Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

The move from Iran comes as retaliation to President Trump’s lethal drone strike on Friday that killed Iranian General Qassem Soleimani. Tensions have only escalated since as 2020 kicks off to a volatile start.

We’re seeing increased trading volume as the conflict develops. Here are five charts you should be watching as retaliation ratchets up: XAUUSD, XAUAUD, XTIUSD, US500, and AUDJPY.

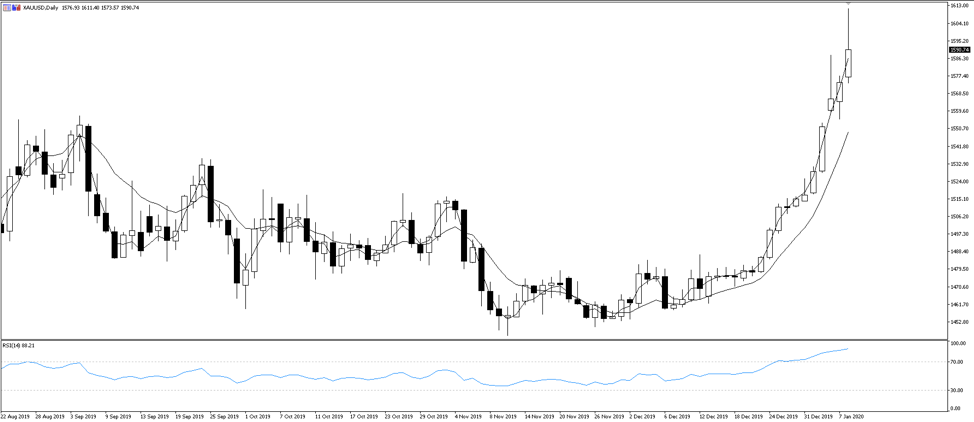

Gold

Gold hit a six-year high on Monday when it soared past 1550 USD. Then today as news of the US-Iraqi airbase strike unfolded, the precious metal flew even further: past 1600 to a high of 1611. Gold continues its daily gains against the greenback after two weeks of gentle appreciation before gapping higher on this week’s open.

Look at this week’s daily candles: the move is almost vertical. And even though gold pared back a bit Monday after spiking higher, the move has continued throughout the week. Gold is our hedge against this week’s geopolitical risk.

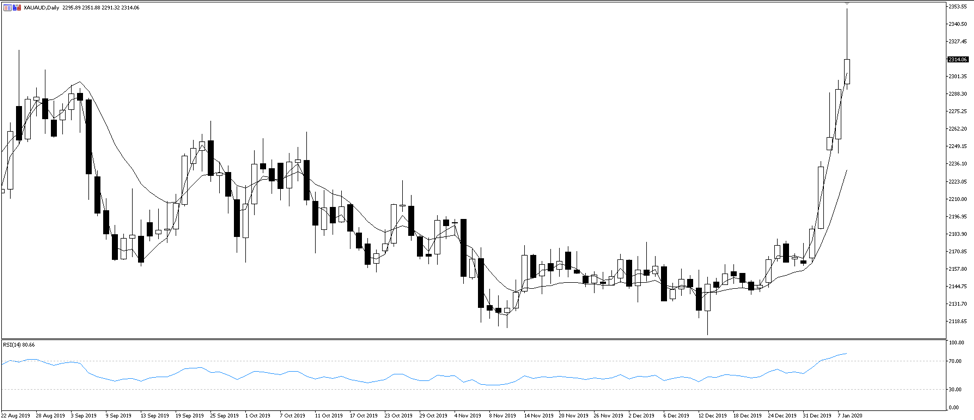

We’re not just watching XAUUSD though. Also consider gold against the Aussie dollar (XAUAUD), which hit an all-time high of 2351 this morning.

We have a bullish RSI for both XAUUSD and XAUAUD, reflecting the strong upward move. If we see a pullback while awaiting further news, it will likely be short-lived. Do expect gold to track higher again if the US retaliates, or rhetoric of retaliation from either side intensifies. Critical one to watch.

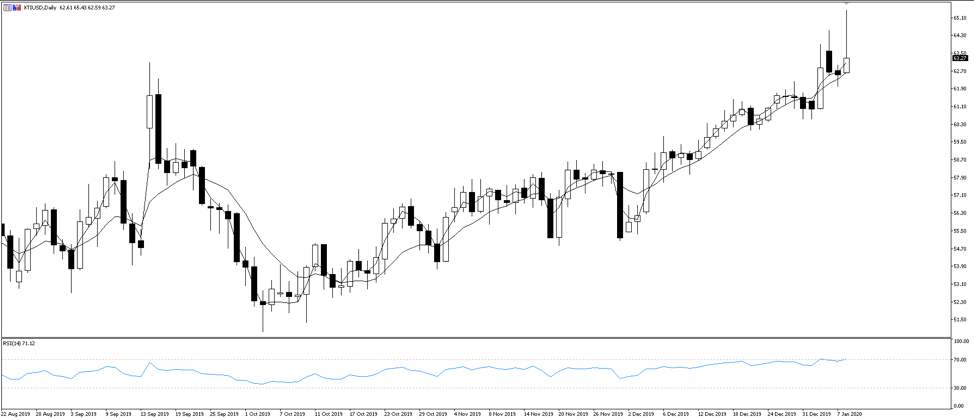

WTI crude (XTIUSD)

Oil is of course extremely sensitive to geopolitical tensions in this region, and WTI crude (XTIUSD) jumped as much as 4.5% today from its opening price.

