Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Liquidity is currently not the bearish catalyst for the equity drawdown that many thought it might be.

Economic data continues to frustrate those positioned portfolios for a recession - US consumer confidence, new home sales, and durable goods all come in hotter-than-expected. At the same time, US core PCE inflation was a touch softer at 4.6%, with softer core inflation prints also seen in Japan (Tokyo), Europe and Canada.

It seems good economic news is truly good news for stocks and high beta FX – case in point, on the week, we saw the market’s expectations for the peak fed funds rate (currently seen in November) increasing by 7bp to 5.4%. Amid tighter expected Fed policy, US 2yr Treasuries gained 15bp on the week (to 4.89%), and yet, despite the rise in bond yields, the NAS100 gained 2.2% - closing out the best first half ever, with a remarkable gain of 39%.

We’re also seeing bullish breakouts in the US500, and EU equities, with the SPA35 breaking out, while the skew is risk is that the FRA40 retests the 17 April highs.

As we see in the calendar below, there is a heavy focus in the week ahead on the labour market. Unlike recent months, as long as the growth and jobs data stay firm and highlights that a US recession is a 2024 story, and with inflation grinding to target, then the equity (and risk) bulls will continue to buy dips. The risk bulls will want a solid nonfarm payrolls report, but any goodwill will be conditional on average hourly earnings (AHE) holding below 4.3%.

In FX markets, the USD has been frustrating, and just when the bulls were hoping for a break of 103.38 resistance (in the USD index), the sellers reversed the goodwill. We remain on intervention watch in Japan, notably with the trade-weighted JPY falling 0.5% on the week and well below levels since Sept 2022, when the MoF bought Y2.8t. We’ve seen clear signs that the PBoC has reached its tolerance level on USDCNY and is pushing back. USDCNH remains central to all USD moves.

It will be a quiet start to the week with Independence Day in the US tomorrow, but let’s see if the new month brings a new trend – but knowing that the NAS100 has rallied in the last 15 consecutive months of July, it feels like the pain trade is still to the upside and the odds are skewed for higher levels – an open mind will always serve us well in trading, but for now, I am happy to just roll with it.

NAS100 weekly – printed a bullish outside week

Tactical play of the week: Long NAS100 (stop orders) above 15,220. A new month, but nothing changes – Ride the momentum, and the strong get stronger.

Rearview alpha plays:

- G10 and EM FX play of last week: Long NOKSEK (+1.8% last week), long USDRUB (+5.4%)

- Equity indices play of last week: Long SPA35 (+3.5%) – to the highest levels since Feb 2020

- Commodity plays of last week – short corn (-16%), long Cocoa +4.6% (strong uptrend)

- Equity plays for the radar – Bega Cheese (BGA.AU) – shares have fallen for 8 days in a row. Apple (eyeing $200 with a market cap over $3t).

The key event risks for the week ahead

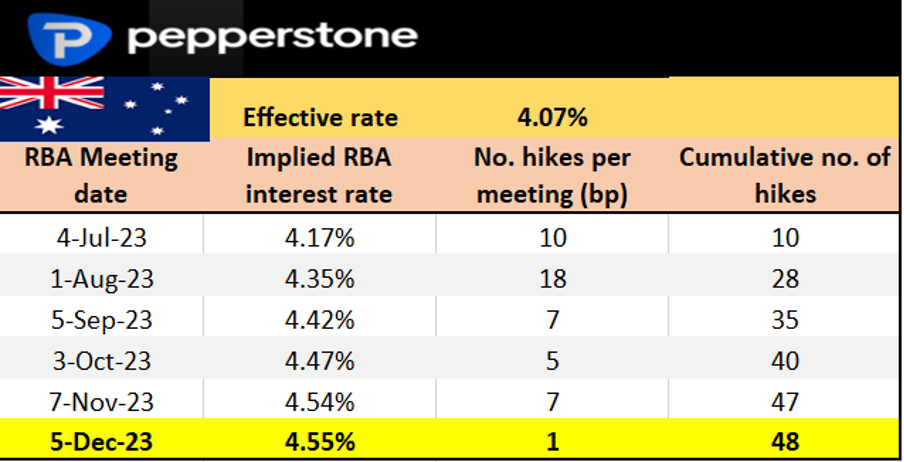

RBA meeting (Tuesday 14:30 AEST) – It's hard to recall a time when making a call on an RBA policy decision was so finely balanced. One could make just as good a case to hike, as they could to hold. The economist community are evenly split (14 of 27 economists are calling for a pause), and Aussie rate futures are pricing a 40% chance of a hike. Given this dynamic, the RBA may lean on the path of least regret and hike. On the week I see AUDUSD trading a 0.6750 to 0.6580 range. AUDNZD is the cleanest play on the RBA meeting and relative policy divergence, and on the week, I would look to sell rallies into 1.0950/60.

Aussie interest rate futures – expectations for RBA policy per meeting

US ISM manufacturing (Tuesday 00:00 AEST) – the market expects a slight improvement in the pace of decline with the consensus set at 47.2 (vs 46.9 last month). We may need a reading above 50 to get the USD fired up, although a read above 50 would certainly surprise. Good data seems to be a positive for risky assets despite the move higher in bond yields, so expect equity to rally on a stronger-than-expected print.

US weekly jobless claims (Thursday 22:30 AEST) – The economist consensus is for 245k weekly claims. Last week, we saw a strong reaction to the lower-than-expected claims print, so we know the market is looking at this data point closely. That said, we’d need a big increase/decrease from last week’s print (of 239,000) to move the dial this time around.

JOLTS job openings (Friday 00:00 AEST) – the consensus here is for job openings to fall to 9.98m (from 10.1m). A pullback below 10m openings would be further relief for risky assets. A big upside surprise may see US treasuries rally (yields lower) and USDJPY should find sellers.

US ISM services (Friday 00:00 AEST) – the market consensus is for slightly stronger growth in the US service sector at 51.3 (50.3). Again, we look for extreme reads vs consensus, but above 52.0 would really push back on the idea of a near-term economic slowdown.

US non-farm payrolls (Friday 22:30 AEST) – the marquee economic data point of the week, where the market consensus is for 225k net jobs (the economist’s range is seen between 263k and 124k). The unemployment rate is eyed to fall back to 3.6% (3.7%), with average hourly earnings seen at 4.2% YoY. The form guide suggests the risk is for a number above 200k, having beaten expectations for 14 straight NFP prints. A big upside surprise should see USDJPY rally hard and push the BoJ/MoF a step closer to JPY intervention.

Canada employment report (Friday 22:30 AEST) – the consensus is for 20k jobs to have been created, and the unemployment rate to lift a touch to 5.3%. With 13bp of hikes priced for the 12 July Bank of Canada (BoC) meeting, the outcome of the jobs report could influence that pricing and by extension the CAD. There has clear indecision on the USDCAD daily of late, subsequently, I would look to buy/sell a break of 1.3285 or 1.3116.

Mexico CPI (Fri 22:00 AEST) – those that sit in the camp that Banxico cut rates in Nov/Dec will be closely watching the CPI print. The market expects a further dip in headline inflation to 5.07% and core inflation to 6.87% (from 7.39%). Carry traders are still drawn to the MXN and happy to jump on any weakness, subsequently, USDMXN seems likely to test the recent lows of 17.0227.

Central bank speakers

ECB – Villeroy, Guindos, Lagarde (Sat 02:45 AEST)

BoE – Catherine Mann (Sat 00:30 AEST), Bailey (Sunday 17:30 AEST)

US – FOMC minutes (Thurs 04:00 AEST), Williams and Logan

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.jpg?height=420)