- English (UK)

FTSE 100 weekly outlook: New All-Time High, MPC Decision Seen on a Knife-Edge

Summary

- New All-Time High: From Monday’s low into Wednesday’s new all-time high, the FTSE 100 index rallied 1.6%. A setback emerged as global equity momentum slowed.

- Catalysts:Strong earnings in energy heavyweights Shell alongside the banking sector strength maintained recent positive sentiment.

- Week ahead: Focus will be on Q3 earnings from BP and AstraZeneca, but Thursday’s MPC rate decision will take centre stage, with the market appearing split between unchanged and a 25bp cut.

What is driving the FTSE 100 price?

Global risk sentiment started strong last week, lifting the FTSE 100 as upbeat earnings out of the US from Microsoft and Amazon helped fuel optimism. But margin pressure at Alphabet and Meta triggered a tech-led setback, dragging global equities lower into the weekend.

In the UK, energy and financials anchored the FTSE 100’s climb to a record 9,798 on Wednesday. Shell helped by firm oil prices, reinforcing its 7.16% index weight, while financials held steady thanks to solid earnings and macro stability. Together, they kept the rally alive even as global sentiment wavered somewhat.

This all helped the FTSE 100 climb 1.6% off Monday’s low at 9,640, posting a new record high of 9,798 on Wednesday. Energy and financials led the advance, but momentum faded into the weekend, with the index settling at 9,741, marking a modest pullback visible on the 4-hour chart below.

Where next for the FTSE 100?

Maintaining the momentum of this recent up move continues to be important.

After last week’s late pullback, all eyes are on whether the FTSE 100 can reignite upside momentum and make a run at the psychological 10,000 mark. The index hit a record 9,798 midweek before fading to 9,741 into Friday’s close. This week’s focus shifts to heavyweight Q3 earnings: BP (2.73% weighting) on Tuesday and AstraZeneca (7.1%) on Thursday, which is the UK’s biggest company by market capitalisation. Strong results could resume the rally, especially with energy and healthcare also acting as key stabilisers.

All eyes now turn to Thursday’s Bank of England decision, with the MPC set to announce rates at mid-day with the press conference at 12.30pm. Markets are split, some expect a 25bp cut to 3.75%, while others see a hold at 4.00% amid persistent inflation risks. The outcome could be pivotal for FTSE 100 momentum, especially with the earnings from BP and AstraZeneca also in play. A dovish surprise may fuel a push toward 10,000, while a hold could stall the rally.

Goldman Sachs surprised markets last week by forecasting a 25bp rate cut, citing softer inflation and cooling wage growth. But others expect the Bank of England to hold at 4.00%, stating the MPC might prefer to wait for more data and the November 25th Autumn Budget before easing.

Market pricing reflects the split view, with only a modest chance of a cut priced in ahead of Thursday’s decision. The outcome could be important for FTSE 100 index momentum and rate-sensitive sectors.

