- English (UK)

Week Ahead Playbook: Goldilocks Macro + Past Peak Uncertainty = The Bulls In Charge

The Week That Was – Themes

The inevitable breakup of the Trump-Musk billionaire bromance stole plenty of headlines last week but, frankly, besides introducing a considerably greater degree of risk around TSLA stock, changes little for markets more broadly, despite the interest that particular soap opera garnered.

Instead, focus among market participants remains primarily on the issue of trade, especially with just one month now remaining until the pause on ‘Liberation Day’ tariffs is due to come to an end. The overall direction of travel remains towards calmer heads prevailing, rhetoric cooling, and deals being done, even if concrete progress on that final point is still somewhat elusive.

Last week brought a long-awaited call between Chinese President Xi and the aforementioned President Trump which, while yielding little by way of substantial progress, did appear to smooth out some issues around rare earth exports from China, and at least improved the relationship to a stage where further talks will take place in London this week.

Clearly, while still considerably elevated compared to ‘normal’ times, whatever they are at this stage, the degree of trade uncertainty is now considerably lower than at any point over the last couple of months. I remain firmly of the view that peak uncertainty, and the peak chaos that came with it in early-April, is now firmly in the rear view mirror. Trade remains a narrative, naturally, but it is no longer the only narrative for participants to concern themselves with.

In fact, it remains the case that despite elevated uncertainty, the US economy continues to tick along very well indeed.

