- English (UK)

US earnings the marquee risk this week

I would argue that for single stock and equity index traders US earnings will likely prove to be the most influential factor, with 40% of the S&P500 market cap due to report this week, with 4 of the 6 biggest market cap names in the NAS100 reporting.

With some sizeable moves implied by the options market for the individual names on the day of reporting, movement at a stock level could resonate across other plays within their sector and potentially promote wide-index volatility. Nvidia and Apple aside, company earnings don’t come much bigger than Microsoft, where the options market implies a move (higher or lower) of 4.7% - the after-market session on Tuesday (when MSFT report) could get lively, so make sure you’ve got our US 24hr equity offering on your platform to assess (and even trade) the ensuing move.

US nonfarm payrolls will offer meaningful insights for macro heads

US nonfarm payrolls are the next most meaningful event risk for me. From a playbook/risk perspective, if the payrolls print comes out around 200k, with an unchanged unemployment rate then making a call on the USD, NAS100 and gold is a tough exercise as the macro argument doesn’t really evolve.

It is easier clearly to consider the path of the USD if we see a payrolls print below 170k, concurrently with a higher unemployment (U/E) rate, and a further moderation in average earnings. In fact, if we see a U/E rate above 4.1% then one could argue the US swaps pricing may even price a small probability of a 50bp cut in the September FOMC meeting – a factor which should suggest buying USDs because there is little chance that will play out.

A lower U/E rate, and above 200k payrolls would make the macro somewhat messy as it challenges the strong consensus position for a cut in September.

The FOMC meeting to open the door to cuts

The Fed meeting statement and Powell’s presser is really an exercise in assessing what’s priced into the US swaps/rates curve and whether the tone sufficiently meets these expectations for easing. The door needs to be opened for a cut or US 2yr Treasury yield will spike higher, and the USD will rally hard, taking US equity lower. The options market implies a -/+1% move in the S&P500 on FOMC day, which is above the typical -/+0.8% move we’ve seen in recent meetings - so the market is priced for increased movement, and that needs to be accounted for in our risk and position sizing.

The BoJ meeting will get good airtime, and while the JPY has undergone a huge rally of late, let’s not forget that the BoJ also have a strong history of disappointing those calling for hawkish policy action. I am somewhat sceptical that BoJ action will have much of an effect on the JPY anyhow, as the move we’ve seen has been more about a position unwind, with JPY-funded carry positions unwound, with cross-asset volatility and expected Fed policy changes the greater driver. Still, it’s a risk that could promote vol and needs to be considered.

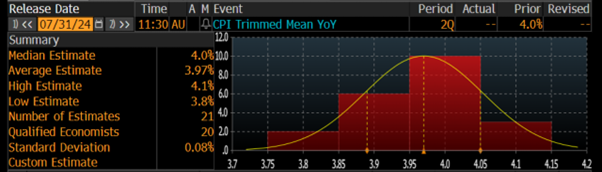

Aus Q2 CPI to make or break an August RBA rate hike

The Aus CPI print will be closely watched by AUD and ASX200 traders, as it could put the 6 August RBA meeting as a truly ‘live’ event, while a weaker-than-expected outcome could take any chance of a rate hike off the table – much to the relief of the local equity market.

We also see increased two-way risks to the GBP with the BoE meeting a lineball call as to whether the BoE cut bank rate. While the EU and Swiss CPI reports could also move the dial on the EUR and CHF.

Elsewhere, I will be watching crude oil and gold in the wake of rising geopolitical news flow between Israel and Hezbollah.

Good luck to all.

US Earnings due this week – It’s a busy week on the US corporate reporting calendar. 40% of the S&P500 market cap report numbers, but the names that should get the greatest attention from clients include:

AMD (the options market implies a -/+7.7% move on the day of reporting), Boeing (-/+4.2%), Microsoft (-/+4.7%), Meta (-/+8.7%), (QCOM -/+7.6%), Coinbase (-/+9.8%), Apple (-/+3.8%), Amazon (-/+7.2%) and Intel (-/+7.4%).

The ASX200 full-year earnings season commences with Rio Tinto starting proceedings on Wednesday.

