Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

A traders’ week ahead playbook – a week littered with landmines

Key event risk summary:

- FOMC meeting (3 Nov 5 am AEDT) and chair Jay Powell press conference – the Fed hike 75bp, but it’s all about the guidance

- RBAmeeting (1 Nov 14:30 AEDT) – A 25bp hike is expected, watch for the optionality of a bigger hike in the December meeting

- BoE meeting (3 Nov 23:00 AEDT) – a 75bp expected – Comments from members Mann and Pill will also get a focus throughout the week

- EU CPI estimate (31 Oct 21:00 AEDT)- the market expects inflation to rise to 10.3% from 10%. We also get 16 ECB speakers throughout the week

- US Non-farm payrolls (4 Nov 23:30 AEDT) – The consensus is for 190k jobs, an unemployment rate of 3.6%, average hourly earnings of 4.7%

- China manufacturing and services PMI (31 Oct 12:30 AEDT) – consensus is for the manufacturing index to fall to 49.8 (from 50.1)

- US ISM manufacturing (2 Nov 01:00 AEDT) – The consensus is for this to print 50.0

- US services ISM (4 Nov 01:00 AEDT) – the market consensus is 55.1 (from 56.7)

- US JOLTS report – 9,625,000 jobs openings expected (from 10.053m)

Risk assets put on a show on Friday, but I can’t help but feel the improved sentiment may run into headwinds this week – an open mind to change in market structure is always advantageous and while we endeavour to assess risk and potential outcomes, the market will do what it wants to do, and we dynamically react to flow and price.

The ‘peak rates’ trade - catalysed by the WSJ article, as well as dovish turns from the RBA, BoC, and ECB has been well traded, and despite poor earnings from several mega tech names, we see the US500, US30 and US2000 breaking strongly higher. The ECB’s dovish narrative helped EU equities put on a show and price momentum is strong - a significant 26bp (to 2.07%) tightening of the Italian 10yr BTP – German 10yr bund spread on the week has also assisted, as this one of the core gauges of sentiment to the region. That said, with various EU inflation prints coming in hot (German CPI printed 11.6% vs 10.9% eyed), and the wider EU region CPI print expected to increase to 10.3%, this may have some questioning whether the ECB went too early on its dovish turn.

Another talking point is that despite the positive equity flow, we saw the USD supported, with tailwinds coming from the US Treasury market, with the US 2yr Treasury +14bp on Friday into 4.41% - we also see US 5yr real rates +8bp to 1.54% and holding the 1.50% range lows. If the USD builds, then one suspects goodwill towards equity will reverse.

With US real rates and the DXY rising, gold has found sellers into $1645 and looks to revisit $1621 support, where a break would get real attention from clients.

Month-end flows may be a factor in the equity move, and we know US corporate buybacks have ramped up to $5b a day – we’ve seen an insatiable bid in Apple and the buyers put in a powerful statement on Friday, showing real leadership in a sector that is in the doghouse.

A central bank bonanza

We watch and react to guidance from the FOMC, RBA, Norges Bank, and BoE – The Fed naturally commands our core attention as the sole entity that can move all markets, and everyone wants to understand what a “step down” in future rate hikes looks like – A 75bp hike at this meeting is a lock, but it’s the readiness to slow the future pace of hikes that could move rates pricing, and in turn, the USD, NAS100 and gold. With 59bp of additional hikes priced for the December FOMC meeting, market pricing feels fair, and the Fed will want to give themselves maximum flexibility, so they would be free to hike by 50bp or 75bp. That will be determined by the ongoing data and financial conditions.

The market craves insight and definition from the Fed – I’m not sure we get it, so with USD positioning less stretched, at the margin, this favours a USD rally. USDCNH remains a key driver here, so watch for a re-test of 7.3000. USDJPY has bounced off 145.00 which is where we saw big volume in recent days, so that may be significant for a rally into 149.00.

The FOMC meeting aside, it’s a monster week of US data. So consider we also get the JOLTS employment report, ISM manufacturing, ISM services and non-farm payrolls – we also gear up for the US Mid-Term elections and as we look at the potential outcomes could indeed drive broad market volatility - needless to say, this is a blockbuster week for event risk and portfolio landmines.

For the US500 to break back above 4000 we’ll need to see clarity on easing back to 50bp in Dec, as well as a clear cooling of US labour markets – when it comes to US and global data bad news is good news for risk and vice versa.

(Daily of copper)

Copper and crude are worth putting on the radar, notably copper is consolidating with price trading in an ever-narrow range – on one hand, we watch China PMIs, but the US ISM manufacturing report is expected to print 50.0 on the diffusion index, so it wouldn’t surprise too intently if this fell below 50.0 – the line between growth and contraction.

The RBA to hike 25bp

The RBA should hike by 25bp, and while there are calls for 50bp, this seems a hero call driven by last week's above consensus CPI/PPI print. A 50bp hike, should it come, would shock the markets and we’d likely see big vol in the AUS200 and Aussie banks – consumer stocks would attract increased shorting flow. We see AUDUSD 1-week implied at 17.4%, which is the highest in G10 FX – so the market is looking here for movement. AUDNZD has been an interesting trade, falling from 1.1450 to 1.1000 – I expect this to chop around and consolidate here, with price back in the May to Sept range.

Can GBPJPY kick on?

The BoE should hike by 75bp, and again this is fully priced so a 50bp hike – a low probability, but not several economists have made compelling arguments why we could see a smaller hike. EURGBP looks heavy on the daily, but GBPJPY is one that has come on the radar and is an interesting tactical case study – consider price has broken out and I question if this can really kick and trend – what worries the potential negative divergence (price and the RSI) is, as well as running into another fight with the BoJ who could intervene once more.

(GBPJPY daily)

Another big week for traders – where the ability to be in front of the screens when the data drops is clearly advantageous. Position sizing will keep you in the game, but so will being humble and knowing when to hold and when to fold.

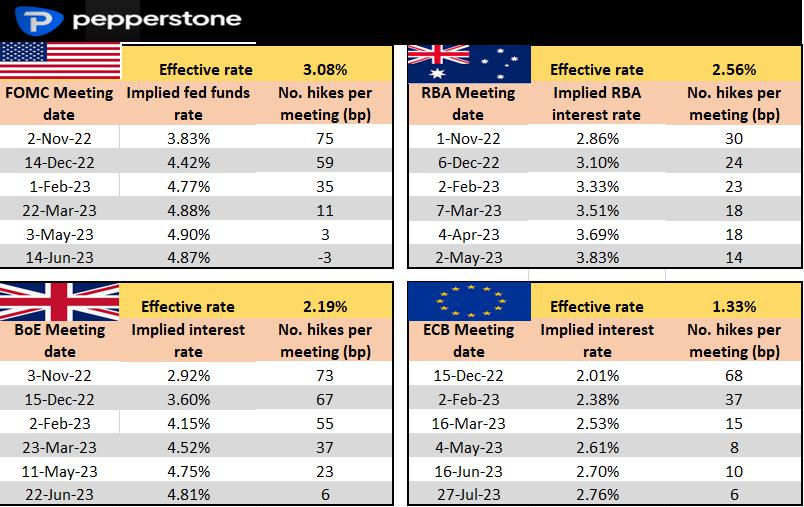

Rates Review – we look at market pricing for the upcoming meeting, what’s priced and the step up to the following meeting (s)

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.