Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

The Daily Fix – Managing exposures before the event risk deluge

• Is the rotation from tech into small caps over?

• US equity closes higher amid a tight range – the calm before the storm?

• Microsoft’s earnings in focus and they will need to blow the lights out

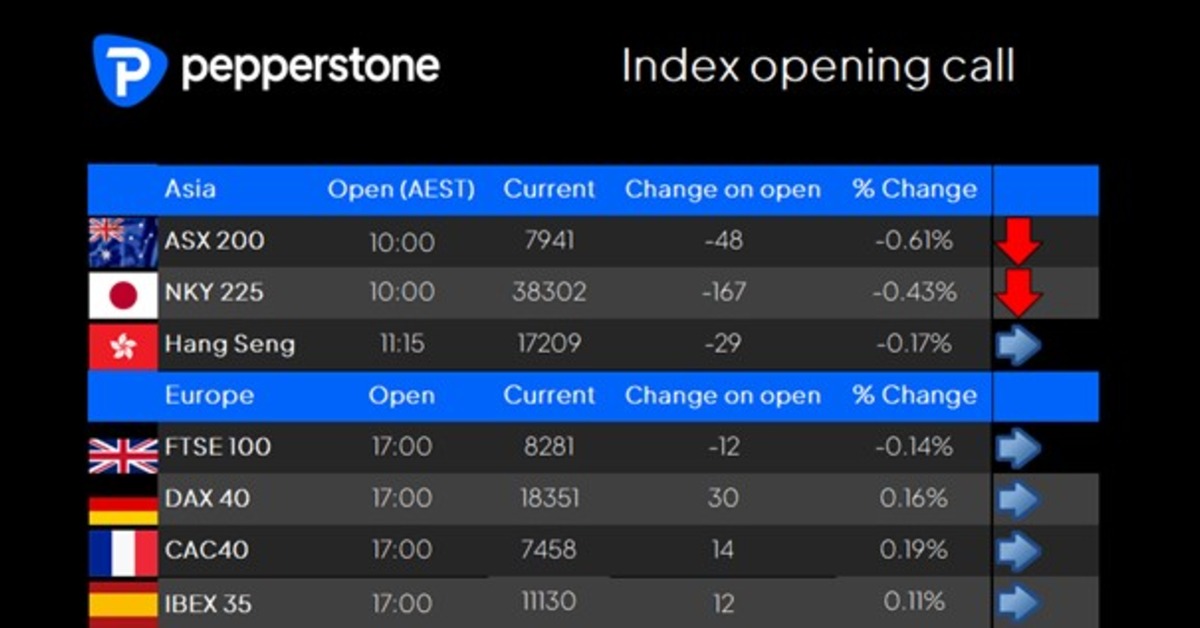

• Our Asia opening calls suggest modest downside on open

• Is the rotation from tech into small caps over?

• US equity closes higher amid a tight range – the calm before the storm?

• Microsoft’s earnings in focus and they will need to blow the lights out

• Our Asia opening calls suggest modest downside on open

As we close out of US trade and look ahead to what will be a modestly weaker open across the Asian equity bourses, where the term ‘calm before the storm’ has been heard across the floors on the day.

