- English (UK)

Venezuela after the capture of Nicolás Maduro: implications for oil, emerging markets and the global order

Overview of the geopolitical and financial landscape

This marks a geopolitical turning point for Latin America, with implications that extend beyond Venezuela and affect oil markets, capital flows and emerging market risk premia. Although the immediate outcome has been relatively contained, significant uncertainty remains regarding the type of political transition that will ultimately materialize. The short-term impact on crude oil is likely to be limited, given the structural deterioration of Venezuela’s oil industry. For financial markets, the event reshapes expectations and reinforces the role of geopolitical risk in price formation.

Initial impact on markets, oil and geopolitical risk

The capture of Nicolás Maduro by United States military forces represents one of the most disruptive geopolitical events for Latin America in recent decades and carries financial consequences that go well beyond Venezuela itself. In this context, the event may generate second-round effects on oil markets, emerging market risk premia, capital flows into the region and, more broadly, on the implicit architecture that has shaped international relations with the United States.

Unlike other failed “regime change” episodes, the immediate outcome has so far been relatively contained, as there has been no collapse of domestic order or large-scale military confrontation. At the same time, the response capacity of Venezuela’s armed forces appears limited. While this reduces the risk of imminent chaos, it does not eliminate the structural uncertainty surrounding the country’s future political, economic and geopolitical trajectory.

Political scenarios and implications for financial markets

Against this backdrop, three potential scenarios can be identified for the resolution of the situation in Venezuela. The most favorable scenario would see US intervention opening a window — not without frictions — toward institutional normalization, economic reconstruction and, eventually, presidential elections.

A less optimistic and arguably more plausible scenario aligns with a more transactional and opportunistic approach to US foreign policy, prioritizing a rapid reactivation of the oil industry and the attraction of foreign investment, even if democratic processes are delayed or diluted.

The most adverse scenario — and one that currently appears less likely — would involve internal power struggles and prolonged political paralysis, with a US administration reluctant to commit sufficient resources to ensure long-term stability.

For financial markets, the central challenge is not merely to interpret the immediate outcome, but to assess what type of precedent is being set and how this may alter expectations regarding the future behavior of major powers. Investors should recognize that current prices reflect a shifting mix of these potential outcomes.

Venezuela: macroeconomic outlook and recovery expectations

From a macroeconomic perspective, it is important to recall that Venezuela’s economy is currently operating at a fraction of its historical size, following one of the most severe contractions of recent decades. This implies significant recovery potential given the low starting point. However, returning to output and income levels close to those observed prior to the collapse will necessarily be a multi-year process and will depend critically on the nature of the political transition, as the destruction of physical capital and the loss of human capital constrain a rapid convergence.

Even so, the mere possibility of a relatively orderly regime change has begun to alter investors’ long-term expectations and, with it, the valuation of assets that had remained deeply distressed.

Over time, and under a new regime, it is conceivable that relations with multilateral institutions could normalise, opening the door to some form of financial assistance alongside the establishment of a more credible fiscal and monetary framework. This could eventually initiate a process of Venezuelan debt restructuring, although such a process would likely be complex and protracted.

