- English (UK)

UK Budget Day Preview: Significant Fiscal Tightening Comes With Perilous Political Risks

Summary

- Fiscal Tightening: The Budget will bring tax hikes to the tune of around £20bln, as Chancellor Reeves seeks to double headroom vs. the fiscal rules

- Political Risks: With the fiscal package unlikely to please anyone, risks of a rebellion among Labour MPs are clearly growing

- Buy The News?: Given crowded GBP/Gilt short positioning, a 'buy the news' reaction could well pan out post-event

After months of leaks, rumours, trial balloons, and even an emergency press conference, ‘Budget Day’ is finally almost upon us.

Budget Contours Are Well Known

At this point, given all the pitch rolling that’s taken place, the contours of what Chancellor Reeves is likely to announce later are well-known.

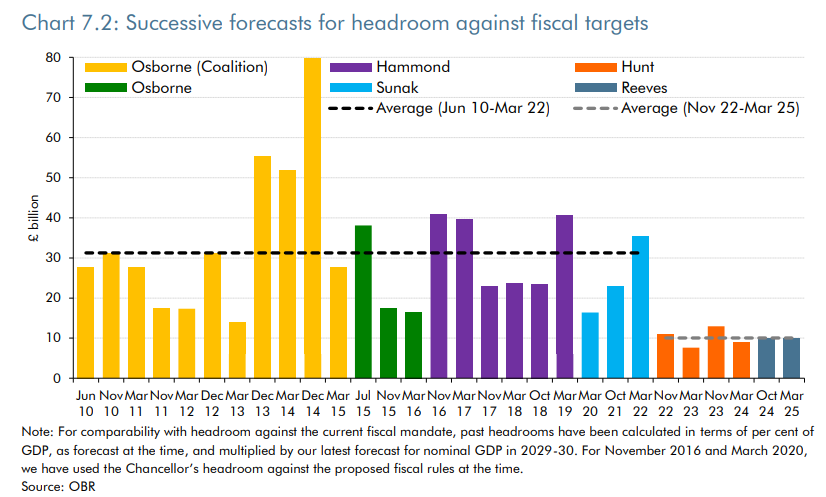

With the entirety of the £9.9bln of headroom against the fiscal rules having been eroded since the ‘Spring Statement’, a significant fiscal tightening, delivered almost entirely via tax hikes, is on the cards, not only to restore headroom to that prior level, but likely in an attempt to double the ‘buffer’ with which the Treasury are operating.

What tax hikes could be coming?

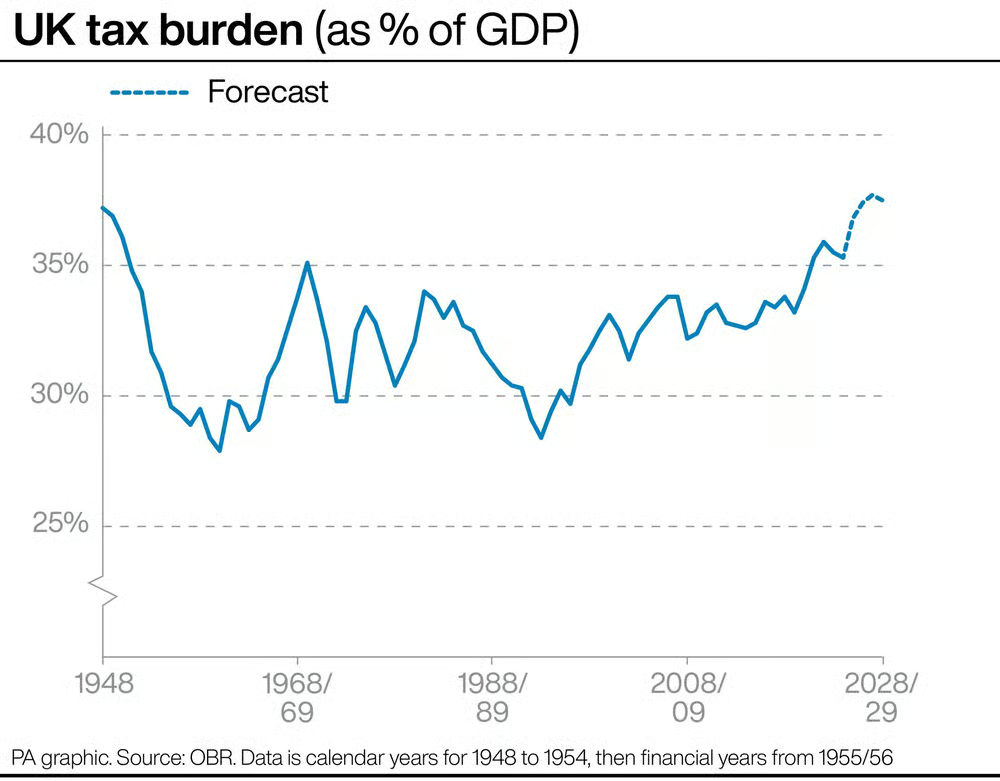

With the Government unable, and unwilling, to deliver sizeable spending cuts, and with the Chancellor seemingly having ruled out a manifesto-busting income tax hike, focus instead will fall on a ‘smorgasbord’ of smaller tax increases.

These are likely to include an extension of the freeze on income tax thresholds to 2030, the imposition of National Insurance on salary sacrifice schemes, revaluing the top three council tax bands, the possible imposition of a council tax surcharge on the most expensive of properties, a pay-per-mile scheme for EVs, and much else besides.

A ‘tourist tax’, as well as changes to taxes on sugary drinks have also been mooted.

Will public spending also rise?

All of this is to not only plug the ‘black hole’ that has emerged over the last six months, but also to fund a higher degree of government spending, probably to the tune of £10bln, compared to the last OBR forecast.

This uplift stems not only from plans to scrap the two-child benefit cap, but also the failure to reform welfare spending over the summer.

The most significant problem here, however, is that the planned spending increases will be front-loaded, and the planned tax hikes are primarily back-loaded, leading to major question marks over the sustainability of these proposals.

What will market participants be focused on?

Speaking of questions, market participants will probably have three in reaction to Reeves’s announcement.

Firstly, are the books balanced and, if so, are they balanced in reality, not just on paper via some forecast trickery?

Secondly, what is the gilt financing remit for the year ahead, and is this lower than it was in FY24/25?

Thirdly, what does the fallout from all this look like politically, and is it bad enough to push rebel Labour MPs into forcing a leadership challenge?

How might UK markets react?

For markets, this does feel like we’re setting up for a ‘sell the rumour, buy the news’ event, especially if the Budget itself ends up not being as bad as participants had worried it could be, thus sparking a fairly significant round of short covering in the GBP and Gilts.

That said, the real ‘fun’ will start when the political fallout gets going, and the fiscal package inevitably goes down like a lead balloon, so I remain inclined to fade any upside in both UK FX and FI if it were to occur.

_10_2025-11-25_11-54-02.jpg)

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.