- English (UK)

The variability of the market has been driven by US President Donald Trump, although this is fast becoming an evergreen comment, with narrative from Trump that China had been in touch with US trade officials wanting to get back to the negotiating table. These talks were later denied by Chinese officials. The market has also done a 180-degree assessment on Trump’s concern for equities. Perhaps he really is worried about the stock market as a voting mechanism on his tenure as the US President. Either way, the market has shown a clear interest in supporting drawdowns multiple times through August into 2830, and the defined range of 2946 (also the 50-day MA) to 2830 is firmly on the radar, where a breakout should be respected.

Volumes have been on the light side (20% below the 30-day average on the S&P500), which won’t shock given the time of year, although breadth has been compelling, with 88% of S&P 500 constituents closing higher on the day. Volatility traders haven’t been overly inspired by the moves in the equity markets, with the VIX index lower by 0.55 vols, where, at 19.32%, the S&P 500 implied volatility gauge still suggests the US equity benchmark and, presumably, global developed markets equities should have daily moves north of 1%. High-yield credit has outperformed IG, with the spreads coming in 5bp against investment-grade credit. Again, this is hardly a euphoric move.

The leads for Asia

We can see S&P 500 futures sit 1.7% higher at 16:10 AEST (i.e., the ASX 200 cash close), so this will inspire Aussie equity traders, although the move in the S&P500 futures has overshot the net change in the Aussie SPI futures, where the Aussie index futures sit up a mere 18-points again from 16:10 AEST. The broader Asia equity region should open a touch stronger, but it’ll tell us a lot about psychology if the market sells into the opening strength. That wouldn’t surprise me.

Data review

Trump aside, the event risk in the form of economic data has been mixed. Clearly, the USD has been the beneficiary here.

In Europe, the German IFO August business climate survey fell to 94.3, below the consensus of 95.0, where this read came in the lowest since 2012. The expectations survey fell to the lowest levels since June 2009. It's no wonder EURUSD was offered from 1.1150 all through European trade, hitting a session low of 1.1094 just before 06:00 AEST. We look ahead to the start of European trade today not just because UK traders head back to their desks, offering much-needed liquidity to markets, but because we get the German Q2 GDP data (16:00 AEST), which is widely expected to print the second quarter of economic contraction, officially placing Germany — the powerhouse of Europe — in a technical recession.

US data was a touch more positive, with July durable goods orders increasing 2.1%, transportation orders 7%, and non-defence capital goods 0.4%. Dallas Fed manufacturing index increased 10.0 points, which was stronger than forecast and arresting three consecutive months during which this index has been contracting. Along with the better tone in stocks, rates markets have responded, with Fed funds futures now pricing a 10.2% chance of a 50bp cut in the September FOMC meeting. And the fact we saw US five-year inflation swaps push up 3bp to 1.91% is also a huge reason why the Federal Reserve will remain behind market pricing on rates for the time being.

In US trade tonight (00:00 AEST), we get the August US consumer confidence report, with expectations this falls from 135.7 to 129. It gets quite messy if we get a strong print here, as the market is positioned for tough times ahead and very late cycle investments, with a very crowded position in recession hedges such as JPY, CHF, US Treasurys and gold. Presumably, at some stage this positioning will need clear validation and require real cracks to emerge in the soft data — that’s one to watch.

