- English (UK)

Daily Fix: RBA cuts, but AUD is the star performer

Event risk to watch out for

The highlight and significant event risk in the coming 12 hours or so falls on a speech happening at 20:35 AEST, from New York Federal Reserve President John Williams, who could offer some key insights into the debate as to whether we see a 25- or 50-bp cut at the July FOMC meeting. That argument is swaying closer to the 25bp side of the ledger at this stage. We may feasibly need a punchier response (than currently priced) to push the S&P 500 and Dow higher from here and maintain these record highs, although Q2 earnings are just around the corner.

Consider we see the USD index (USDX) testing the 200-day MA and former September 2018 uptrend, how price acts around here will be very telling. Only a few days ago the market was warming to a more protracted and meaningful move lower in the greenback, as well as to the start of a more bearish trend. We’ve, however, had to do a reassessment here.

Aside from the upcoming John Williams speech on the data docket, we get US factory orders, durable goods and ISM service data in early US trade. Also, while the market craves answers on future Fed policy — as it does with many other central banks — it feels as though Friday’s US non-farm payrolls is still the real prize even when such data is important.

Around the Asian markets today

It’s been a fairly sanguine session here in Asia, where we’ve seen some buying in the Hang Seng, although the Hong Kong index was closed yesterday and has played catch-up. Japan and China are flat on the day, as is the case in G10 FX markets, with small selling seen in crude markets. The key focus on the floor today, though, has been pre-positioning and the subsequent reaction to the Reserve Bank of Australia meeting, where we saw the Australian central bank cut the cash rate to 1% — a fate that was 84% priced into rates markets.

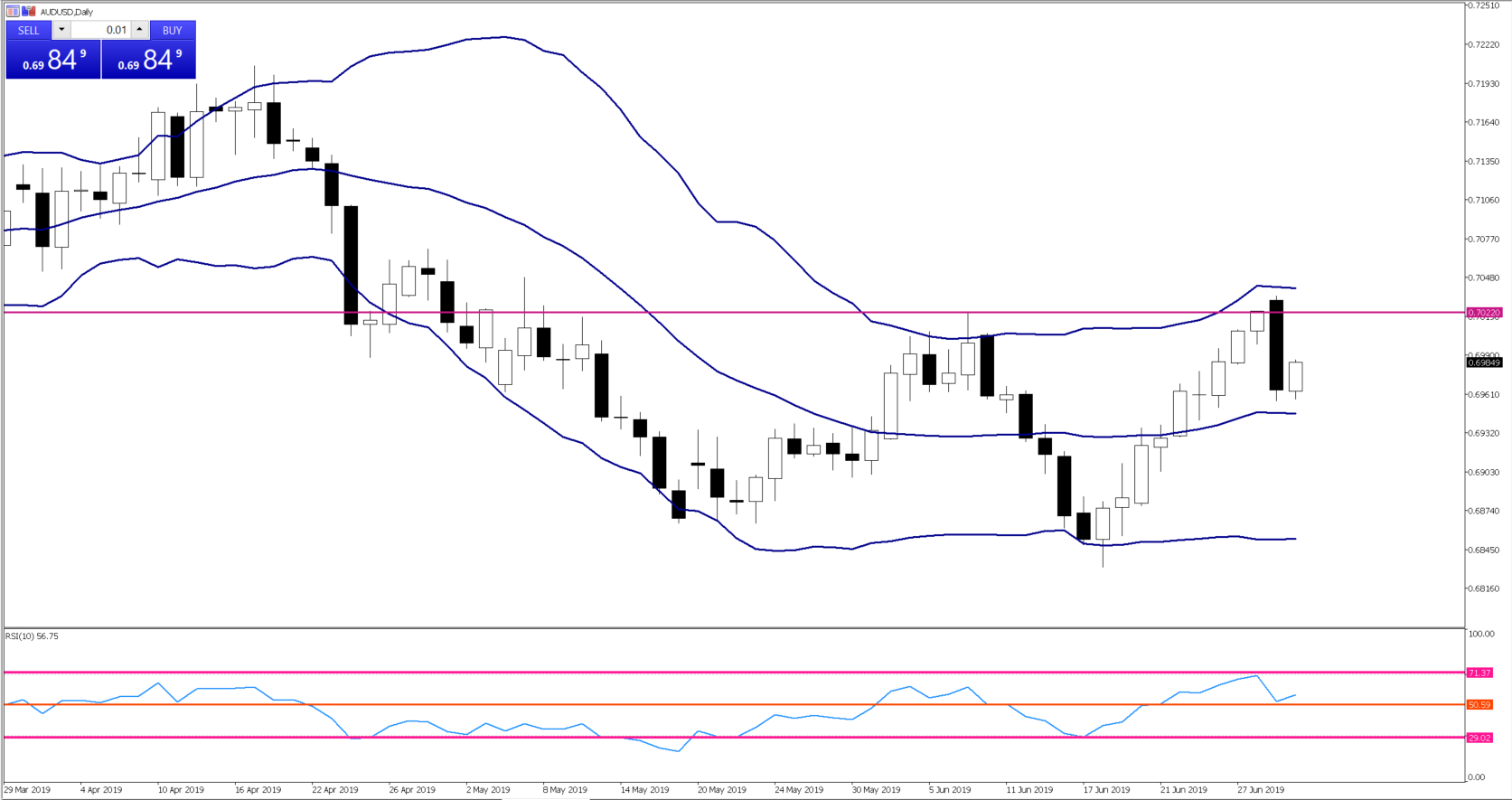

AUDUSD fell into 0.6959, before quickly reversing. We see price now trading marginally higher than where we were pre-cut. Reading the statement, we see the bank has opened the door to further cuts. But an August cut was already priced, and one suspects that should we get a better feel to the next Aussie employment print (18 July), and/or stability in the Q2 CPI print (31 July), then there’ll be a few questioning the merits of third consecutive cut.

It’s for this reason why trading around these events can be incredibly difficult at times. Some will be scratching their heads that, despite the RBA cutting, the AUD is the best-performing currency on the day.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.