- English (UK)

In a mildly hawkish cut, Fed Chair Powell said he felt monetary policy was ‘in a good place’ with a favourable outlook for the US economy, however was quick to address it’s not exempt from global downside risks.

Powell’s favourable outlook is an economy with strong consumer spending, overall solid jobs growth, and an employment level at a 50-year low.

Inflation tracking below the 2% target remains a key risk, as do developments in trade tensions between the US and China.

Shifting the pledge: from acting to assessing

The overall sentiment of the statement remained the same, however the FOMC shifted its pledge from acting as appropriate to sustain the expansion, to monitoring data and assessing the ‘appropriate path’ for the fed funds rate. So, rate cuts are no longer on the near-term horizon, unless the outlook becomes less favourable. Rate hikes are also off the cards. Powell said a hike can only be expected if inflation materially moves up.

So what data are the FOMC monitoring as they assess the appropriate path? The model below is our best guess here at Pepperstone, a mix of vital economic data, prices, and market conditions. Data prints are correct at 9am this morning.

"Fed watchlist: the data, prices, financial conditions"

With the Fed’s focus on inflation, we’re watching the US 5y breakeven inflation rate. This is the market expectations of inflation five years from now. If this tracks up as the Fed expects, their rose-tinted outlook will continue.

But if expected inflation doesn’t tick up, rate cut expectations will grow, and the USD will weaken accordingly, which could be an opportunity to go long on EURUSD, AUDUSD, and gold (XAUUSD).

The other focus is on trade. After a series of rate cuts to insure against trade uncertainties, we now wait to see whether phase one of the trade agreement goes through as planned. Beyond that, we’ll be watching the December tariffs. If they are reduced, the outlook will become more favourable. A removal of these tariffs could see the return of hike probabilities, which in turn should strengthen the USDX.

With the 2020 US presidential election approaching, further escalation of trade tensions seems unlikely.

Markets are currently pricing one more rate cut by the end of 2020.

How the event traded

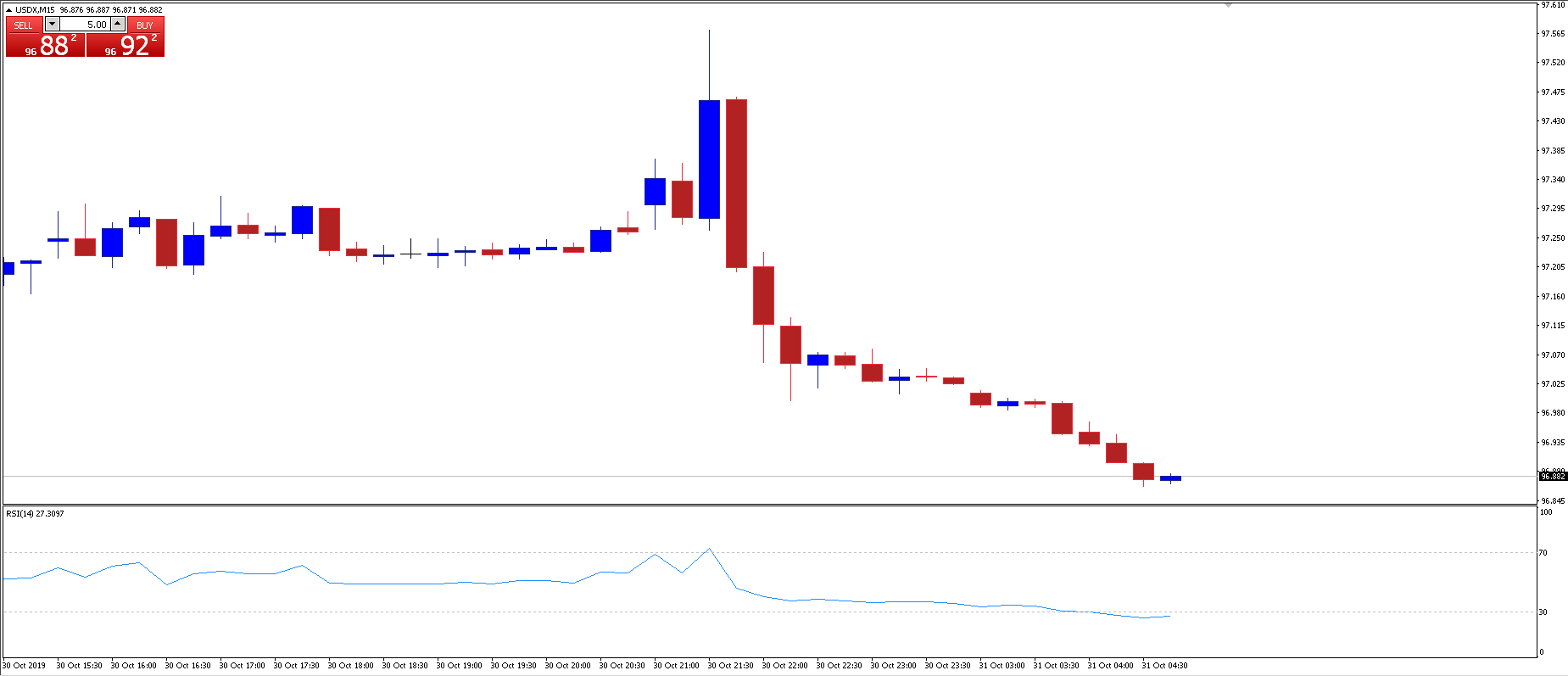

Price action started typical of a hawkish rate cut, with the USD strengthening when Fed Chair Jerome Powell announced the cut and hold approach amid a favourable outlook.

The gains were quickly sold off when Powell noted the world is not exempt from global downside risks, and committed to low rates for a long time as the Fed waits for inflation to tick up and rides out trade uncertainties. The USDX closed lower on the session.

"USDX 15-min chart: The USDX strengthened on the hawkish rate cut but closed lower on the day when Powell committed to holding rates for a long time."

Similarly, USDJPY spiked on the initial news, breaking above the 109 level to a 109.287 high, before closing on the day at 108.841.

"USDJPY 15-min chart: USDJPY spiked on the hawkish cut announcement."

Despite the rate cut being almost completely priced in, stocks soared on the news and the S&P500 (US500) closed at yet another record high, this time at the 3046 level.

"US500 daily chart: The S\u0026P500 closed at another record high."

FOMC votes converge

The FOMC voted 8-2 in favour of the cut. Kansas City Fed President Esther George and Boston Fed President Eric Rosengren dissented from the vote, preferring to hold the rate. George and Rosengren dissented from all three rate cuts this year.

St Louis Fed President James Bullard this time voted with the majority, indicating that views within the committee are converging for now. Bullard dissented the September vote, favouring a faster 50bp cut to the 1.5 – 1.75% target range.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.