Similarly, there was a 3% increase on the day at Friday’s close after the initial strike from the US. By Tuesday the gains had mostly pared back, as the conflict hadn’t affected oil supply.

XTIUSD will remain sensitive to the news flow, and higher levels will stick if the conflict disrupts oil supply. The US earlier this week expressed concern that Iran might strike Saudi oil fields in retaliation.

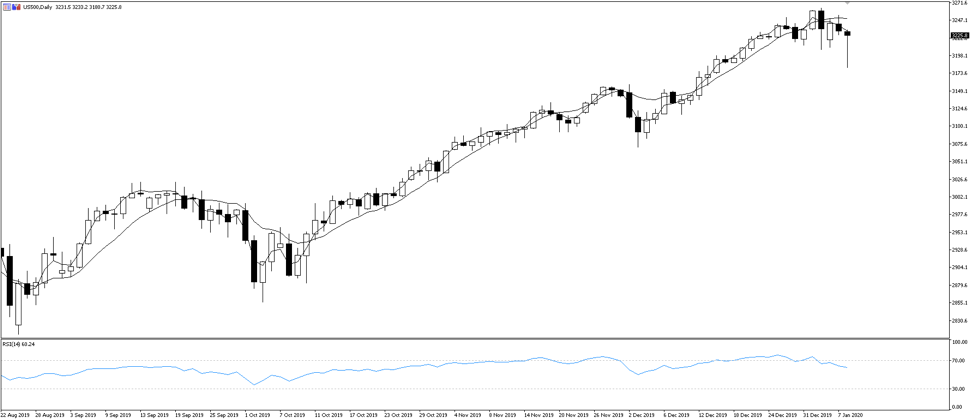

US500

US stocks took a considerable hit, with US stock futures slipping 1.2% as news of the air strike emerged. But nothing seems to hinder US stocks for too long these days, strengthening again when news flow calms. Today’s losses seem to have mostly recovered: the index is now trading back above the Monday and Tuesday lows.

There is opportunity in these quick and decent moves, but please be sure to reduce stop-losses and take-profits in order to manage your own risk.

AUDJPY

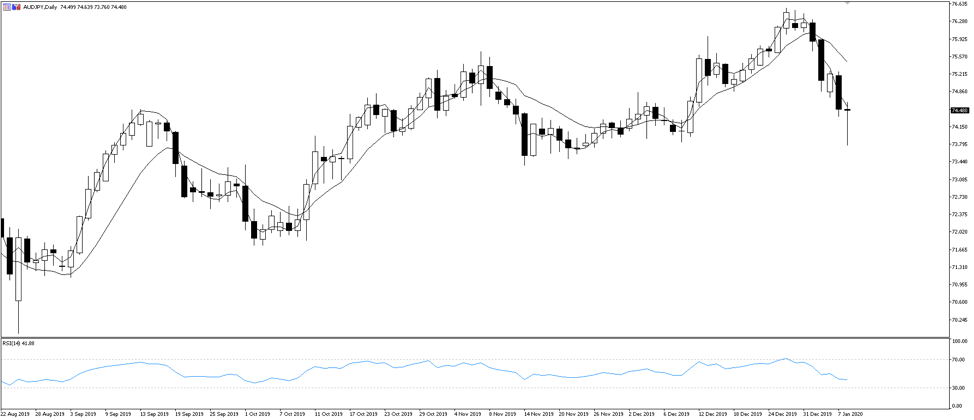

Consider AUDJPY, an important risk proxy, which has proven very sensitive to news flow since the initial attack on Friday. The safe haven Japanese yen against AUD offered more pronounced moves than the popular pair USDJPY.

The greenback can act as a safe haven in its own right at times, so with USD removed from the equation, AUDJPY gives a cleaner read on event risk. At AUDJPY’s low this morning of 73.760, that was a 1.9% decline since Friday’s open before the initial US attack. In contrast, USDJPY hit only a 0.8% decline since Friday’s open when the pair hit a 107.651 low amid the airstrikes this morning.

The mood is tense. If we see escalation either side, risk will increase and gold will rally further. If markets take the view that the tit for tat retaliation will not lead to an all-out war, equities will rally and gold sell off. Of course, there is too much uncertainty at this point to know. Keep watch.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.