Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

The US consumer seemed to have been receptive to the tariff news flow seen through May, with a solid rebound in consumer confidence levels, while respondents to the Dallas Fed manufacturing survey also saw their operating environment in a less negative space. US durable goods orders fell 6.3%, although this was modestly less bad than feared and the aggregation of these economic data points resulted in minimal pushback and headwinds for US risk appreciation.

The US Treasury Department also issued $69b of 2-year paper, and while traders are more focused on demand for longer-dated maturities, and despite average demand at this auction, the US 2yr yield settled -1bp, with the 10yr Treasury -7bp at 4.45%, and the 30yr -9bp at 4.95%. US 10yr real yields also moved lower (-6bp) offering some additional breathing room for US equity appreciation.

Ultimately the reduction in yield is less reflective of concerns about the data flow and indicative of the buyers – many of whom went missing last week – coming back in the market and expressing improved confidence of holding longer-maturity paper. This flows in USTs, in part, driven by a monster rally in long, and ultra-long end JGBs (40yr Japanese govt bond yields closed -23bp). The Treasury Department are set to issue $70b in 5yr paper in the session ahead, so we'll see if that has influence on the Treasury curve.

US equity higher, risk FX lower

Perversely the USD has found solace in the rally in US duration – and again this speaks to some improved confidence to hold US assets. Cross-asset correlations break down frequently, but with US equity rallying strongly and risk FX (AUDUSD, NZDUSD) down on the day, one can argue this move speaks to the flows into broad US assets, with international players presumably getting set without a currency hedge in place.

Drilling into the moves in US equity, we see small caps have outperformed with the Russell 2k cash market closing +2.5% and eyeing a push into the 15 May range highs (and 100-day MA) at 2114. The equity bulls will have noticed the 2.4% rally in the KRE ETF (US small and regional banks ETF), and this remains a decent guide on sentiment towards the R2K, as these financial plays are the epicentre of so much in the US economy.

S&P500 futures smashed through the 5900 level once US cash equity trade opened and kicked in gear, with a strong intraday trend in play, with both the S&P500 cash and futures index closing at session highs. Volumes in both S&P500 cash and futures have been on the lighter side, and a touch below recent averages, while in the options space, 3.28m SPX500 options traded hands – in line with the 20-day average – with 1.4 puts traded to every call option, which is typical.

The street covering NVDA shorts into earnings

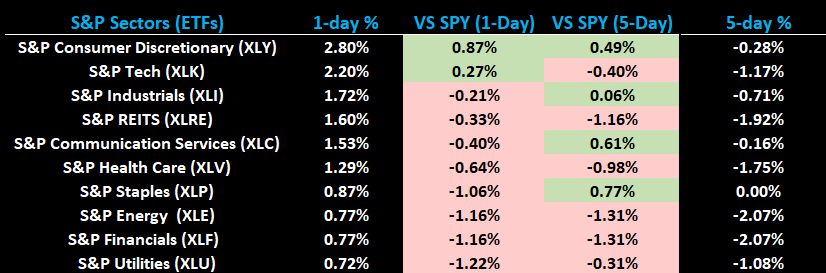

All S&P500 sectors have closed well in the green, although only consumer discretionary and tech outperformed the index, with Tesla (+6.6%), Nvidia (+3%) and the remaining MAG7 players finding form and putting in the bulk of the index points. Naturally, the focus shifts to Nvidia's earnings, with the stock looking to break above the recent highs of $137.40 and above $140 – the market clearly doesn’t want to go into earnings (after market in the session ahead) short, and there is renewed confidence that Nvidia can beat the consensus estimates for Q126 sales of $43.33b, and set to guide to Q226 sales above $46.27b. Margins matter, and investors want to hear conviction that margins have troughed at 71% and are set to push back towards 74% by Q426.

Nvidia’s options pricing implies a move of -/+6.8% on earnings, which if this is realised on the buy side, gets the share price above $140+. A 7% rally in NVDA should see S&P500 futures test the 20 May high of 5993, and even 6000. NAS100 futures would gain at an even faster clip, and if NVDA can be at the heart of the market move, and show real leadership, then all-time highs in the NAS100 will likely come into play soon enough. Of course, the risk of disappointing the market is there, but it feels as though the buy-side shops see earnings as the final big hurdle to be overweight this name - so a beat and raise in both sales and margins and the rally is on.

The ASX200 and NKY225 looking highly constructive

Our calls for the Asia open suggest the NKY225 is where the outperformance lies for the respective cash equity opens, and while there will be some focus on today’s 40yr JGB auction (set for 13:35 AEST), the news yesterday that the Ministry of Finance has consulted with the big fixed income hitters to consider the issuance size raises expectations that there will be improved demand for the ultra-long duration Japanese govt debt. We shall see, but expectations of improved demand have been raised, so there is a risk of volatility in the JGB market, which could spill over into the equity market. For now, the set-up in the NKY225 looks constructive and I like this higher in the near term.

The ASX200 also looks strong, with our opening call putting the index just 2% from the ATH recorded on 14 May. Tech should outperform on open, while financials should push further higher, with yet another ATH likely to be seen in CBA, while the regional banks should also work. The combination of continued expectations of a 25bp cut in the July RBA meeting, low cross-asset volatility promoting demand for any asset that has a high yield and underlying momentum in equity offering tailwinds for the Aussie equity market.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.