Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Gold Outlook: Consolidation at Elevated Levels Amid Geopolitical Uncertainty

.jpg)

Gold experienced a turbulent week, marked by a sharp rally followed by an equally swift reversal. Prices briefly surged above $3,450 amid intensifying tensions in the Middle East, before retreating as safe-haven demand quickly cooled.

Although the U.S. military formally intervened in the Middle East conflict last Sunday by striking Iran’s nuclear facilities, gold failed to sustain its upward momentum following a gap higher at Monday’s open. More notably, there were limited panic-driven safe-haven inflows. This reflects a cautious tone in the market, with traders appearing to take a wait-and-see approach to the evolving news flow.

While geopolitical risk remains a key focus, investors cannot ignore a range of more traditional macroeconomic drivers—particularly U.S. growth prospects, fiscal sustainability, and ongoing developments in trade and tariffs.

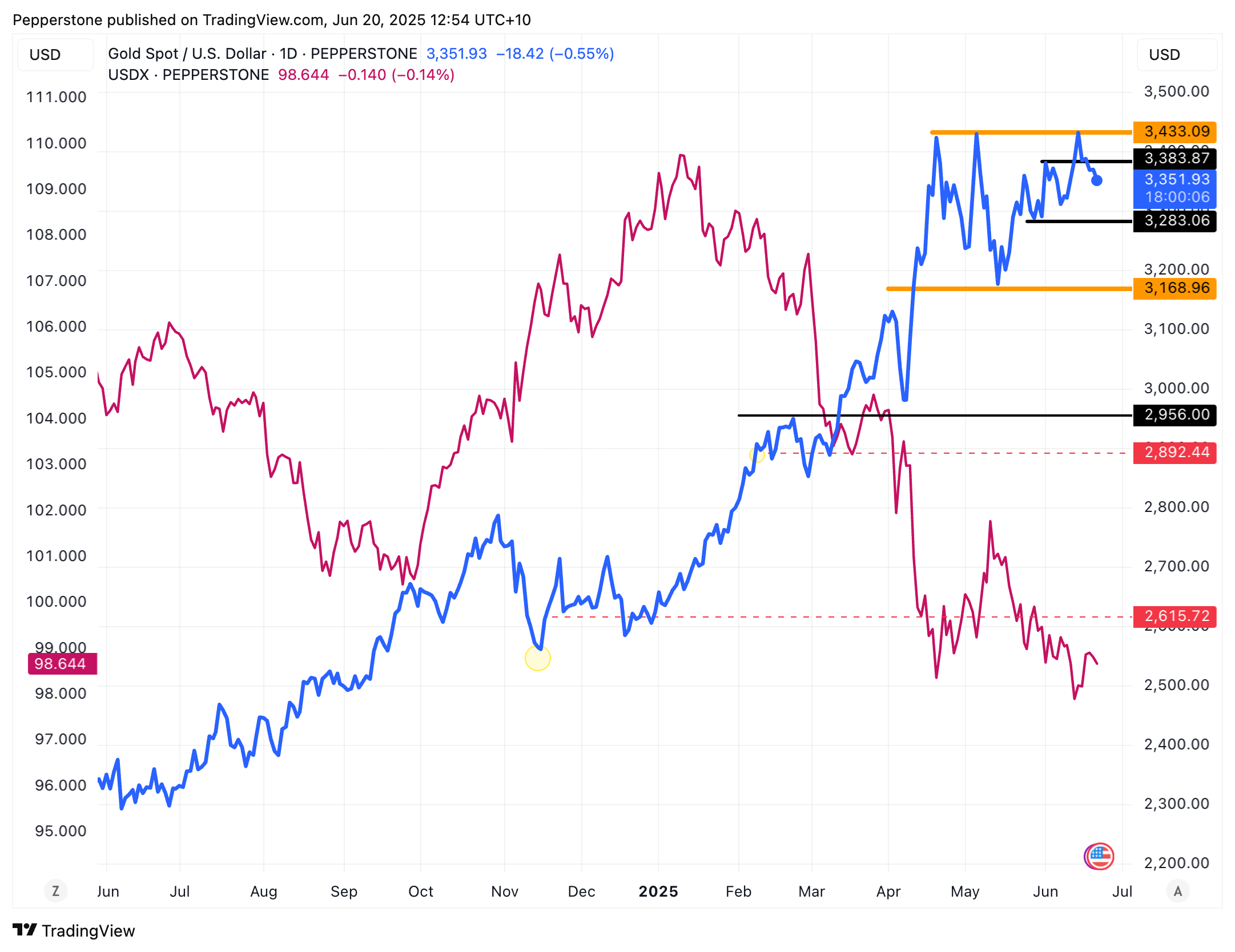

Technical Picture: Market Struggles to Break Key Resistance

On the daily XAUUSD chart, bears dominated the market last week. After briefly breaking above the key resistance level at $3,430 on Monday, gold failed to stage a meaningful breakout, with the battle between bulls and bears quickly shifting back to the $3,380 region.

Prices then edged lower in a steady decline throughout the week. However, toward the end of the week, intensified two-way flows pointed to a fierce tug-of-war between buyers and sellers, which in turn helped temper the downtrend.

The week opened with a $22 gap higher on Monday, bringing gold back to retest the $3,380 level. If downside pressure persists, support could emerge near the 50-day moving average and the $3,280 mark. To the upside, $3,450 remains a well-tested resistance zone. A sustained break above this level would be necessary for bulls to regain confidence in a potential test - and eventual breakout - the all-time high at $3,500.

Geopolitical Calm Shattered by U.S. Strikes, Uncertainty Lingers

