- English (UK)

A Third Straight Rate Cut

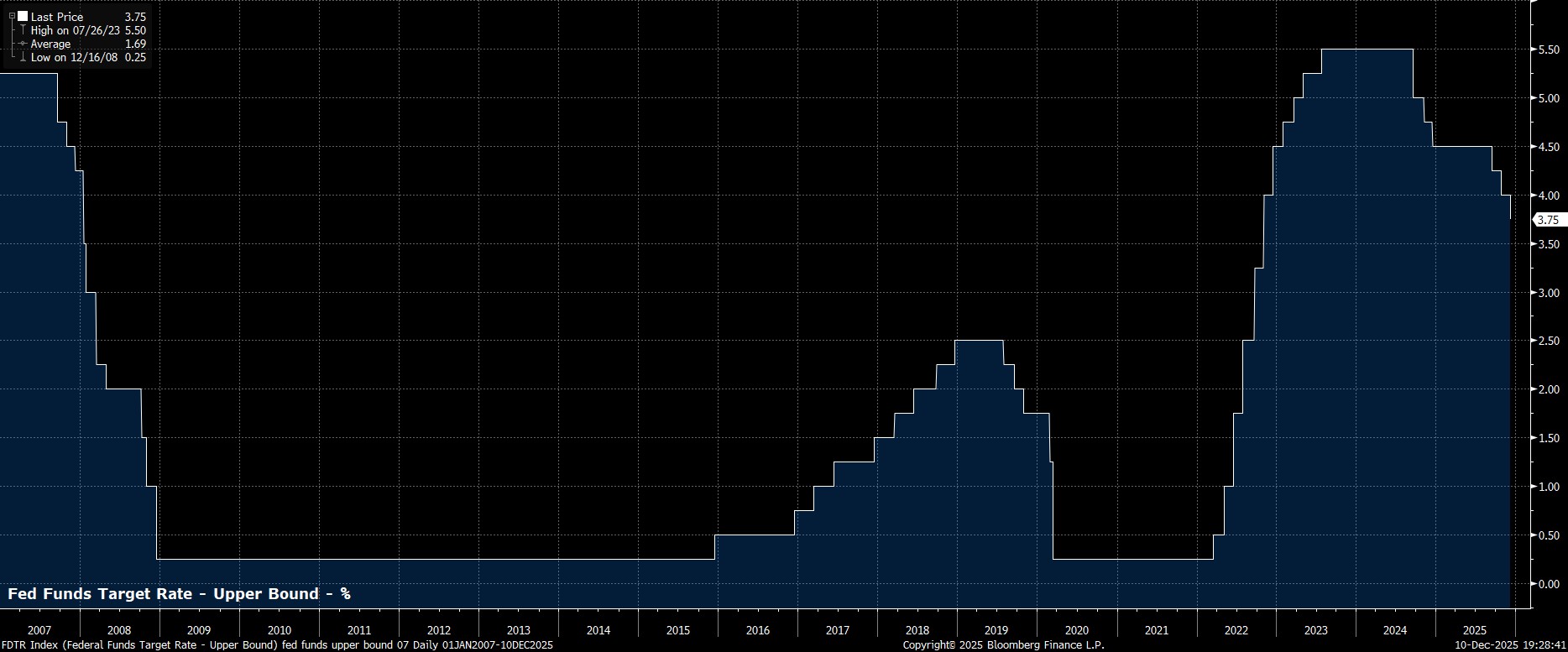

As expected, the FOMC delivered a third straight 25bp cut at the conclusion of this year’s final policy meeting, lowering the target range for the fed funds rate to 3.50% - 3.75%, bang in line with the outcome that money markets had fully discounted prior to the announcement.

Such a cut comes as policymakers continue with their attempts to support a stalling US labour market, and as upside inflation risks stemming from tariffs continue to have a much smaller impact on price metrics than had been feared.