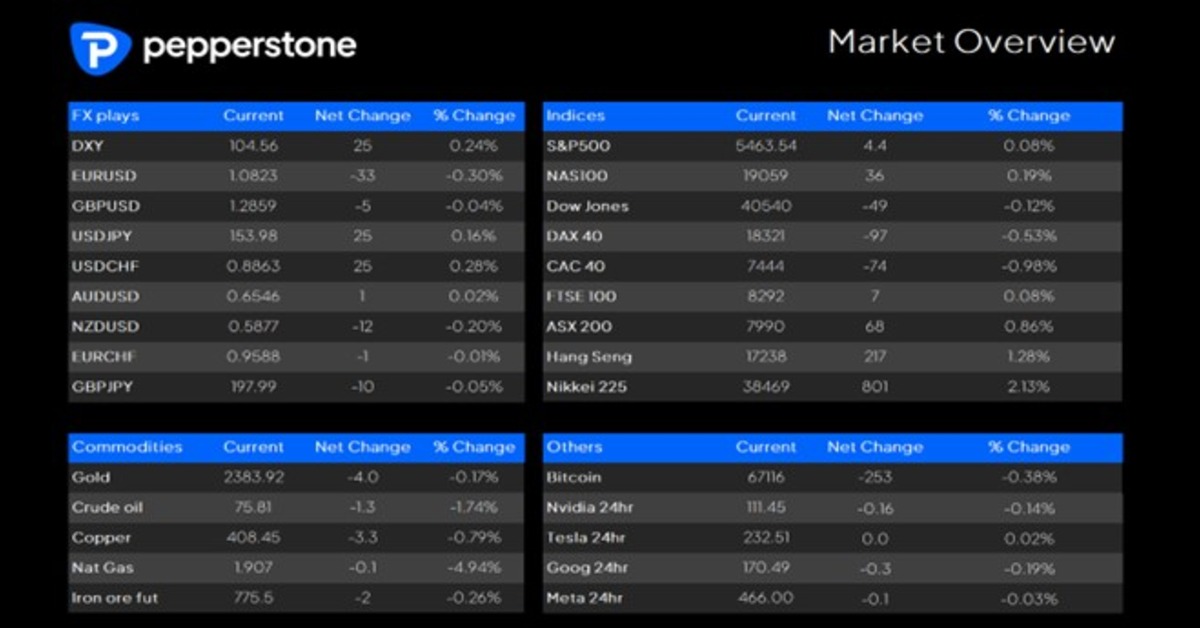

We get set in preparation for a number of potential landmines, where agility will be key, but for now, we wrap up a session where the S&P500 and NAS100 closed a touch higher, with traders banking profits in small caps (the Russell 2k fell 1.1%) after the explosive run, with traders now questioning if the rotation from tech to small caps has run its course. We’ve also seen crude fall 1.8%, while the USD is firmer and US Treasury yields are down a touch at the long end of the curve.

Looking at the intraday tape, we see that the S&P500 had a whippy ride, with traders selling into moves into 5487 and buying weakness into 5444, with the index settling at the 44th percentile of this range – a balanced market, where index traders had to square up and reverse positions throughout the day, with the S&P500 trading a tight 43-point high-low range on the day. Market breadth reflected this dynamic with 55% of S&P500 stocks higher, with only consumer discretionary making a play, and notably this was Tesla and McDonald’s seeing a strong run on the day. Energy was the clear laggard, with crude lower, and finding sellers ahead of Thursday’s OPEC meeting

One suspects that these subdued conditions will change, and we could easily see greater range expansion and volatility both at an index and single stock level. In the session ahead, we get spluttering’s of data in the form of US JOLTS job openings, consumer confidence and house prices, although when the real focal point is Wednesday's Fed meeting and NFPs (on Friday), one suspects these economic data points won’t move markets too intently unless they miss the mark by a truly wide margin.

We also get earnings from AMD and Microsoft in the after-market session ahead and certainly, Microsoft needs to deliver in spades as the bar is set high and long-only funds have accumulated a sizeable position in this name. Notably, there is focus on whether Microsoft can beat expectations on consensus growth metrics for its Azure business, and as we saw with Alphabet, FY2025 capex guidance will come under huge scrutiny, and while the consensus here is for $52b, they will likely need to guide above $60b to meet the positioning.

Our FX flows should ramp up as the week progresses, where on the day traders have seen consolidation in a number of G10 FX pairs, although we have seen good high-low range expansion in GBPUSD and EURUSD and that has attracted the short-term players. GBPUSD has seen good activity, with buyers leaning into longs into 1.2812, and the former highs in early June.

Turning to Asia, and as detailed, our opening calls suggest a weaker open, especially for the ASX200 which once again shows it is struggling to find new buyers into 8000 – there is little in the leads to really inspire buying activity on the open with commodities generally lower, with limited moves in bonds/rates. BHP, for example, looks to open -0.1% at $41.99. Data is limited today, and what we do see won't move markets, so this is a day for position/position management and to review broad exposures ahead of US earnings, and then tomorrow’s Aus CPI, BoJ meeting, German & EU CPI.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.