- English (UK)

Markets Navigate Tariff Drama: S&P500 Reverses from 6000, Gold Surges

Yet, in less than 24 hours the Court of Appeals ruled a stay order for the court to consider the motion for 5 June (plaintiff) and 9 June (the Trump Admin) – this will see the US continue to collect tariff revenues – temporarily at least - as per the prior IEEPA levels, with US effective tariff rate remaining, for now, at 11%.

Try making business investment plans to these further twists in the script – in the meantime, the markets give the news of a stay a wide berth and the lack of any major reaction in the US equity futures, the USD, or gold is starkly telling.

To be fair, the reaction in markets to the initial news that the Court of International Trade had ruled Trump’s use of IEEPA as unjustified was never that prolific anyhow – NAS100 futures may have rallied 2%, but we can part attribute that to Nvidia’s strong numbers and the positive flow into the broader semi space – but the reaction on a cross-asset basis was orderly and well managed.

Traders take a deep breath and consider that their job of trying to make money from the aggregate flows that dictate the price action, objectively managing volatility and the risk in a position – and while that is never an easy task, it seems relatively straightforward compared to those who have spent time on Chat GPT or liaising with their in-house US public policy experts analysing Trump’s legal options and the process of what comes next – and once they have that down pat, considering how the saga may affect ongoing trade negotiations, where the US effective tariff rate may settle (and by when), the future US deficit and the impact on inflation and term premium.

And then attempting to suggest where investors need to be positioned in their portfolios…

We can make assumptions of what the collective felt on the day and expressed through the flows and ultimately portrayed in the price action - but for traders blocking out the news has probably kept sanity levels in check. One can simply take a quick look at the intraday chart of S&P500 futures and see that we’re back to exactly the levels we were 24 hours ago – it’s almost as if nothing ever happened, and it was all a bad dream…

Certainly there's not a great feel to the price action and the technical set-up (on the daily) looks ominously like a double top – and as such, a break of the session lows of 5884 and some will be looking down at the 200-day MA (5810) and the neckline (of the double top) at 5756. I question if the market is set up to trade a range of 6000 to 5850 into month-end and into the early throws of next week.

Taking a more holistic view, we see US Inflation expectations initially fell hard through EU trade, with US 1-year inflation swaps -15bp to 3.15%, before reversing higher through US trade to close at 3.23% (-7bp on the day). The US 10-year Treasury found better buyers, with yields falling from 4.53% to 4.41% and flat lining for the meat of US trade. The USD tracked UST yields and saw absolutely no impact from the news of the stay on tariffs.

Gold traded down to $3245 in Asia, where the buyers took control and dominated through both EU and US trade, resulting in a strong low-high trend day, with price rising $85 off the lows to $3331 – the rejection of Wednesday’s lows (and the long candle wick) on the daily candle has caught my interest - we now know where the risk lies for long positions and with price breaking the recent trend of lower highs (best seen on the 4-hr chart), a push through $3330 could see price test the 23 May swing high of $3365 as the first target.

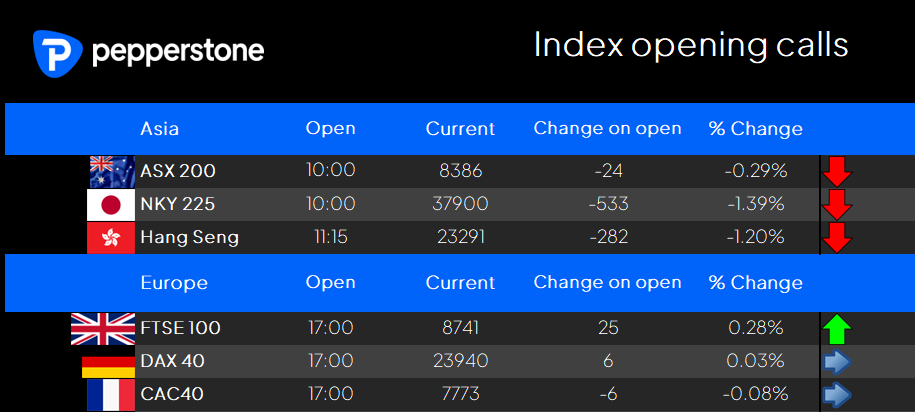

What is clear is that the reversal in S&P500 futures will weigh on the Asia cash equity open and we see futures -1.4% lower than where Asia closed shop yesterday. Our opening calls suggest the selling will be most pronounced in Japan and HK equity, with the ASX200 eyed -0.3%. Again, we close off a turbulent but positive month of May (the ASX200 is +3.5% MTD) and the rebalancing flows that may play out from portfolio managers but also from the MSCI index rebalancing.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.