Committee Divisions Deepen

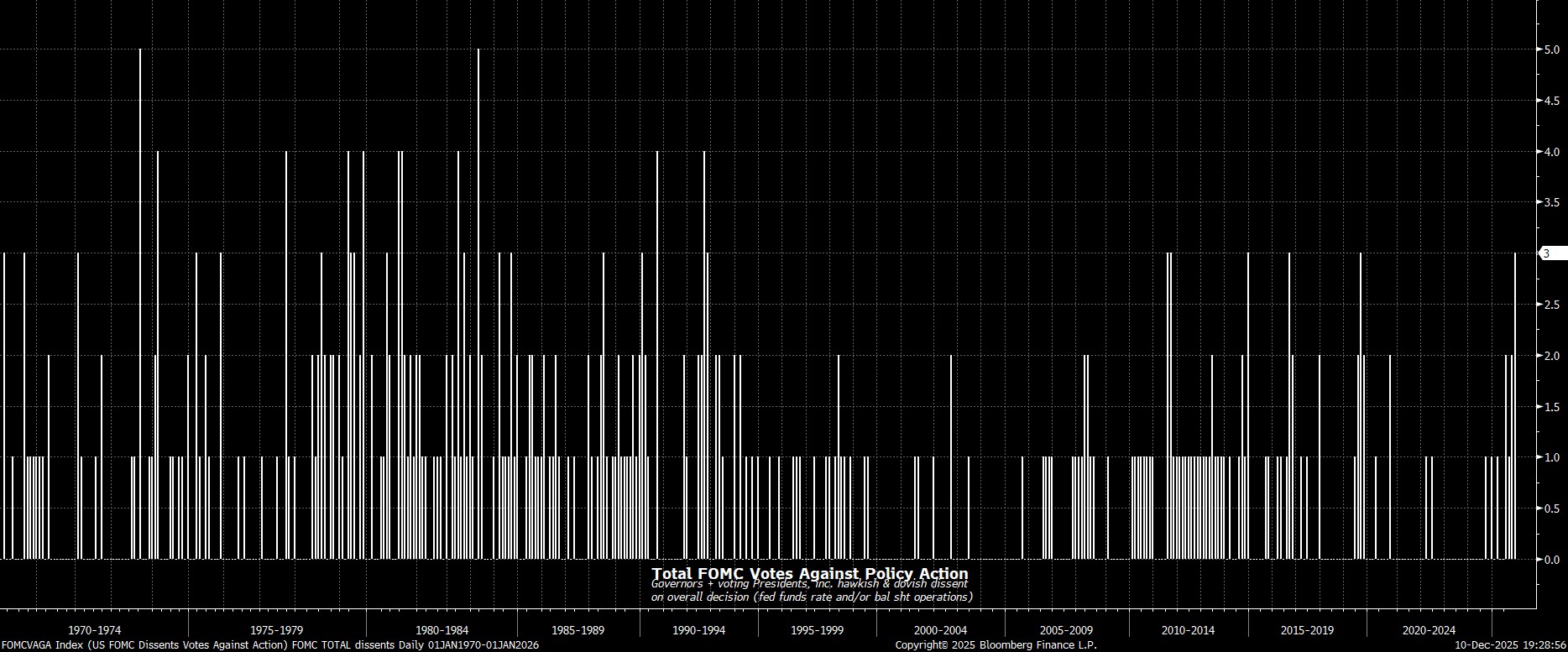

Despite having delivered another rate reduction, the decision to do so was again not a unanimous one among policymakers.

In fact, divisions among Committee members have deepened since the last confab, with the December meeting seeing Chicago Fed President Goolsbee join Kansas City Fed President Schmid in dissenting for rates to remain unchanged. Meanwhile, Governor Miran, at what is likely to be his penultimate meeting, again dissented for a larger 50bp cut, making this the first FOMC meeting with three dissenting votes since 2019. However, with those regional Presidents set to rotate off the Committee at year-end, the vote split has limited signalling power in terms of the policy outlook.

Statement Sees Guidance Tweaked

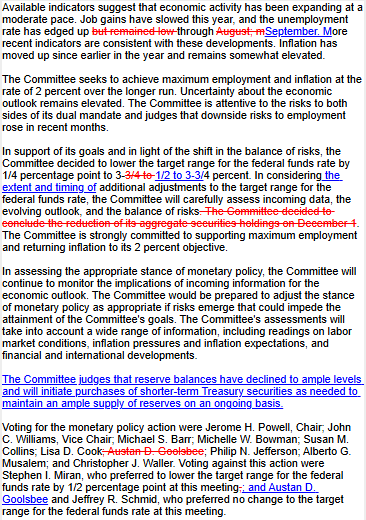

Accompanying the decision was the FOMC’s updated policy statement.