Just as markets were starting to grow numb to the Middle East conflict, convinced that the Middle East conflict had not materially disrupted oil exports, the narrative shifted sharply over the weekend. The U.S. military launched strikes on three of Iran’s nuclear enrichment facilities, an escalation that surprised many and reignited concerns over regional instability. Although Iran has yet to respond formally, the move is widely viewed as crossing a major red line, significantly raising the odds of retaliatory action.

The market reaction was swift. Gold opened the week with a sharp gap higher, reflecting renewed safe-haven demand. While a full-blown escalation may still be unlikely, the perceived risk premium has expanded.

Betting markets have increased the implied probability of Iran attempting to block or disrupt traffic through the Strait of Hormuz - a move that could trigger a spike in oil prices and global inflation expectations. Even the possibility of such disruption is enough to rekindle investor interest in gold as a geopolitical hedge, especially in an already fragile macro environment.

Mixed U.S. Data Paints a Clouded Outlook

With geopolitical tensions fading into the background, markets have begun to reassess domestic fundamentals, starting with recent U.S. data.

Macroeconomic signals from the U.S. remain mixed. The University of Michigan’s June consumer sentiment index jumped from 52.2 to 60.5, while inflation expectations moderated, suggesting near-term relief from stagflation concerns. This marginally improved risk sentiment, reducing immediate demand for gold as a hedge.

However, broader indicators suggest a gradual loss of economic momentum. May’s retail sales control group exceeded expectations, but the headline figure declined 0.9% month-on-month - the sharpest drop since March 2023. Initial jobless claims continued to climb, highlighting labor market softness.

At the latest FOMC meeting, policymakers maintained a cautious “wait-and-see” stance. The updated economic projections showed higher inflation and slower growth, hinting at rising stagflation risks. The divergence among committee members signals that rate path uncertainty is unlikely to ease in Q3, leaving gold well-positioned as a portfolio stabilizer.

Fiscal Strain Returns to the Fore

Fiscal risks are also resurfacing. The U.S. federal deficit widened to $316 billion in May, bringing the year-to-date total to $1.36 trillion. Interest payments alone are projected to reach $1.2 trillion this year.