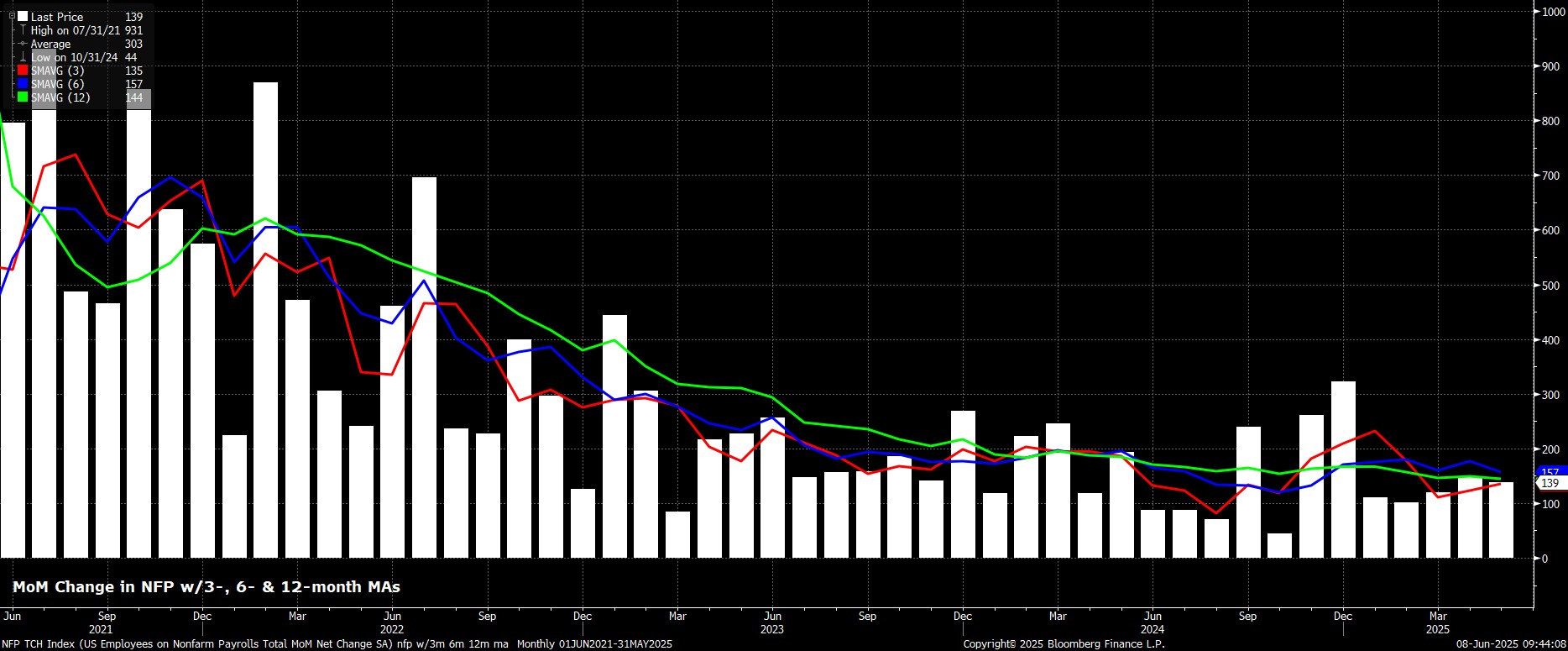

Friday’s ‘goldilocks’ May labour market report reinforced this point. The economy added +139k jobs last month, topping both the consensus estimate, and the breakeven payrolls pace, while average earnings rose 0.4% MoM/3.9% YoY, a pace that shouldn’t cause too much concern over potential upside inflation risks stemming from the labour market. While the household survey was a little softer – unemployment steady at 4.2%, participation falling to 62.4% – this part of the employment report has been particularly volatile of late, owing to falling survey response rates, and should be taken with a bit of a pinch of salt.

That jobs report serves to reinforce the FOMC’s ‘wait and see’ approach, which remains the most logical policy stance at the present juncture. With underlying economic growth solid, and the labour market still ticking along well, there is little cost in remaining on the sidelines for the time being, as policymakers continue to assess how the various tariffs that have been imposed will shift the balance of risks to each side of the dual mandate. The bar for any cuts before the fourth quarter is a very high one indeed, with my own base case now that just one 25bp reduction comes before the year is out. President Trump’s calls on Friday for a 100bp cut on the back of that jobs report were utterly laughable.

Of considerably more interest than yet another Trump rant about J-Pow, were comments that the President made much later in the day, alluding to the fact that he already has a name in mind to succeed Powell next May, and that this decision would be announced “very soon”.

This feeds back into an idea that I posited a short while ago, where we end up with a ‘shadow’ Fed Chair – i.e., Trump names a successor early, sends him out to make as many speeches as possible to provide forward guidance on what he will do when in the job, and attempts to engineer a scenario where market participants focus almost solely on what the new Chair has to say, and what he will do, effectively making Powell redundant before his term ends. Whether or not that happens, it seems that the first criteria for getting the job is to be a ‘yes man’, meaning that the future of Fed policy independence still appears rather bleak.

