, which is also where the 50% retracement of the Q3 decline resides.

In the near-term, however, after such a significant one-day rally (the best since early-January, in fact), a period of consolidation may be due, seeing cable tread water in a roughly one big figure range between support at the 200dma, and resistance at the 100dma.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.