In terms of the economic assessment, language was little changed, perhaps unsurprisingly so, given the lack of data received since the prior confab, as a result of delays stemming from the government shutdown. As such, inflation was again described as being ‘somewhat elevated’, while unemployment remains ‘low’, as the economy continues to expand at a ‘moderate pace’.

Meanwhile, as for the policy outlook, the statement now alludes to the ‘extent and timing’ of additional adjustments to the fed funds rate. This, clearly, is a hawkish tweak to the language used last time out, and suggests a greater degree of data dependency from policymakers as we move into the new year.

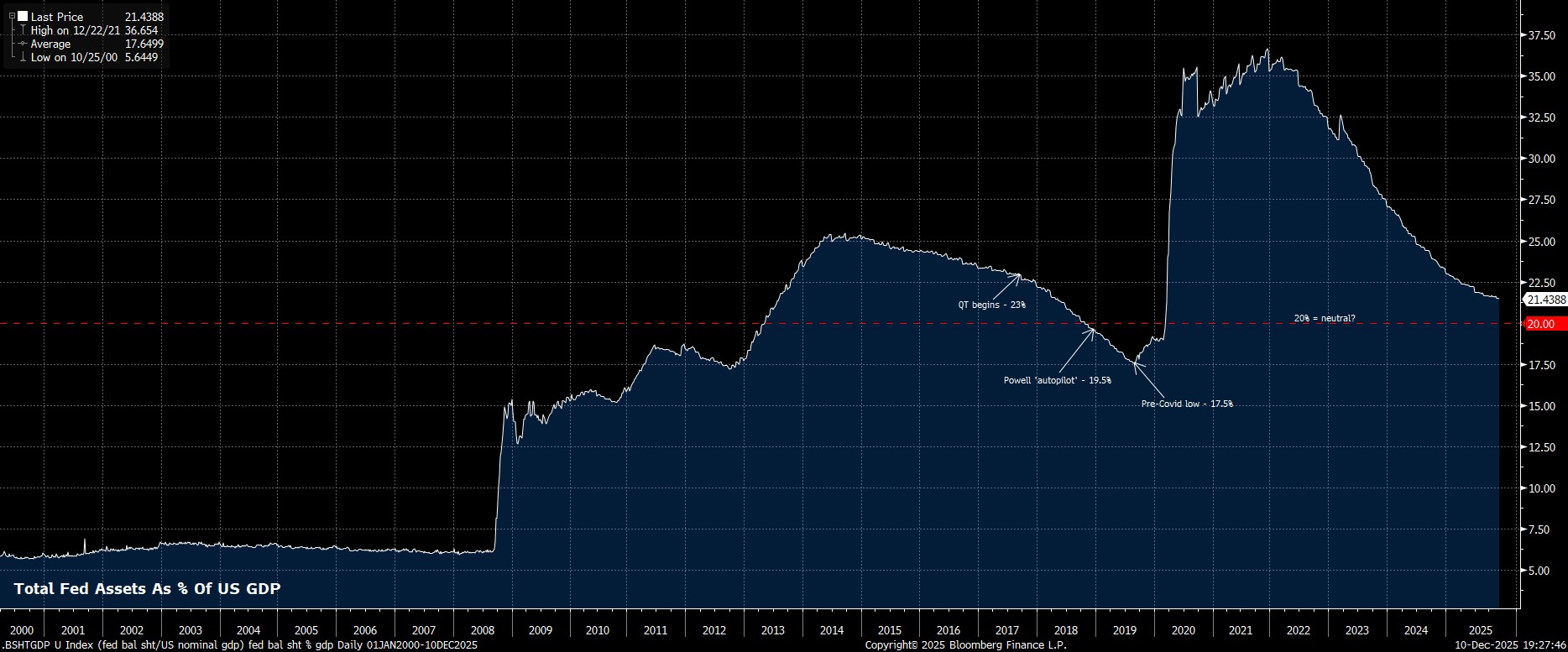

Balance Sheet Expansion Resumes

The FOMC also decided, at the final meeting of the year, to resume balance sheet expansion, noting that $40bln of Treasury bills will be purchased over the next 30 days, with further purchases beyond that period, in order to ensure that reserves within the US financial system remain at an ample level.

To be clear, this is in no way whatsoever a return to quantitative easing (QE), with the Fed not aiming to lower long-term rates, or reduce duration in the market through this policy action. Instead, these purchases are being made simply to ensure that the financial system continues to function smoothly, and that no plumbing issues crop up.