In this context, former President Trump’s proposed “Big and Beautiful Act” could further elevate debt levels. While the plan outlines tax cuts followed by spending reductions, the interim effect may be an enlarged fiscal gap. In the absence of a credible long-term fiscal consolidation plan, structural tailwinds for gold are likely to persist well into H2 2025.

Combined with the Fed’s cautious stance, this backdrop supports ongoing gold demand as a hedge against macro instability.

Negative Correlation with the Dollar Adds Further Support

Another supportive factor lies in gold’s historically strong inverse relationship with the DXY. Over the past year, this correlation has averaged approximately -0.96.

Should credit risk intensify, the dollar weakens, and the Fed maintains a dovish posture under a second Trump administration, a bearish outlook for the dollar may provide additional tailwinds for gold.

Gold Holds Steady Amid Mixed Drivers, Awaiting Clear Direction

In summary, gold has pulled back after a sharp rally, settling into a consolidation phase. This reflects the market’s ongoing reassessment of geopolitical risks, the U.S. economic outlook, and shifting tariff policies.

As the market continues to price in the latest developments between the U.S. and Iran, gold remains range-bound at elevated levels, with no clear trend emerging. Meanwhile, traditional factors like tariffs, inflation, and economic slowdown also have the potential to cause price fluctuations.

As a result, unless geopolitical tensions escalate sharply, cautious sentiment is likely to keep gold trading within a relatively narrow band near these highs. Although bears hold a temporary edge, given the market’s renewed sensitivity to geopolitical news, buying dips appears more prudent than initiating shorts at current levels.

Key Risks and Catalysts Ahead

Looking ahead, the situation in the Middle East will remain under close scrutiny, especially the possibility of Iran targeting U.S. military bases, which could further escalate tensions. If the conflict intensifies significantly, gold prices may rise above the $3,450 mark.

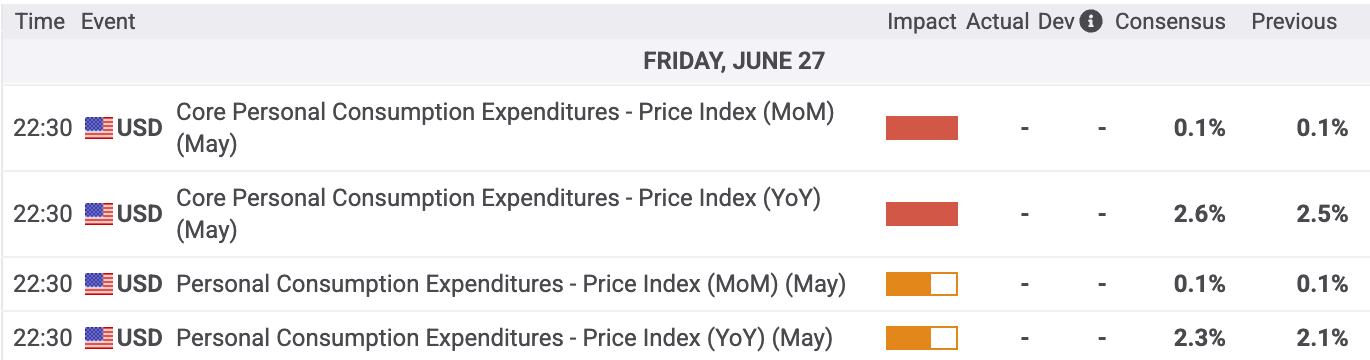

Additionally, the upcoming June core PCE data from the U.S. is expected to draw considerable attention. Market consensus forecasts a 0.1% increase MoM and a 2.6% rise YoY.

If oil prices continue to rise and inflation shows signs of picking up, the Fed may choose to maintain a wait-and-see approach. However, if inflation cools down alongside earlier indications of labor market weakness from rising jobless claims, the Fed is likely to adopt a more dovish stance at its July meeting. Such a shift could provide additional support for gold prices.

As gold market volatility heats up and key events unfold, seize the moment with Pepperstone’s gold CFDs - now offering spreads reduced by up to 30% to explore market opportunities.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.