- English (UK)

The Daily Fix: Risk on the front foot although the FOMC meeting looms

The UK-EU trade talks are on the right track again it seems, with GBPUSD eyeing 1.3500 as the news flow turns more optimistic. The general vibe is that a deal is in the works, although we may be looking at this as a 2021 story.

At 1.3500 (in cable) we’re probably pricing a fair chunk of a deal into the mix but feel there's scope for 1.3650/1.3700 before traders go to town selling the fact.

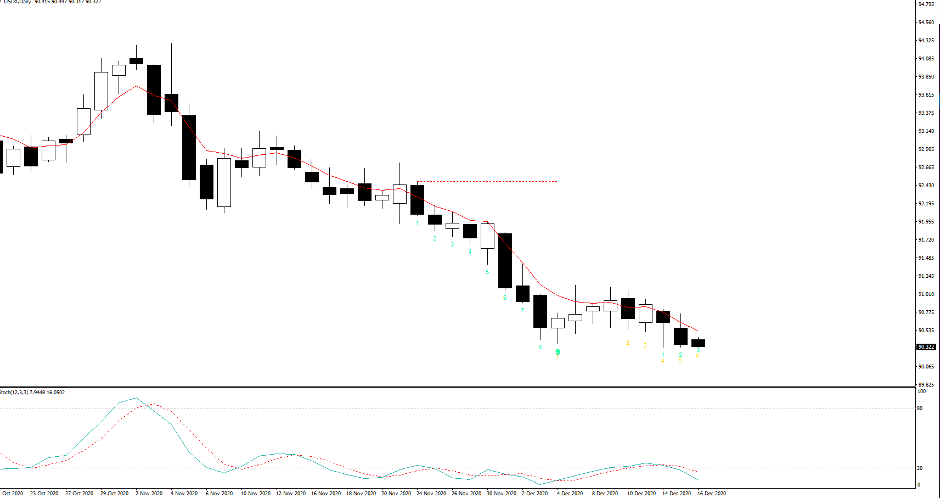

US fiscal stimulus is getting more colour and will be a major focal point in upcoming US trade with talks continuing from the big hitters – Pelosi, Schumer, McConnell and McCarthy. So, we should hear further headlines of an impending deal on a relief package. Equities are bid on this with small caps outperforming once again and the US2000 is on fire. The USDX is eyeing a break of 90.36 with EURUSD, USDCAD, NZDUSD and AUDUSD eyeing clean breaks of recent highs and a continuation of the recent trend. There aren’t many USD bulls left but if they are there, they need to defend current levels.

(USDX daily)

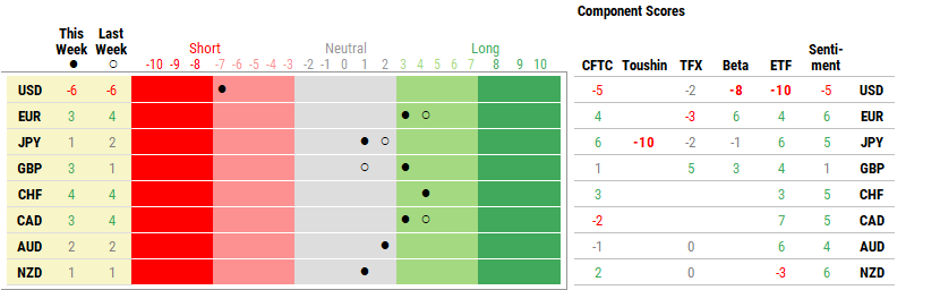

Positioning in the USD is short but taking a more holistic view than just CoT data and it’s not as extreme as you’d think. That said if I look at USD risk reversals and the premium put option volatility wears over calls, and we’ve reached the most extended levels since June.

(Morgan Stanley FX positioning report)

(Source: Morgan Stanley)

Could the Fed meeting (tomorrow at 6:00am AEDT) be the trigger for a small cover in USD shorts? There's certainly a risk of this as I don’t see the Fed doing much given just how incredibly accommodative financial conditions are and the current trajectory of the economy doesn’t warrant any major changes at this stage. That said, we’re talking small changes that could get microanalysis and specifically around the much-anticipated roll-out of qualitative guidance that will allow us to better understand the triggers for the bank to reduce its bond-buying program. It'll also be interesting to get a sense of how split the Fed collective is here, although that may not be fully transparent until we get the minutes.

Some will have positioned themselves for an announcement that they plan to alter the duration of the bonds they buy going forward, or what we know as WAM (weighted-average maturity). However, I see this as a lower probability – perhaps this could cause some modest disappointment and USD covering.

Let’s also consider we get US Nov retail sales (00:30 AEDT) and that may get a look in too.

One trade I’ve looked at and posted on Telegram earlier is CADJPY. We’ve heard from the head of the BoC through Asia today jawboning the CAD lower, but markets have not responded too intently. The set-up on the daily looks interesting though, with price testing the 2018 downtrend and June highs. If we do see some disappointment to the Fed meeting, this may be a good hedge against that and this could be compelling levels to look at short exposures for 80.64.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.