- English (UK)

So, we get the German IFO survey Thursday (at 18:00 AEST). On any other day I’d expect this to get some attention from the market. That said, with the European Central Bank meeting shortly after (at 21:45 AEST), unless the survey is an absolute calamity, I wouldn’t expect the IFO survey to be a market-mover.

Trading the ECB meeting

The first consideration with the ECB meeting is whether they lower rates at this meeting. The market ascribes a 33% probability that the central bank eases by 10bp, taking the deposit rate to -50bp. So, in theory, there’s a small risk the market is disappointed when they likely leave rates unchanged. But that factor will be short-lived as traders turn to the outlook on policy.

Consider that 34 of 39 economists see rates being left on hold (polled by Bloomberg; see below). So, if the ECB wants to cause a reaction, they know the hurdle to do so is low. One research house (Commerzbank) is even calling for a 20bp cut, which — should it play out — would send the EUR into 1.1100 given how surprised the market would be.

"Source: Bloomberg"

As said, though, a cut at this meeting seems unlikely. Instead, it’s the guidance on what comes in the months ahead that the market will really key off.

The most likely path is that the deposit rate remains at -40bp, where it’s the tone and level of concern that traders will look to buy or sell EURs. It’s widely expected that the ECB alters its forward guidance on any future rate-setting, moving to a full easing bias validating the consensus view that the ECB eases rates in the September meeting. A more explicit guidance on restarting its asset purchase program (QE) in the months ahead would also keep EUR bears fairly content.

How options markets can give us a statistical edge when trading event risk

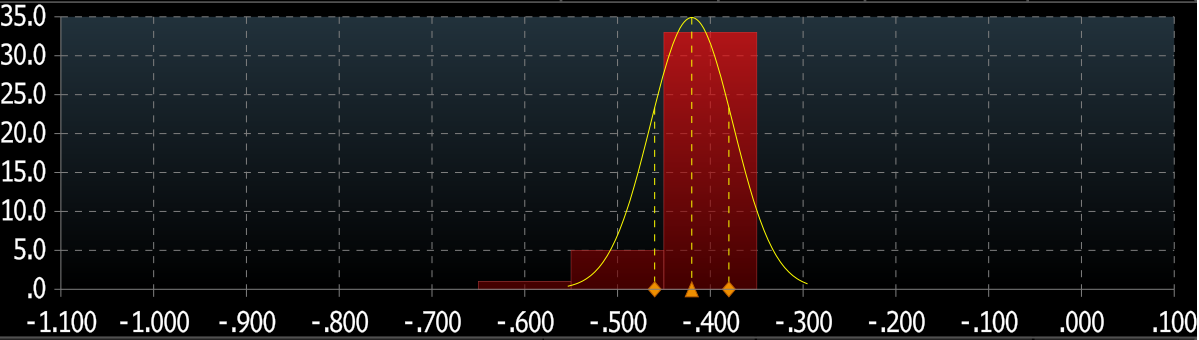

EURUSD implied volatility for options expiring on Thursday sits at 7.2%. We can use this implied volatility and apply to the Black-Scholes formula to understand the implied move (up or down) set by the market through this time. So, applying this logic, the market implies a move in EURUSD of 47 pips (high or lower) through Thursday and into the New York options expiry.

As you can see from the chart (the white-shaded area), the market believes moves in price will be contained to a range of 1.1152 to 1.1246, with a 68.2% level of confidence (one standard deviation).

If the market is really surprised by what they hear, we could see EURUSD trading into, but no further than, 1.1127. Using options pricing is a move (from the current spot price) the market feels 90% confident it won’t breach. For those running mean-reversion strategies on the day, the 1.1120/40 area is where I’d be looking to buy.

On the upside, if the market is disappointed by what they hear, then traders feel EURUSD shouldn’t overshoot 1.1252 (with a 68.2% degree of confidence). But if we take the confidence factor out to 90%, EURUSD shouldn’t trade any higher than 1.1285. This is interesting, as it marries nicely with the July highs. If I had no position in EURUSD, and was looking at high conviction levels to sell into on the day, then 1.1270/85 would be where I’d be looking as a short-term trade.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.