- English (UK)

I’ve focused a lot of attention of late on the AUD, as like most, the fact that the rates markets had priced in over four hikes in 2022 was just too much and where the prospect of this playing out seems quite remote. Well, the RBA coined the market pricing a “complete overreaction to the recent inflation data”. The RBA even went out of their way to portray just how important wages are for genuine demand-driven inflation and on their estimates, we don’t hit the magical 3% level until 2023 – this justifies their base case that 2023 feels right for hikes, although they’ve moved towards a data driven model and away from calender-based guidance.

It suggests the next wage print on 17 November could be a big risk and catalyst for AUD traders.

Along with other factors, the narrative from the RBA has seen some buying in rates and 3-year Aussie bond yields have dropped 12bp since the RBA statement hit the market. However, despite the modest repricing, this is still a market of the belief that we get multiple rate hikes next year and importantly at a faster clip than most other developed market economies.

The interesting dynamic is that Aussie 10yr real (adjusted for inflation-expectations) bond yields trade at a 77bp premium to US real rates and close to the highest yield premium since 2014. Aussie 2-year swaps rates trade at a 44bp premium to that of the US, suggesting the RBA hike 2 times more in that period over the Fed.

While investors will look at currency hedging ratios, I’d argue Australia as an investment destination for fixed income managers is looking quite attractive – especially when real (adjusted for inflation-expectations) returns were nearly positive.

The factors which are not quite as supportive are the terms of trade consideration and we know the RBA is looking closely at China, expressing concern at the recent slowdown. The other effect has been China imposing curbs on steel production into the winter Olympics – if we cast our eyes back to recent data on 27 October, Chinese steel production fell 21% YoY in September, with output falling 2%, yet inventories have not been drawn down.

In response to the news flow, iron ore (IO) futures on the SGX have lost over 50% since July, while IO futures on the Dalian exchange are 51% lower from highs seen on 16 July. At one stage yesterday, iron ore futures were limit down, but have since come off the lows.

Rebar (steel) futures have been in close focus, and we’ve seen prices lose around 25% of late, while coal futures have been on a one-way teat since 19 October.

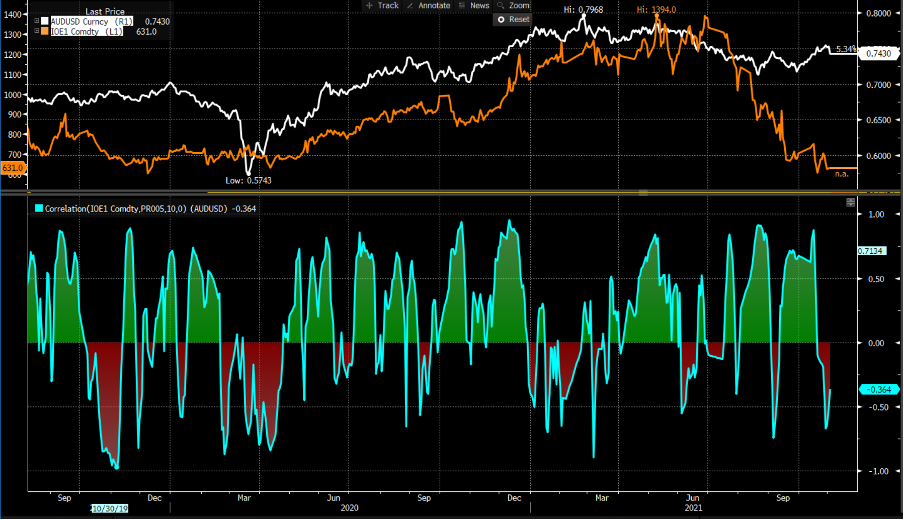

10-day correlation between AUDUSD and iron ore futures

We can see the 10-day rolling correlation between Dalian iron ore futures and AUDUSD has been increasing but is statistically insignificant at this stage. The high level of open interest in the futures market suggests short positions are at risk of covering, and that could see exaggerated moves higher, which could benefit the AUD and the likes of RIO, FMG and BHP (in equity land). Of course, FX is a relative play, and the USD has its own issues to consider with the FOMC and non-farm payrolls out this week.

AUDUSD chart

Technically, the structure of the AUDUSD has changed quite rapidly and despite leveraged funds running a sizeable 38k short position, the clean break through the 0.7450 support zone has sellers looking for recoil to confirm this is now significant resistance.

Tactically, I like the support I am seeing in AUD rates differentials and higher equity prices tend to be good for this pair as well, so the market may use this weakness to enter longs. If it's really the start of a bearish trend, I’d be looking for the move into the 5-day EMA and for here whether traders sell more aggressively into here, if they do reject it I’d be taking a more bearish bias – a daily close above the average could negate a trend.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.