- English (UK)

Get ready for Brexit phase two

The EU agreed its mandate for talks on its future relationship with the UK on Tuesday and Boris Johnson sets out his today. The ‘red lines’ for negotiations are now ready for the commencement of the official talks of Brexit round two, which open in Brussels next Monday.

Like all negotiating mandates, we need to bear in mind both now, and throughout the next potentially tortuous phase, that the documents represent an opening bid which experienced negotiators know will be whittled down through the necessary compromises that lead to a deal.

As an initial example, the EU’s set of principles signed off on Tuesday are at odds with statements made by Boris Johnson and David Frost, the chief UK negotiator, about the UK’s desire to fully ‘take back control’ on January 1. In previous weeks, in his first major speech, Frost outlined the first major red line as he dismissed signing up to a ‘level playing field’ setting common rules and standards, to prevent businesses in the UK undercutting those on the continent in the bloc.

A tough road ahead

Regarding other specific trade agreement objectives, the most important red lines for the EU also concern protecting the integrity of the single market and customs union, and securing fishing rights in British waters. For the UK, those lines include an end to regulatory alignment and the jurisdiction of the EU court.

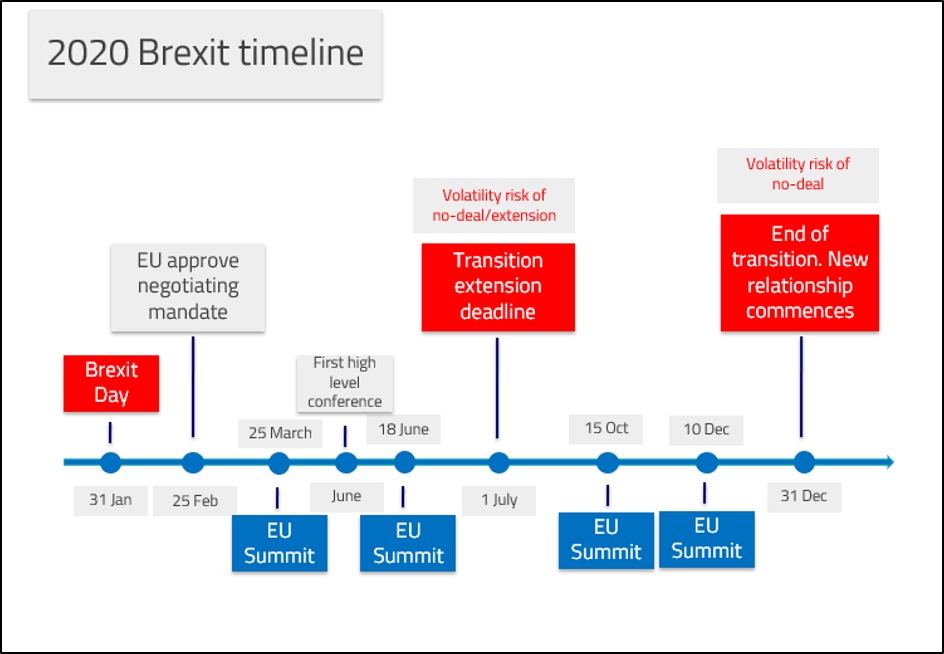

Of course, both sides have stated that the ambition is to strike a comprehensive trade deal before the deadline on 31 December 2020. PM Johnson has refused to extend this transition period (for now) which means in reality, the UK and EU will have to prioritise the most urgent issues. He’s also said he would rather walk away from negotiations and trade on WTO terms from the start of next year, than sign a deal where the UK becomes a rule taker and falls under the jurisdiction of the EU Court. From their side, the EU have expressed very clearly that the deadline of July1 for extending the transition is inflexible.

How deep is the red?

PM Johnson has enshrined in law the 31 December deadline which suggests that ultimately, the UK government may concede in some areas, in order to get a deal done in some form this year. With his healthy, recently gained Parliamentary majority, perhaps the PM has some flexibility too in making some concessions, as he won’t have to face voters again until 2024.

On the flip side, walking away from these talks may not be as significant as in previous Brexit negotiations, simply because the differences between a free-trade agreement and no agreement may not be as big as some headlines make out. That agreement doesn’t mean frictionless trade, as the white tape involved means it is easier to pay tariffs. So, will PM Johnson come to the conclusion that doing that is the price worth paying for ‘taking back control’?

Sterling effect

It seems slightly too self-fulfilling that more GBP weakness is on the cards through the second quarter as investors become increasingly impatient with the lack of progress. Elevated Brexit uncertainty will also weigh on business investment, which may bring the Bank of England into play with a rate cut in late Spring.

The more GBPUSD trades in a range – between 1.2850 and 1.3050 near-term, and 1.28 and 1.32 longer-term (since mid-October) – the stronger the breakout will be. With waning upward momentum currently, could the pound be in the early stages of a new correction phase?

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.