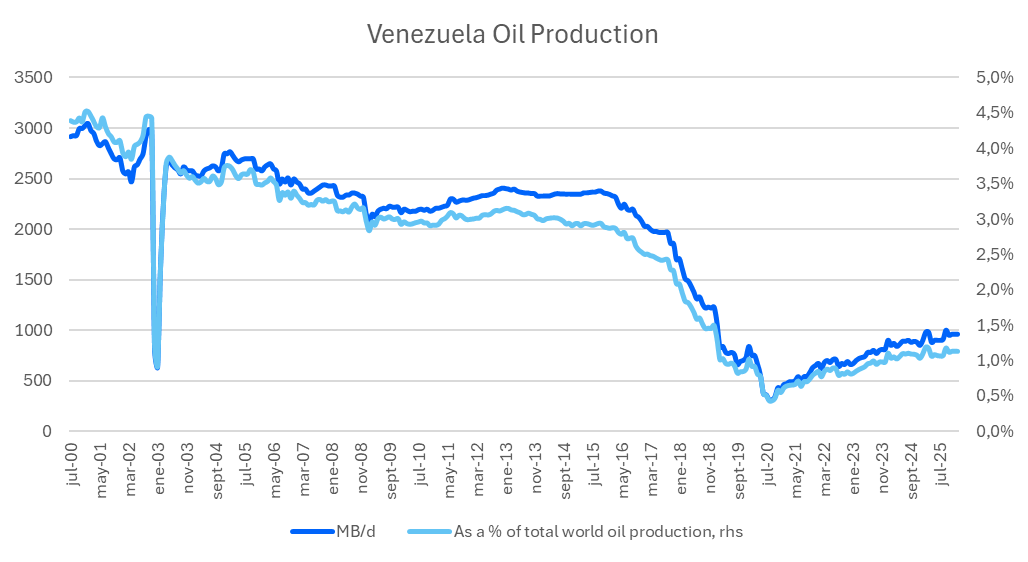

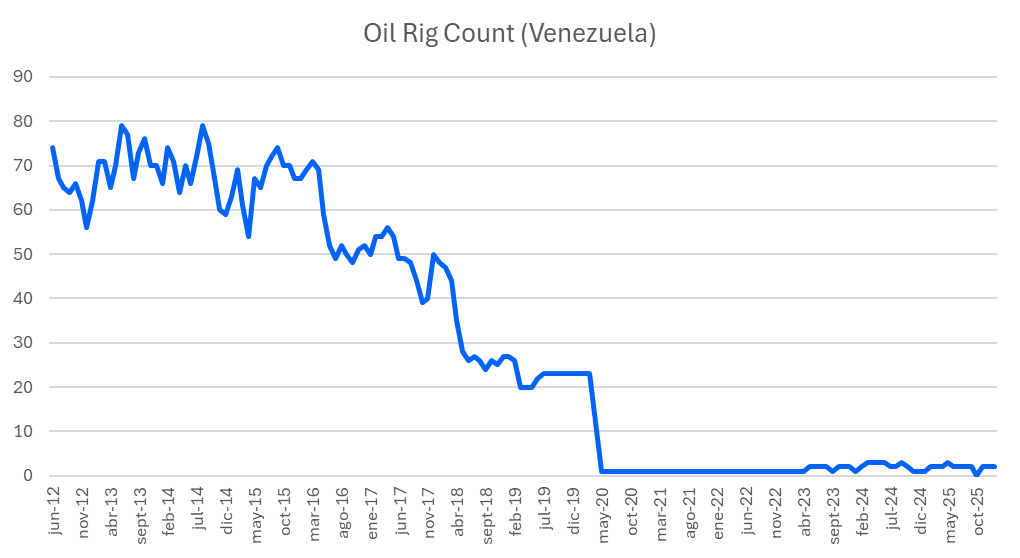

Oil remains the primary transmission channel to global markets. Venezuelan production is still far below historical levels, and any meaningful recovery faces significant technical, financial and regulatory constraints. The narrative that a political change would automatically trigger a surge in supply is misleading.

Even under optimistic assumptions, reactivating the sector will require years of investment, openness to foreign capital, legal certainty and infrastructure rebuilding. In the short term, the transition process itself introduces additional risks, including asset protection, contract renegotiation and the redefinition of sanctions regimes. As a result, the immediate impact on oil prices is likely to be limited and, in some cases, even mildly bullish due to the uncertainty premium.

Only over a medium- to long-term horizon, and if production were to gradually approach previous levels, could a moderate disinflationary effect on global crude prices materialise — driven more by capacity accumulation than by a sudden supply shock.

Geopolitical implications beyond Venezuela

Beyond Venezuela, the episode carries broader geopolitical implications. The signal sent by the United States is one of willingness to exercise power directly within its sphere of influence, reinforcing the perception that it seeks to reaffirm its primacy in the Western Hemisphere. This has immediate consequences for countries such as Cuba, whose economic fragility has been exacerbated by the loss of Venezuelan energy support and which now faces additional strategic pressure amid a tougher US stance.

At the same time, the relative lack of active support from powers such as China and Russia suggests a pragmatic assessment, in which the costs of direct confrontation currently outweigh the benefits of sustaining a weakened ally.

Conclusion: volatility, oil and political transition

In sum, the capture of Nicolás Maduro represents a turning point that cannot be analysed using traditional macroeconomic frameworks. It is not a conventional macro event, but rather a political shock with multiple short- and long-term consequences. In the near term, volatility is likely to dominate, particularly in oil markets, oil-linked assets and emerging markets.

Over the medium term, attention will focus on Venezuela’s ability to reactivate its oil industry without generating new disruptions and, crucially, on the type of political transition that ultimately takes hold.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.