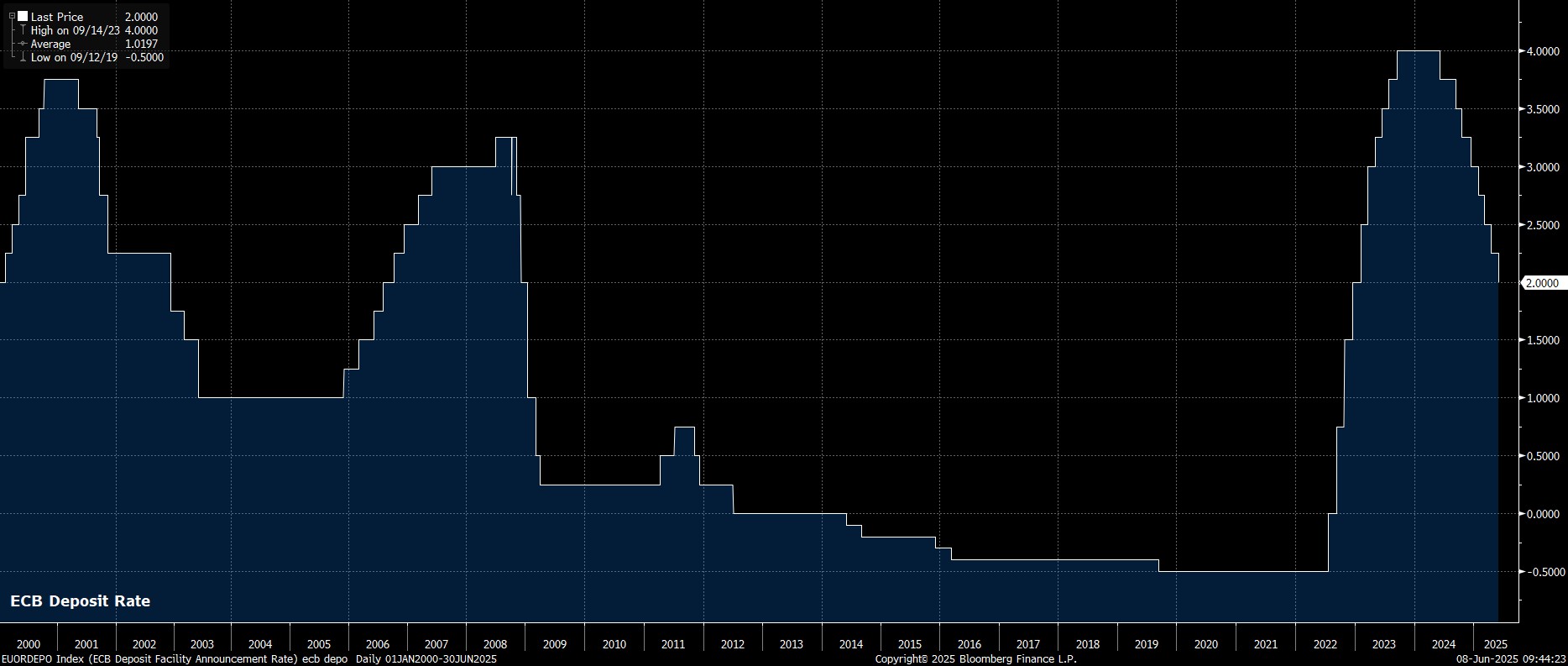

In terms of monetary policy elsewhere, last week brought a 25bp cut from the ECB, the eighth of the cycle, with the deposit rate now standing at 2.00%. Along with this, the latest round of staff macroeconomic projections pointed to slower growth, and a lower inflation profile, with headline HICP seen undershooting the 2% target for the next 18 months or so.

Despite those dovish projections, President Lagarde was at pains to stress that policy is now ‘well positioned’ and in a ‘good place’. This is central bank speak for ‘we are done’ when it comes to the easing cycle; or, at least, the ECB want to be done, unless an external shock forces their hand into delivering another rate reduction. My view, though, is that if those forecasts don’t force them to up the dovish ante, then the bar for something that will is a very high one indeed, with policymakers now likely to try their hardest to ensure that a 2% depo rate is the floor for this cycle.

The Bank of Canada, meanwhile, held rates steady at their June confab, and look likely to extend that pause at the July meeting too, particularly given the stronger than expected Canadian jobs data received on Friday. While the BoC retained as much optionality as possible, noting that another cut ‘may be needed’ if the economy weakens further, the policy trajectory here will largely hinge on developments in the ongoing US-Canada trade saga.

