What is the bid-ask spread?

A bid-ask spread is a two-way quote for buying and selling, which can help you manage trading costs, spot market trends, and make more informed trading decisions. Keep reading to learn more.

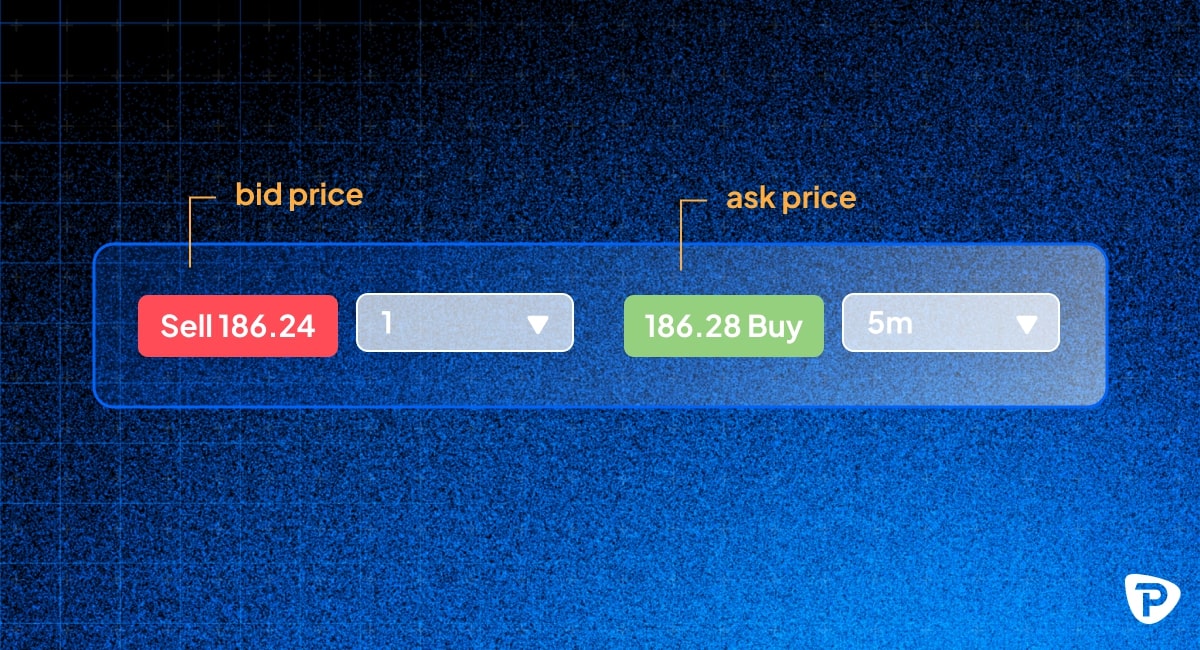

When you look at a trading instrument, you'll often see two prices quoted — the bid and the ask. The bid reflects the highest price traders are willing to pay for the asset, and the ask is the lowest price for which traders are willing to sell it.

For example:

- Bid: 1.1050

- Ask: 1.1052

The difference between these prices is known as the bid-ask spread, also known as the bid-ask price, which is effectively the cost of entering a trade.

_and_bid_price_at_$100_(selling)_with_definitions_provided.jpg)

The bid-ask spread has a direct impact on the price you pay when buying and the amount you receive when selling. If you buy an asset, you pay the ask price (the higher of the two). If you sell, you receive the bid price (the lower of the two).

This means that the moment you open a trade, you’re technically at a loss equal to the spread. The market needs to move in your favour by at least the spread amount for your position to break even.

Why does the bid-ask spread matter?

If you buy an asset and immediately sell it back, you'll often do so at a loss. This is because of the spread. Therefore, the spread matters because it represents a real trading cost. It's how liquidity providers, like brokers and market makers, earn money from facilitating trades. As a result, you should always factor in spread costs when planning your trades, especially if you're placing frequent or large-volume orders.

What influences spread width?

Several factors can influence how wide or tighter a spread is:

- Liquidity

Highly traded instruments, like EUR/USD or USD/JPY and other major forex pairs, tend to have tighter spreads because there’s more activity in the market. - Volatility

During periods of market uncertainty, such as that caused by economic data releases or geopolitical events, spreads may widen due to rapid price changes and less confidence in pricing. - Time of day

Spreads can also be affected by when you're trading. For example, during peak trading hours, like the London–New York session overlap, spreads tend to be tighter. Wider spreads often occur outside of regular market hours or during rollovers.

What do tight or wide spreads say about market conditions?

Spread sizes can provide useful signals about market conditions. Tight spreads usually indicate high liquidity and relatively stable prices. This can be favourable for shorter-term trades or scalping strategies. Wider spreads, however, may suggest lower liquidity, higher uncertainty, or increased volatility — all of which can raise your trading risk. Being aware of spread sizes can help you decide when to trade, or whether to wait for more favourable conditions.

How spreads affect different trading styles

Depending on your strategy and trading time frame, spreads can impact you differently. If you take a short-term approach, such as scalping or day trading – you’ll be more sensitive to spreads.

If you use long-term strategies, like swing and position trading, you’ll be less affected by spread prices. This is because you’ll likely hold your trades for longer and aim for larger moves. With that said, though, it’s still worth monitoring spreads to avoid unnecessary entry or exit costs.

Can you reduce your spread costs?

While you can’t avoid spread costs entirely, there are ways to manage and potentially reduce their impact.

- Trade during peak hours

Aim to place trades during high-liquidity periods — when spreads are typically tighter. - Choose liquid instruments

Major forex pairs, key indices, and popular commodities often offer the most competitive spreads. - Use a broker with low spread offerings

Pepperstone, for example, offers a Razor account, giving you access to ‘raw’ spreads as low as 0.0 pips on FX alongside a set commission fee. - Avoid volatile market conditions

If you’re a new trader, consider staying out of the market during high-impact news events, which can temporarily widen spreads and increase slippage.

Summary: what you need to know

- The bid-ask spread shows the highest price buyers are willing to pay (bid) and the lowest price sellers are willing to accept (ask).

- The spread is the difference between these prices, and it represents a trading cost.

- Spreads are usually tighter in high-liquidity, low-volatility environments and wider during off-hours or periods of uncertainty.

- Paying attention to spreads can help you manage costs, avoid risky conditions and make more informed trading decisions.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.