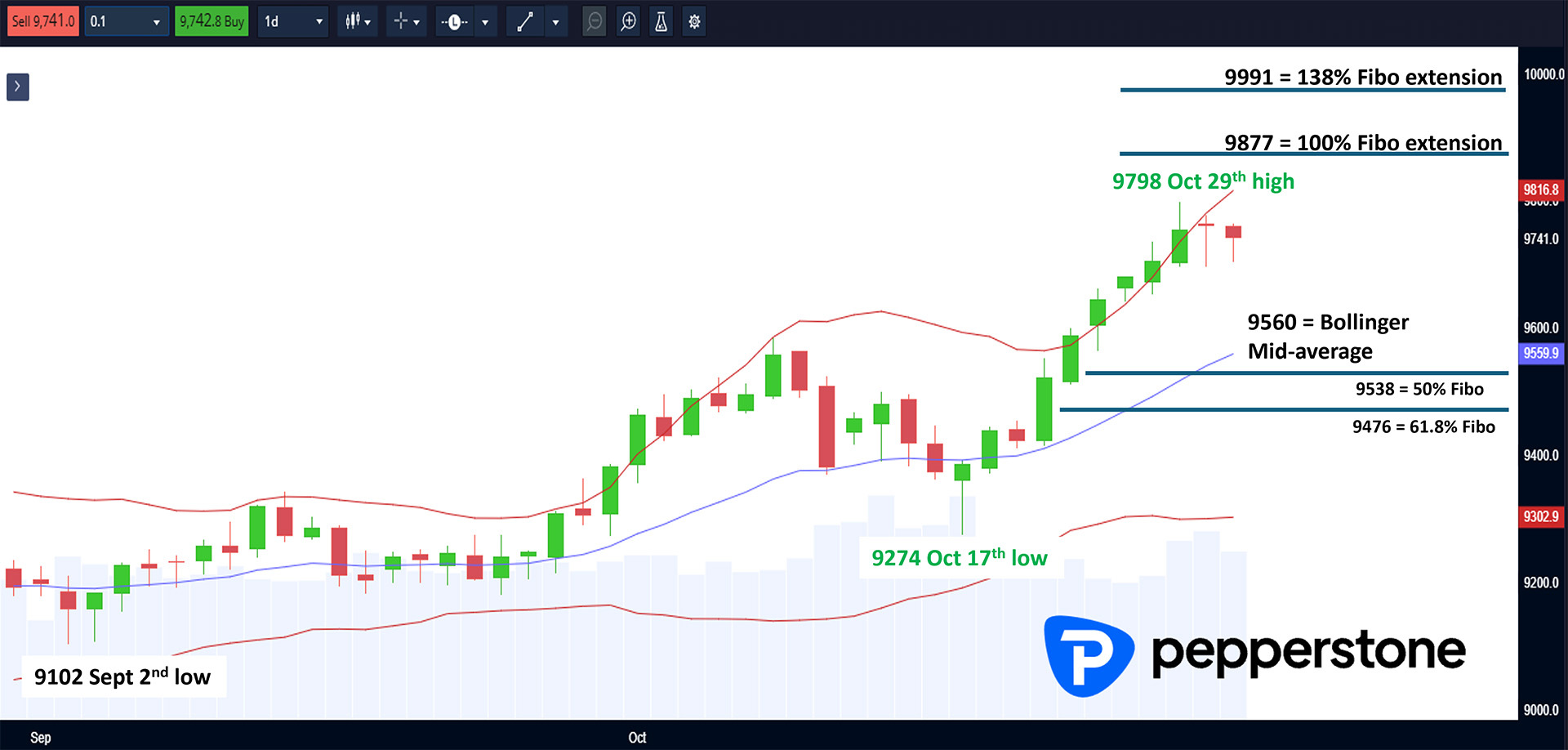

Technical update - FTSE 100 daily chart:

The FTSE 100 appears to continue to trade with a positive bias, holding above the rising Bollinger mid-average on the daily chart. That mid-average, now at 9,560, marks a key support zone if prices pullback next week. As long as price action stays above it, the broader uptrend remains intact.

A break and close above last week’s 9,798 high would suggest renewed upside momentum, which could open the door to 9,877, the 100% Fibonacci extension of the October 7th to 17th price pullback, and potentially 9,991, the 138.2% extension, just shy of the psychological 10,000 mark.

Support: 9560 (Bollinger mid-average), then 9538 (50% mid-point) then 9476 (61.8% Fibonacci retracement)

Resistance: 9798 (October 29th high), then 9877 (100% Fibonacci extension) then 9991 (138% extension).

What FTSE 100 stocks are in focus next week?

Earnings of some popular FTSE 100 stocks are due out next week and could impact sentiment.

Highlights:

- BP which carries a 2.73% weighting in the FTSE 100 is due to release its earnings on Tuesday.

- AstraZeneca, the largest UK company by market cap and carries the highest index weighting, is due to release its earnings on Thursday.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.