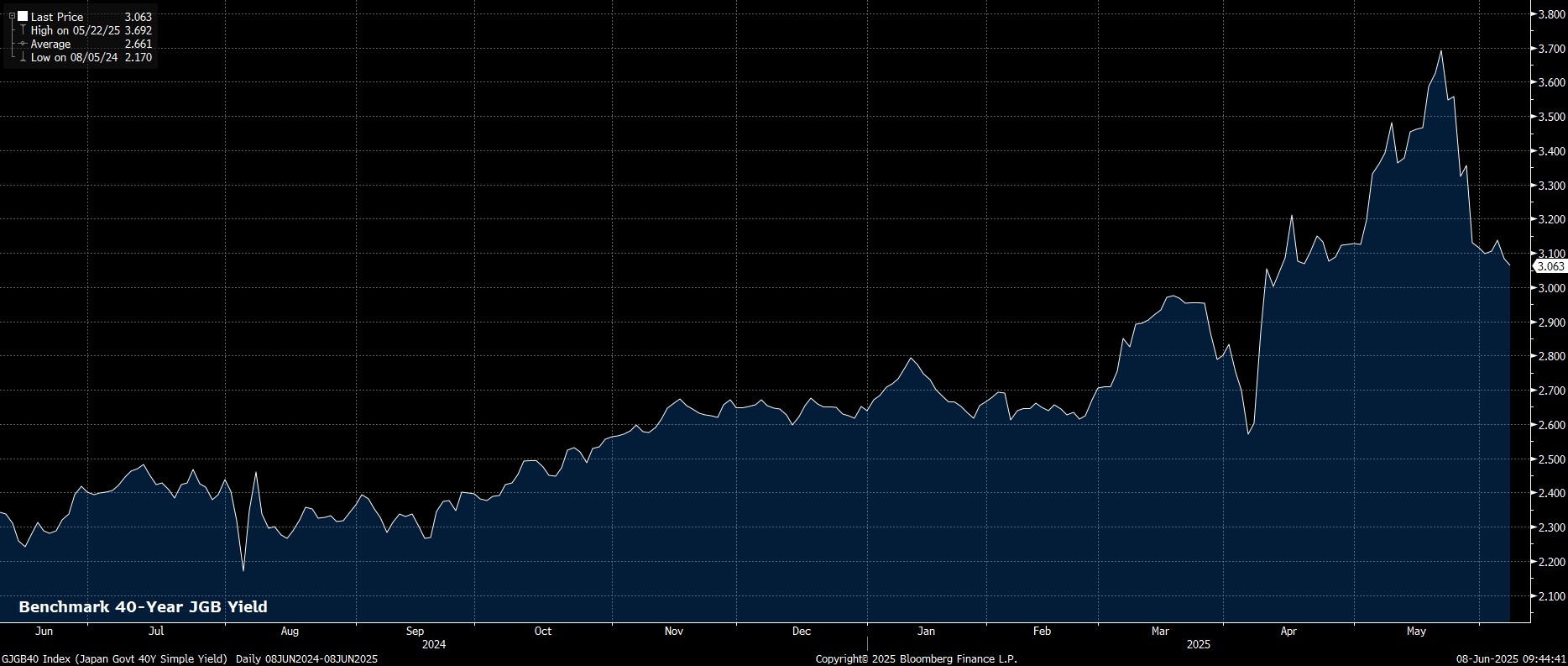

Finally, on the policy front, last week brought a bunch of sources reports from the Bank of Japan, where policymakers seem to be considering slowing the pace of QE tapering in the next fiscal year, growing increasingly concerned about, and mindful of, recent jitters at the super-long end of the JGB curve. These reports, as well as the MoF having trimmed issuance of super-long debt, seems to have done the job in allaying market concerns for the time being, though given the fragile fiscal backdrop in most DM economies, it’s far too early to say that that issue can be put to bed entirely.

On that note, here in the UK, our esteemed Chancellor Rachel Reeves was laying the groundwork for another tax hiking/spend cutting Budget in the autumn last week, noting that no tax changes can be ruled out over the next four years. Given the modicum of fiscal headroom that the government has left itself, I’d go further, and say that said tax hikes are, sadly, virtually guaranteed, as we remain stuck in a vicious doom loop of ever-higher taxes, and ever-lower government spending, to meet fiscal rules which aren’t fit for purpose, but which the Chancellor doesn’t possess the credibility to change.

A lack of credibility also springs to mind when one thinks of the ONS. Not content with being unable to accurately calculate labour market, trade, or producer price data, the ONS told us last week that they mis-calculated CPI – the main UK inflation gauge – last month, overstating the figure by 0.1pp, due to incorrectly accounting for changes in vehicle taxes. It is, sadly, getting to the stage where incoming UK economic data isn’t worth the paper that it’s written on, making the BoE’s job even harder than it already was.

As if all that wasn’t bad enough, last week also brought news that Wise, a rare success story of the London market since their IPO four years ago, will be moving their primary listing to New York. It’s hard to argue with their logic here, given the deeper liquidity and higher valuations on offer Stateside, but this is yet another blow for the Square Mile, especially coming in the week when Cobalt Holdings also scrapped its planned London IPO. I hope that the last company to leave the LSE remembers to turn out the lights.

The Week That Was – Markets

While there were catalysts aplenty over the last five or so trading days, it must be said that financial markets have digested much of this with ease, striking a distinct risk-on vibe across the board as the month of June got underway.

Equities have traded strongly across DM, with stocks in Europe continuing to outperform, as the FTSE 100 notched a 4th straight weekly gain, and the DAX traded to fresh record highs. Performance on Wall Street has also remained solid, with the S&P adding around 1.5% last week, and front futures settling above the 6,000 mark on Friday night. With spoos now, finally, north of what had been stubborn resistance at this level, fresh highs now look to be on the cards, as the bulls remain firmly in control of proceedings.

