- English (UK)

US Small Caps Outperform As Sector Rotation Continues

Summary

- Sector Rotation: Under the surface, US equity participants have increasingly rotated into value, and small cap names

- Driving Forces: Numerous factors are driving the rotation, including expectations of looser monetary/fiscal policies, and the US economy remaining relatively robust

- Outlook: The outlook appears promising, though labour market fragility poses the most significant risk to the ongoing rotation

Sector Rotation Is Nothing New

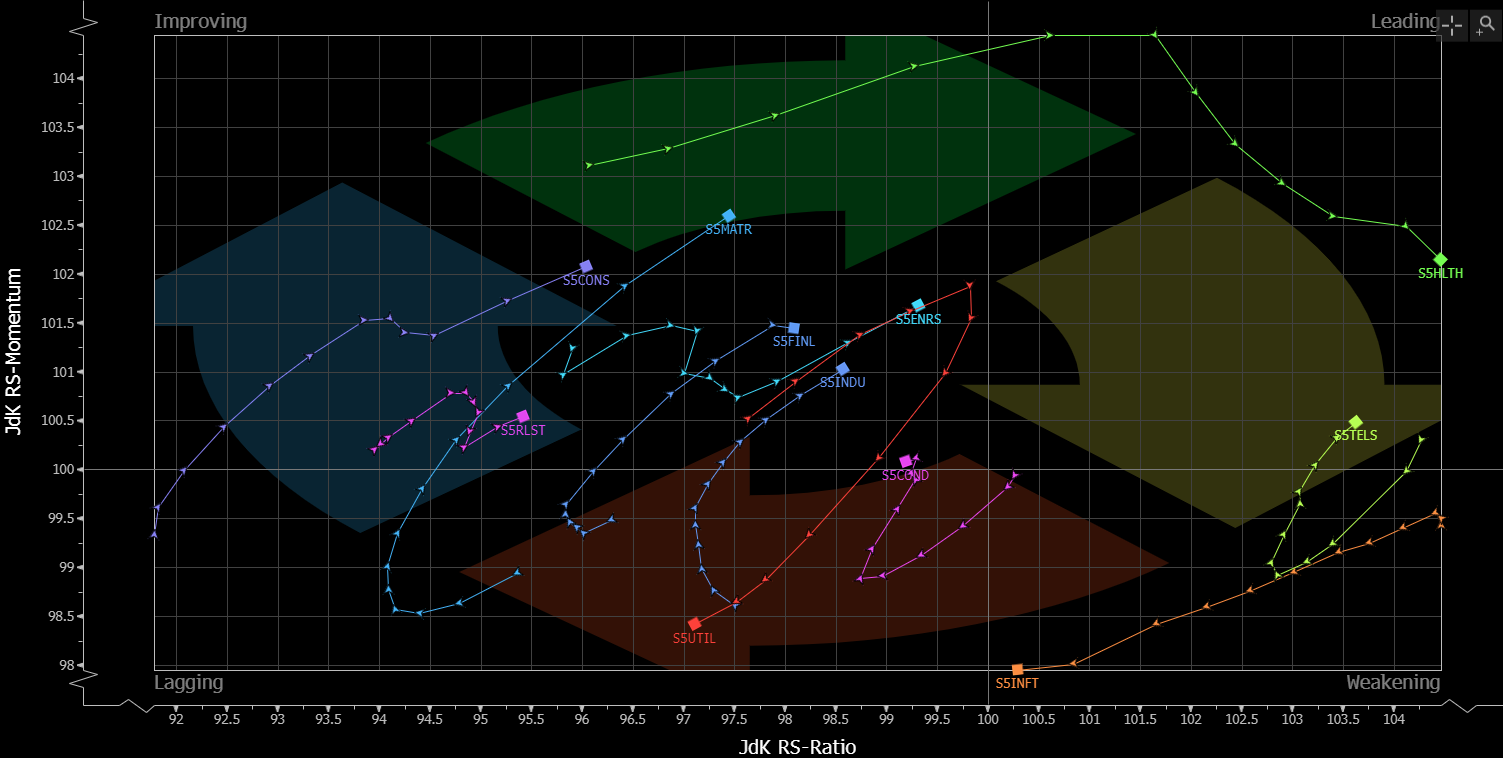

For instance, taking a look at the S&P 500, we see over the last month or so an increasing rotation out of cyclical sectors, and into defensive and value names, which had spent much of the last year or so considerably lagging the market at large, as every man and his dog became rather over-excited about the ‘big tech’ sector.

Small Cap Outperformance Accelerating

There has also been a notable outperformance in small caps in recent sessions, following small caps having underperformed their large cap peers for five years running.

Some signs are beginning to emerge that that run of underperformance may be starting to turn around. Since the turn of the year, the Russell 2000 has outperformed the S&P 500 for nine days running, the longest such streak since 2017, with a longer such run having not been seen since the GFC. In turn, that run now sees the Russell trading at its best levels relative to the SPX in just under a year, while also trading at its best levels relative to the Nasdaq 100 since ‘Liberation Day’ last April.

_r_2026-01-15_10-55-52.jpg)

This prompts two obvious questions – what’s driving the outperformance, and can it continue?

Drivers of Small Cap Outperformance

In terms of drivers, there are a few that immediately spring to mind. Perhaps the most important is that the market remains in a mindset of treating ‘good’ economic news as an outright positive, focusing on the solid macroeconomic backdrop that the data speaks to, as opposed to any monetary policy implications of incoming releases. Given that small caps are considerably more exposed to the ‘real’ economy than megacap tech behemoths, it is logical that the sector has outperformed on the back of the underlying economy having remained robust.

Speaking of which, it is not only the resilient nature of incoming data that is helping to keep small caps underpinned, but also expectations that economic tailwinds will mount as the year progresses. These expectations stem not only from the consensus view that the monetary backdrop will grow increasingly loose as the year progresses, but also that the fiscal stance will ease too, most notably in the second half of the year, amid sizeable tax refunds, and the effects of the ‘One Big Beautiful Bill Act’ (OBBBA) making themselves known.

On top of this, there has also been an undeniable fizzling out of some optimism around the broader AI theme. While stocks exposed to the sector remain buoyant, market participants have become increasingly selective in recent months, not only when it comes to seeking greater clarity around the timeframes over which a return might be obtained from hyperscalers on their sizeable investments into the complex, but also how those investments are being funded. While Oracle (ORCL) and their debt-funded spending boom is the most obvious example of this, other AI bellwethers such as Microsoft (MSFT), Broadcom (AVGO), Meta (META) and Quaalcomm (QCOM) have also been rolling over of late.

The Outlook

Looking forward, it seems plausible to expect that the aforementioned tailwinds continue to propel the sector to the upside over the medium-term, allowing the ongoing sector rotation to continue, even if those betting on a sustained rotation into value have had their fingers burnt numerous times in recent years. Importantly, it is likely to be earnings growth that holds the key as to whether this run can continue, with relative EPS growth having traditionally been the most important driver of small caps, as opposed to margin expansion or earnings multiples.

Of course, some risks do remain. While the potential for delayed Fed policy easing is perhaps the most obvious risk, I’d argue that it is not the most significant. Instead, given the exposed nature of small caps to the ‘real’ economy, the most sizeable risk is the potential for the present labour market stasis to spiral into a broader slowdown, in turn posing headwinds to the economy at large, and likely seeing the recent outperformance reverse in rather rapid fashion. With that not being the base case, however, the present run could well rumble on for some time.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.