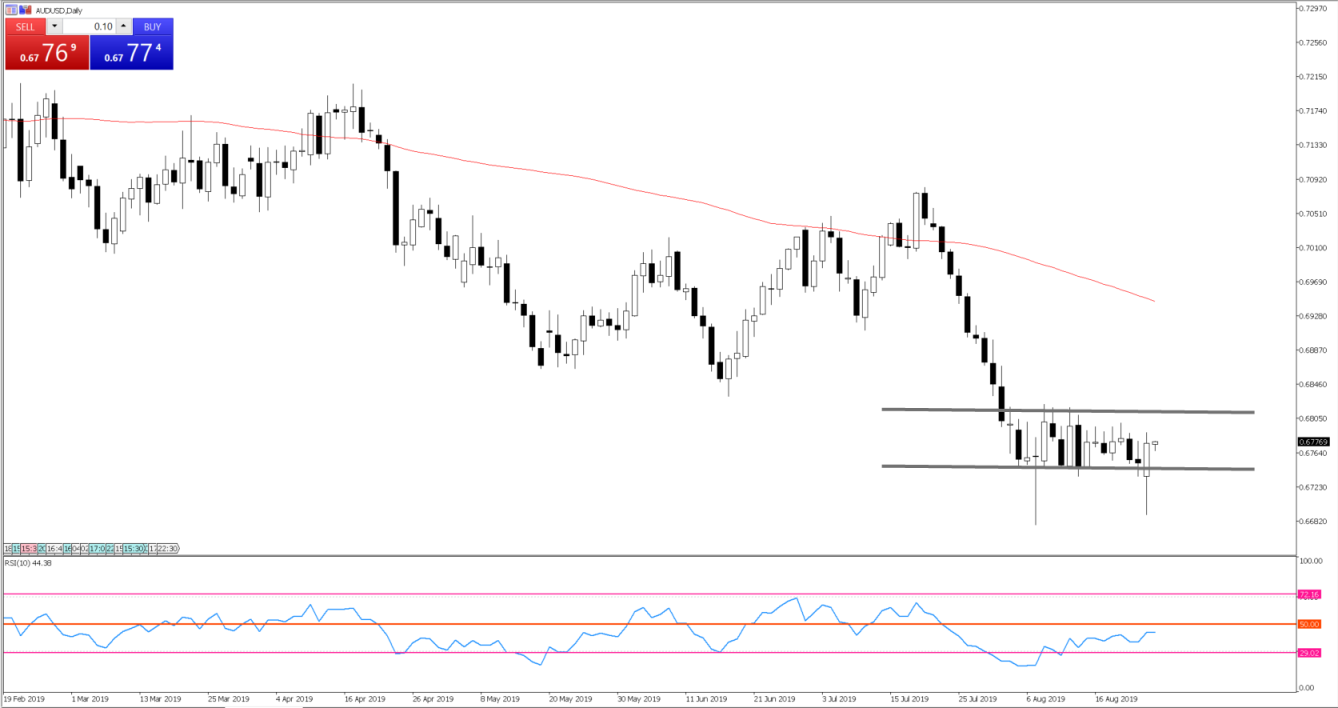

AUD outperforms as G10 proxy of trade

Staying in FX, USDJPY got a working over yesterday, with traders defended the flash crash lows. I’m happy to stand pat on this pair for now, with a preference to fade rallies into the top of the recent range of 106.90. AUD was the star of the show on the day, if for no other reason than its proxy of trade tensions in G10 FX. On the daily timeframe, the support below 67c is clear, and the pair holds the 0.6735-to-0.6820 range for now, where a break here could set a new trend. Which way it breaks is obviously yet to be seen, but, like the setup in the S&P500, it should be respected.

There’s no data to focus on in Australia today, so the AUD will take its direction from moves in the CNH. USDCNH hasn’t been overly interested in Trump’s commentary, where traders have faded CNH strength through US trade, leaving a pronounced Doji candle and clear indecision on the daily. We were watching to see if the pair could close the gap into 7.1385, but it remains open. A kick higher in this cross through Asia today will likely result in modest selling of risk, with AUD and equity downside.

Watching the CNY fix as a vol event

That’s until we get the CNY fix (11:15 AEST) by the People’s Bank of China, where the run has been for the central bank to lift the midpoint by less than the market’s estimates. That’s actually been a positive for markets. Could the PBoC see weakness in Trump’s rhetoric and go for the jugular, weakening the CNY by more than forecast and creating higher volatility in Asia? Perhaps. But it seems that the PBoC wants a stable currency and a limited interest in weaponising the CNY, as some have viewed it.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.