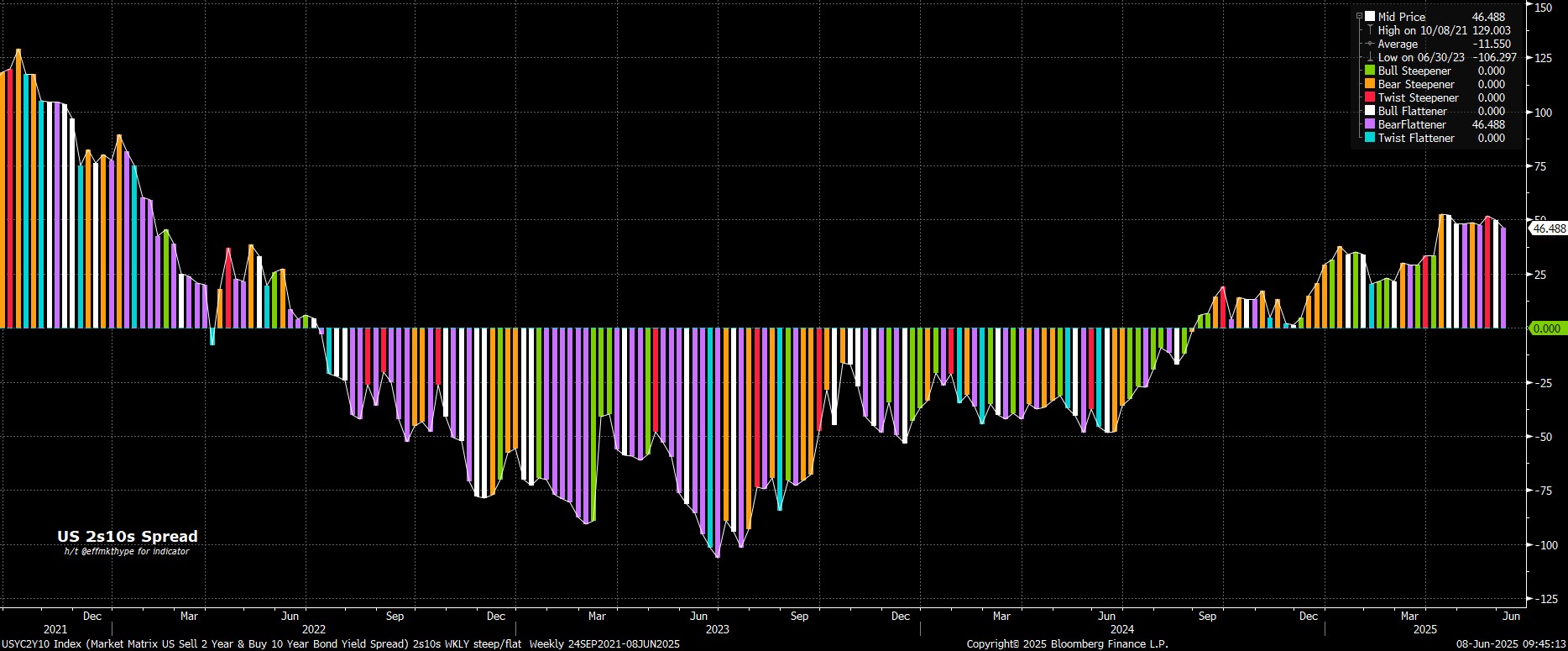

That risk-on tone spilled over into the FI complex too, with Treasuries trading softer across a flatter curve. This weakness was most evident at the front-end, and most sizeable after the ‘goldilocks’ jobs report on Friday, which saw a hawkish repricing of Fed policy expectations, and took the benchmark 2-year yield back above 4%, concluding the worst week since early-April for 2s.

Having said that, this sell-off has taken us back to attractive levels for dip buyers to enter the fray, especially at the long-end with 10s back at 4.50%, and 30s a whisker away from 5%. While these have proven attractive entry points in recent weeks, participants may wish to await this week’s long-end supply, and ensure it is taken down well, before stepping in once again.

