- English (UK)

Chart source data: Metaquotes MT5

The Australian dollar remains range-bound between 68 and 70 US cents, approaching the lower end of the recent range on continued COVID-19 fears both globally as well as domestically in Victoria state. The 20-day EMA (blue line) continues to support price on stronger pullbacks.

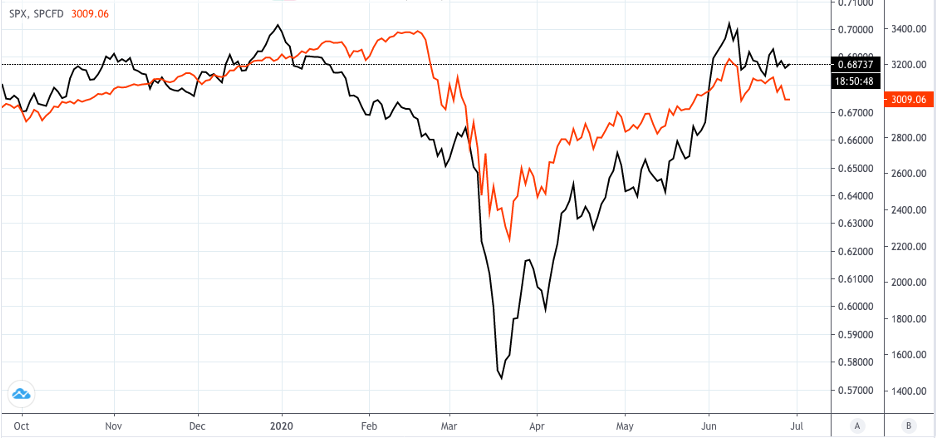

The high beta currency continues to move in a similar direction to the S&P 500 (US500), reflecting global risk sentiment. As US500 futures moved higher early in the asian session, the Australian dollar had also moved higher above 0.6880. AUDUSD opened the week at 0.6855.

The US500 has fallen once again to its 200-MA. Futures are implying the bulls will defend the level in the US session. But whatever way the index moves, AUDUSD is likely to follow.

AUDUSD (black) and the S&P500/US500 (orange). When the equity benchmark moves higher, the AUD tends to as well. Chart source data: TradingView

AUDCAD approaching break out

The set up in the AUDCAD is another one to watch. The pair is pushing at the top of the range at 0.94 and will break higher if AUD gains at a faster pace than CAD. Watch for an AUDCAD daily close above 0.94 resistance.

Chart source data: Metaquotes MT5

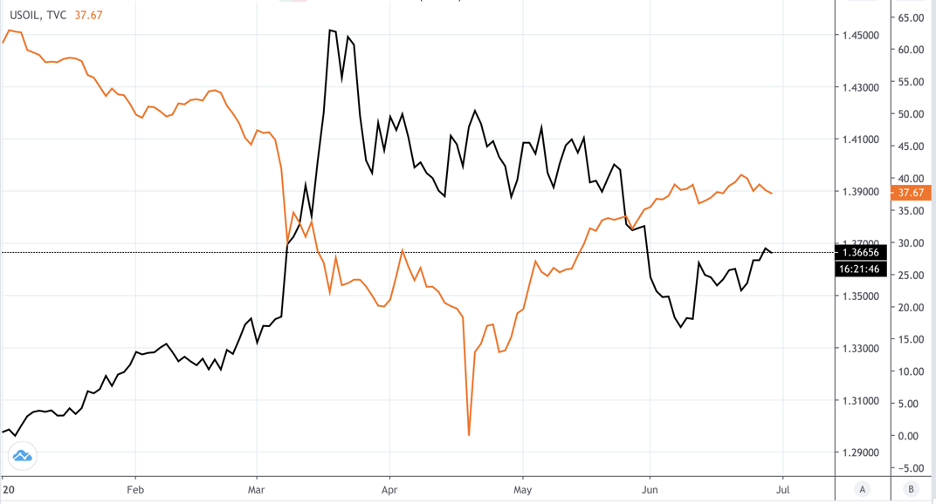

So what’s driving the CAD compared to the AUD? Both are risk proxies - and the AUD tracks the S&P 500 fairly closely these days. Whereas the CAD is a petro-currency and sensitive to the oil market, mostly WTI crude (XTIUSD). So although both are risk proxies, they’re driven by different risk vehicles.

USDCAD (black) and XTIUSD (orange). When oil prices increase, the Canadian dollar tends to strengthen too. Chart source data: TradingView

The AUD is outperforming the CAD right now, and we can see that as it approaches and tests the top of the range at 0.94 on the AUDCAD daily chart. Thinking about the S&P 500 as the AUD’s main driver compared to WTI for CAD, and it can be argued the AUD has a broader risk exposure, hence its outperformance.

These are of course generalisations and smaller day-to-day news flow and data releases will move the currencies as well. However if the oil market makes a big move one day, it will be reflected smaller in the

This potential breakout is one to watch. If we see an AUDCAD daily close above the top of the range (0.9400), it would tell us the AUD bulls have control and could be catalyst for a momentum trade. Keep it on your radar.

Big week ahead for the USD

It’s a big week ahead for data, notably with US ISM manufacturing and Non-farm payrolls for June. The releases will give an underlying read of the US economy - and don’t forget the huge upward surprise from last month’s payroll data, which boosted the US dollar on the day (5 June).

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our online application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)