- English (UK)

Online trading platforms, integrations & trading tools

Bring your vision to life with our suite of smart technology for the sophisticated trader.

Trade your way with advanced third-party platforms

.png?&fit=crop&crop=center)

MT5

An even-more powerful version of MetaTrader? Let more markets, more order types, more features be your answer.

MT4

Automate your trading with the definitive FX platform. Customise with indicators, EAs and pattern-recognition software.

TradingView

Trade directly through show-stopping charts, with hundreds of in-built indicators and strategies.

cTrader

Replicate an institutional liquidity environment and develop trading robots to automate on your behalf.

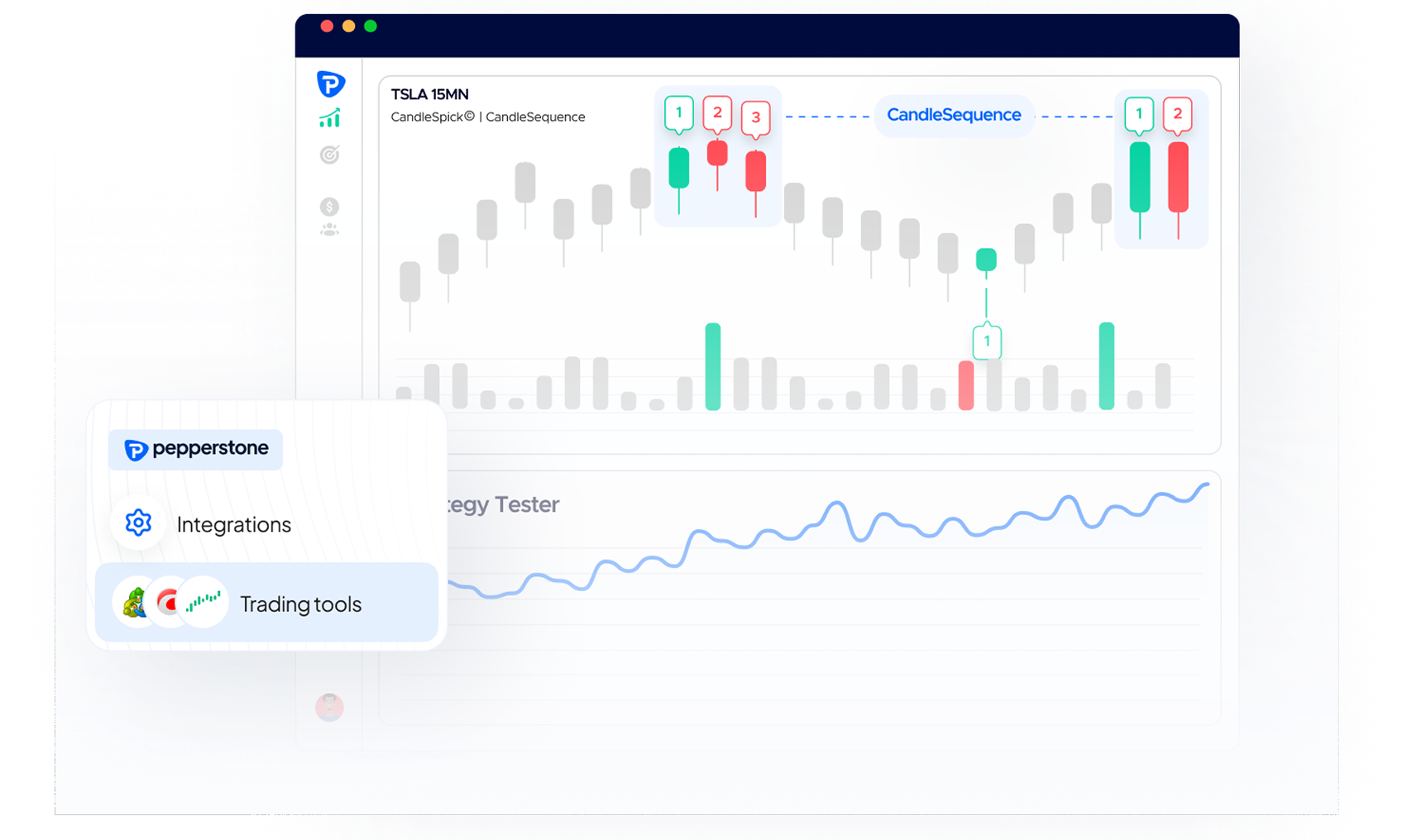

Discover the Pepperstone trading platform

Enjoy a secure and streamlined trading experience on our flagship platform and app. Equipped with the tools you need – and spared the ones you don’t.

Compare our platforms at a glance

Desktop platforms | Windows | Windows | Windows | Windows, Mac OS, Linux | Windows |

Browser version | |||||

App | |||||

Android support | |||||

iOS support | |||||

1350+ instruments | |||||

EAs/automated trading | |||||

Back testing | |||||

Customisable charts/indicators | |||||

Adjustable session times | Localised to client time zones | ||||

Market depth | |||||

Historical data | |||||

Detachable charts | |||||

Cloud-hosting | |||||

FX CFDs | 93 | 61 | 93 | 93 | 93 |

FX spread bets | 91 | 61 | 91 | 91 | 91 |

Indices CFDs | 26 | 26 | 26 | 26 | 26 |

Indices spread bets | 26 | 26 | 26 | 26 | 26 |

Commodity CFDs | 40 | 32 | 40 | 40 | 40 |

Commodity spread bets | 40 | 32 | 40 | 40 | 40 |

Share CFDs | 1400 | 1400 | 1400 | 1400 | |

Share spread bets | 1160 | 1160 | 1260 | 1260 | |

ETF CFDs | 95 | 95 | 95 | 95 | |

ETF spread bets | 95 | 95 | 95 | 95 |

Optimise your strategy with the best tools of the trade

MetaTrader Smart Trader

Optimise your strategy with 28 indicators and EAs, including Trade Terminal and Correlation Matrix, exclusively via the MetaTrader platforms.

APIs

Tech whizz? Develop custom-built systems for automated trading, and connect your own front-end solutions to our elite execution technology and pricing.

Algo trading

Whether you're buying pre-made algorithms or coding your own, execute them seamlessly with our suite of cutting-edge tech.

cTrader Automate

Use cTrader’s API and C# language to create trading strategies that execute on your behalf, and take your backtesting up a notch.

Ready to take your trading to the next level?

Why choose Pepperstone?

Ultra-fast execution

Speeds from 50 milliseconds, with a 99.59% fill rate and no dealer intervention.1

Competitive pricing

Get spreads from 0.0 points on our Razor account,2 plus deep liquidity from Tier 1 banks.

Dedicated support

We’re here to help you around the clock Monday to Friday, and 18 hours at weekends.

24-hour US share CFDs

Make the most of earnings reports, with around-the-clock trading on key US stocks.3

Ready to trade better?

Switch to Pepperstone now and join our global community of over 750,000 traders.⁴ Apply in minutes with our online application process.

1

Register

Sign up with your email address and get a free demo.

2

Answer

We’ll check our products are appropriate for you.

3

Verify

Your safety is our top priority.

4

Fund

That’s it! You’re ready to trade.

199.59%. Fill rates are based on all trades data between 01/07/2025 and 30/09/2025

2Other fees and charges apply.

324-hour trading 5 days per week on select US share CFDs. For exact timings, please refer to the instrument specifications within the trading terminal.

4Data correct as of April 2025.