As for the FX space, the market remains a rather messy one, with trading conditions choppy, recent ranges remaining well-respected, and mean reversion still the order of the day.

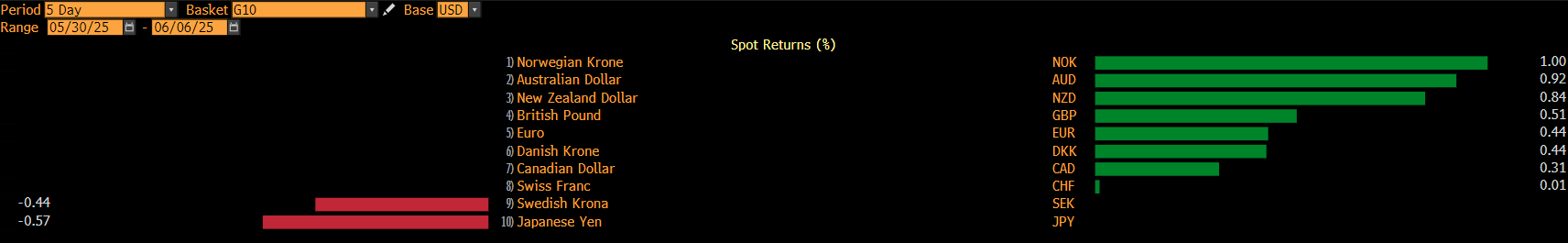

The greenback, per the DXY, remains content to plod along in a band between 98 – 102, showing little sign of wanting to make a convincing break either way at this juncture. The same can be said of most of the rest of the G10 complex, with cable very quickly retreating from fresh cycle highs north of 1.36, and a move north of 1.15 in the EUR too much of an ask, despite that hawkish 25bp ECB cut mentioned earlier on. The JPY goes down as the worst performer on the week, though USDJPY is still sub-145 at the time of writing, and as the below chart shows none of the weekly % moves are especially worth writing home about.

The same can be said of gold, which is also content to trade sideways for the time being, between $3,300/oz and $3,400/oz. Despite that, I still like the bull case for the yellow metal, particularly as buying demand from EM central banks remains healthy, amid ongoing efforts to diversify reserve holdings. I’d, perhaps, re-assess my ‘buy on dips’ view if we get a close beneath the 50-day moving average, but we still have $60 to the downside to play with before having to worry about that.

I’ve saved the best until last, as crude was probably the most interesting asset on the week, amid a classic ‘sell the rumour, buy the fact’ reaction to OPEC+’s announcement of a 411k bpd output hike from July. While a chunky increase, sources reporting in the lead-up to the OPEC+ discussion had indicated that a larger output hike could be on the cards hence, when this was not delivered, the bulls stepped in forcefully.

That said, the demand outlook is still weak, and the Saudi’s are still focused on war for market share, as opposed to a desire to prop up prices. Leaning into the short side against the $65bbl big figure in WTI doesn’t seem like the worst idea as I see it.

The Week Ahead

The new trading week brings with it a considerably lighter data docket than seen in recent weeks, likely meaning that markets can plod along the path of least resistance, which for the time being continues to lead higher for equities, while pointing sideways for Treasuries, and most of G10 FX.

