- English (UK)

Daily Fix: Using volatility framework to assess the week ahead

As detailed on Friday, I think most were hoping to hear from Fed Vice Chair Richard Clarida, as he's considered the true spokesman of the committee. The full agenda, however, hasn’t been announced. But when it’s released, you’ll see it Thursday on the Kansas City Fed website.

We’re also due to hear from Reserve Bank of Australia Governor Philip Lowe, who’ll close out the proceedings Sunday at 02:25 AEST. So, this opens up the prospect of AUD gapping risk on Monday — something for all AUD traders to consider.

Challenges for Monetary Policy

As discussed, the title of the conference is “Challenges for Monetary Policy.” So, with one explanation for the recent yield curve inversion, and the incredible buying taking place in the longer end of the curve being the belief that monetary policy won’t save us should we see a far more aggressive downturn, this title is incredibly relevant. The objective of the conference will, therefore, be about installing a belief that monetary can save us if we see a downturn. While most the speeches will be of an academic nature, I expect central bankers to drill home that they still have the resources to support economics.

Unprecedented policy coordination

I also want to pass over this white paper from the Blackrock Investment Institute, which now includes Stanley Fischer (former vice chair of the Fed) and Philip Hilderbrand (former chair of the Swiss National Bank). For anyone who wants to know one way we may see central bankers respond, read this white paper, which is titled “Dealing with the next downturn: from unconventional monetary policy to unprecedented policy coordination.” It’s getting a lot of attention from strategists.

It’s fitting that we hear more and more noise about a potential fiscal stimulus from the German government. While any fiscal program will take time to play out, if we marry this news flow with a dovish shift from the European Central Bank in its 12 Sept meeting, then EUR assets look incredibly interesting longer term. EURUSD on the weekly is ready to make a move. Which way? We shall see. But when this pattern breaks, then it’ll impact global markets.

"EURUSD, weekly"

There isn’t expected to be any key representation from the ECB at Jackson Hole. But EUR traders will be watching PMI data due Thursday. Any deterioration here will only build up expectations that the ECB cuts its deposit rate to -60%, and talks up renewed QE.

Weekly volatility report

I’ve updated the volatility report for options that expire Monday, thus capturing the event risk over the weekend, with the markets implied moves based on various options strategies. I explain my logic in this webinar.

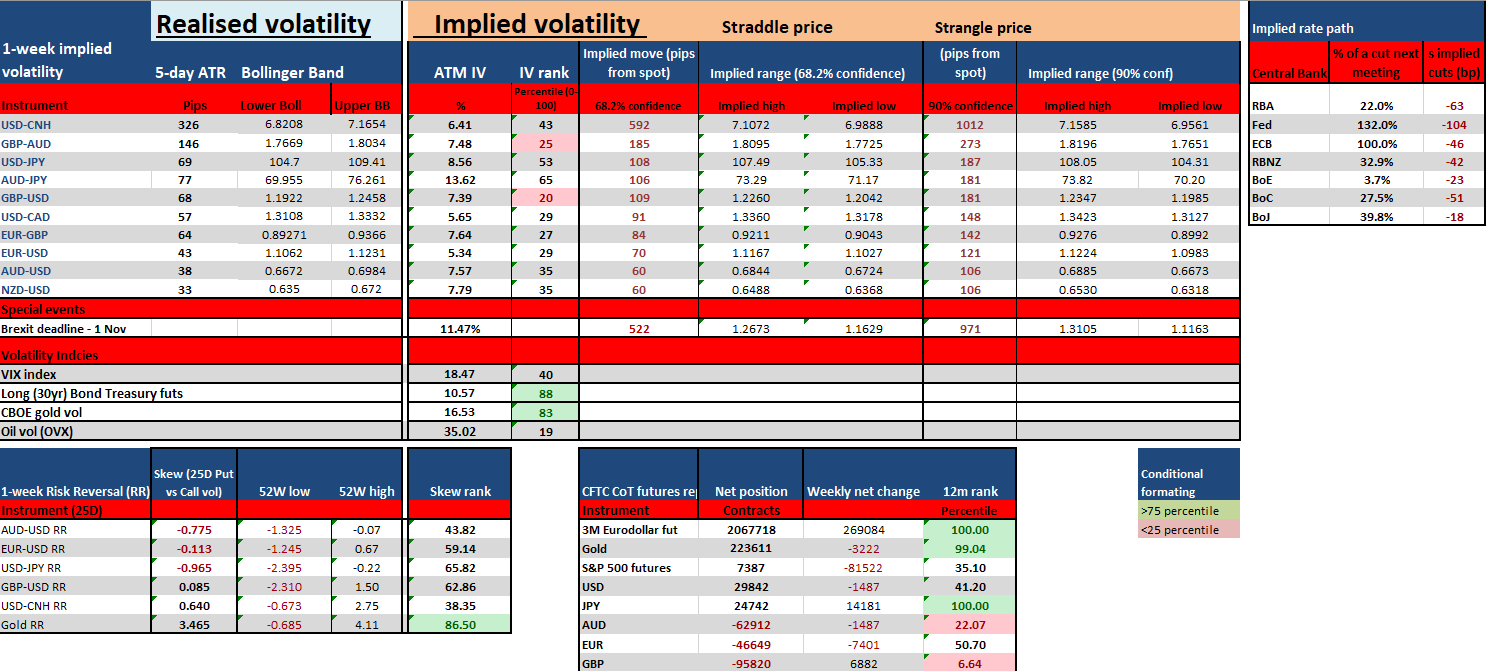

Aside from classic realised volatility measures, such as the ATR and Bollinger bands (BB), which traders use effectively to assess risk and even entry points (BB), I’ve added the weekly Commitment of Traders (CoT) futures positioning (and change) from non-commercial players for key markets I look at. The implied rate path and what’s expected from select central banks for the September meeting, as well as over the coming 12 months and one-week risk reversals offer possibly the best guide on sentiment and perceived directional risk. I have percentile ranked these, which offers context into where the absolute number is in relation to its 12-month range.

I like to use this as a holistic oversite at the start of the week to offer insights into expected moves, while offering insights for our risk-to-reward assessment.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.