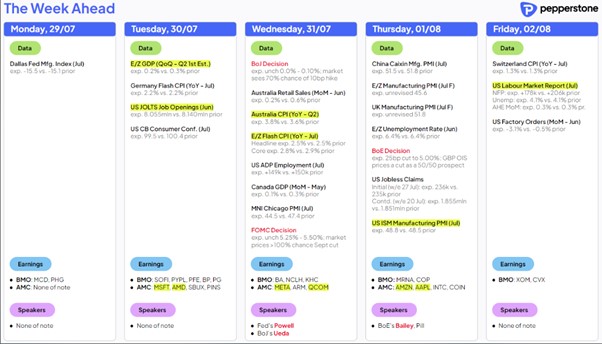

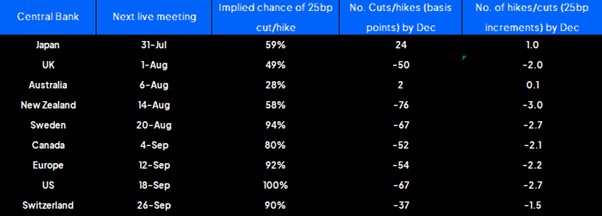

Market expectations for central bank policy changes:

We assess swaps pricing and the implied probability priced for a cut/hike at the next ‘live’ central bank meeting, and the cumulative pricing/expectations by December.

Central bank meetings due this week:

BoJ Meeting (Wednesday – no set time) – The majority of economists see the BoJ keeping rates unchanged at 0.1%, although the distribution of these estimates range includes a 10bp, 15bp and even 25bp hike. Japan Swaps market price a 10bp hike at a 50% probability. There will also be a focus on any changes to the monthly pace of BoJ bond buying, where the central view is we see the monthly pace taken from Y6t p/m to Y4.5t. With the trade-weighted JPY rallying 2.6% last week, a number of traders have covered JPY shorts into the meeting, and positioning is far less extreme.

Fed Reserve meeting and Chair Powell Press conference (Thursday 04:00) – the Fed will leave rates on hold, but the tone of the FOMC statement should evolve to show the Fed has greater confidence in the inflation outlook and to lay the groundwork for a cut in the September FOMC meeting. With a 25bp cut in September now fully priced, and 67bp (or 2.7 25bp cuts) priced by December, the move in the USD, gold and US equity will come in the tone of the FOMC statement and chair Powell’s press conference relative to this pricing. Will the statement meet these expectations sufficiently?

For more intel on the FOMC meeting, see my colleague Michael Brown’s preview

BoE Meeting (Thursday 21:00 AEST / 12:00 UK) – Eyeing UK swaps pricing, a 25bp cut is priced at a 50% probability, so market participants see a cut as finely balanced. Economists, however, see a greater probability of easing, with 24 of 32 polled by Bloomberg calling for a 25bp cut to pull bank rate to 5%. The split in the MPC votes for a hold/cut may also be closely followed.

For more intel on the BoE meeting, see my colleague Michael Brown’s preview

Marquee economic data & consensus expectations:

US nonfarm payrolls (Friday 22:30 AEST) – the consensus is for payrolls to come in at 178k (economists’ estimates range from 225k to 70k), with the unemployment rate unchanged at 4.1%, and average hourly earnings at 3.7% (from 3.9%). There may be disruptions that impact the nonfarm payrolls print, notably from Hurricane Beryl, so forecasting the jobs report is typically a huge challenge.

An unemployment print that ticks up to 4.2%, with an NFP print below 170k would be a surprise, but it could feasibly bring a 50bp cut onto the table in September, at least in swaps/rates pricing.

Other notable US economic data points this week that could move markets include Consumer confidence (Wed) and ISM Manufacturing (Thursday).

Australia Q2 CPI (Wed 11:30 AEST) – Headline CPI is expected at 1% Q/Q / 3.8% y/y, with trimmed-mean CPI at 1% q/q / 4% y/y (the economist estimates range from 4.1% to 3.8%). For a more detailed preview on Aus CPI, see my preview

EU CPI (Wed 19:00 AEST) – Headline CPI is eyed at 2.5% y/y (unchanged), with core CPI at 2.8% y/y (from 2.9%). The market already sees a cut from the ECB in the September meeting, but

China manufacturing & services PMIs (Wed 11:30 AEST) – Manufacturing PMI is expected to come in a little worse than the prior month at 49.4 (from 49.5), with services PMI expected at 50.2 (50.5).

Switzerland CPI (Friday 16:30 AEST) – Headline CPI expected at 1.3% y/y (unchanged) with core CPI also unchanged at 1.1% y/y.

Good luck to all,

Chris

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.