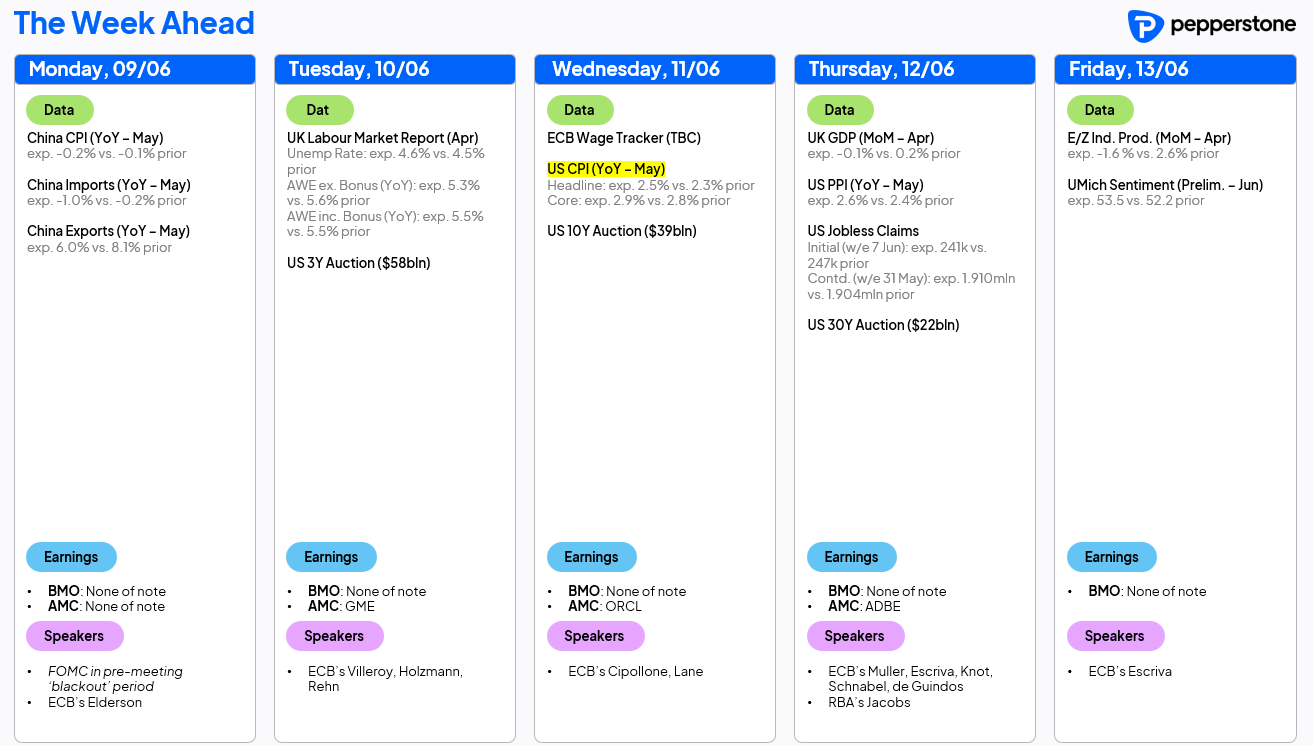

In terms of highlights, attention is naturally drawn to the May US CPI report on Wednesday, though the latest round of US-China trade talks in London might well steal some attention before that, with the balance of risks clearly tilting towards a market-positive outcome here.

As for that inflation data, both headline and core CPI are set to have ticked higher last month, to 2.5% YoY and 2.9% YoY respectively. Particular attention will be paid to goods prices, with the May report likely to be the first where the impact of any tariff-induced price hikes becomes clear. This is, as mentioned earlier, likely to be the start of a quarter or two of tariffs pushing inflation higher, with that ‘hump’ in price metrics likely to begin fading by the fourth quarter of the year. In any case, data in line with expectations will give the FOMC – who are now in the pre-meeting ‘blackout’ period – no reason whatsoever to shift from the current ‘wait and see’ approach.

Elsewhere, on the data front, we get the latest jobs and GDP figures out of the UK. The labour market continues to weaken gradually, though the figures must be taken with a pinch of salt given ongoing issues at the ONS. GDP, meanwhile, is set to have fallen by 0.1% MoM in April, likely a result of the positive impacts of tariff front-running being unwound, as consumer spending remains remarkably resilient.

This week also brings a deluge of figures from China, including the latest inflation and trade figures, though as always a large degree of caution is required when interpreting the figures. We also receive the latest eurozone wage figures, and preliminary UMich consumer sentiment, though these latter two gauges are unlikely to be market moving.

In terms of other catalysts, a chunky week of Treasury supply awaits with 3-, 10- and 30-year auctions due, where particular focus will likely fall on those long-end auctions, particularly given ongoing market jitters over the sustainability of the US fiscal trajectory, as the ‘One, Big, Beautiful Bill’ continues to make its way through the Senate. Earnings season, meanwhile, is as good as over , though figures from Oracle (ORCL) and Adobe (ADBE) might attract a modicum of interest. At least, they’ll be of more interest than the deluge of ECB speakers who are on the slate, all of whom will likely reiterate Lagarde’s message that the easing cycle is as good as over.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.