Projections Little Changed

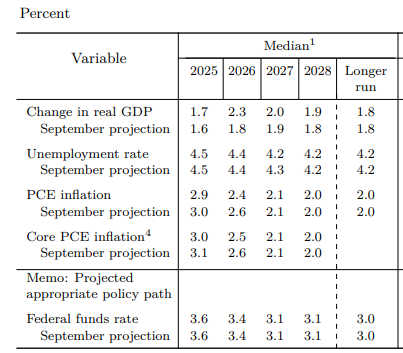

The December meeting also brought with it an update to the FOMC’s quarterly Summary of Economic Projections (SEP).

Perhaps unsurprisingly, given the lack of economic data released since the last forecast round in September, the projections were largely unchanged across the horizon. While the near-term growth outlook was revised marginally higher, likely reflecting a fiscal boost from the OBBBA, other forecasts were pretty much unchanged, with both headline and core PCE still seen falling back towards the 2% target over the next three years.

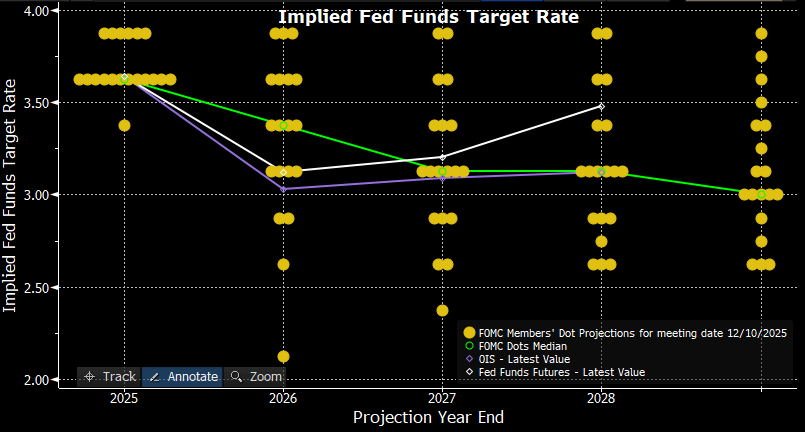

Reflecting those fresh economic projections, the Committee’s updated ‘dot plot’ pointed was also largely unchanged, with the median expectation continuing to point to just one further 25bp cut in each of the next two years, before the fed funds rate settles around 3% in 2028, roughly in line with most estimates of the nominal neutral rate.

Powell Plays For Time At The Presser

Reflecting on all of this, at the post meeting press conference, Chair Powell reiterated that there is no ‘risk free’ path for policy moving forwards, and that the FOMC will continue to make decisions on a ‘meeting-by-meeting’ basis dependent on the evolution of incoming data.

However, Powell also flagged that the fed funds rate now stands within a range of ‘plausible estimates’ for the neutral rate, while also noting that the Committee are now ‘well positioned’ to ‘wait and see’ how the economy evolves from here, implying a higher bar for further rate reductions in the near-term.

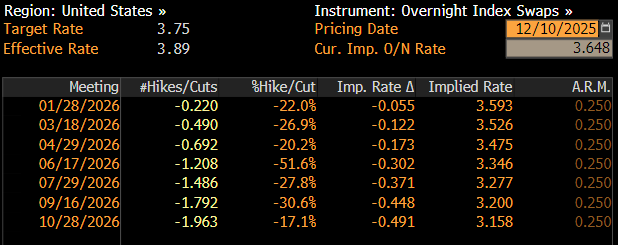

Markets Continue To Price Further Cuts

As all of the above was digested, market-based rate expectations were relatively little changed across the curve, with further cuts continuing to be discounted into next year, albeit with the next 25bp cut not fully priced until next June. The curve continues to display a ‘kink’ around this date, as well, largely reflective of that coinciding with the timing of a new Chair being appointed.

Bias Remains Towards Further Easing, Eventually

On the whole, the December FOMC brought little by way of significant surprises, with policymakers delivering the ‘hawkish cut’ that had been fully expected.

However, Chair Powell has clearly attempted to move the bar for another rate reduction considerably higher, perhaps unsurprisingly so given not only the divided nature of the Committee, but also taking into account the need to move more slowly as rates approach their neutral level.

That said, the direction of travel for rates clearly remains lower, with further cuts on the cards next year, though whether said cuts come in the first quarter, or later, will depend largely on the evolution of incoming labour market data between now, and the January confab.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.