Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

WHERE WE STAND – Ugh, I can’t believe I’m doing this again, but we have to talk about the whole Trump-Powell dynamic once more.

After the FOMC stood pat last Wednesday, the President seems to have gone into overdrive with his calls for rate cuts, while also floating the possibility of firing the Fed Chair once more, for the apparent crime of holding rates steady amid a solid labour market and sizeable upside inflation risks. Funnily enough, someone who has been a lifelong real estate developer, and who now wants super-low borrowing costs to fund his political agenda, as opposed to actually getting a grip of the deficit issue, isn’t a particular fan of such an approach. Nor, apparently, are other senior Trump Admin officials, with Commerce Sec Lutnick joining in with this criticism over the weekend.

Let’s get a few things straight – yet again.

Firstly, there’s no reason for the Fed to cut right now. The labour market is solid; unemployment is low, and job creation is healthy. On the other side of the dual mandate, inflation remains considerably north of 2%, and upside risks are plentiful, stemming primarily from tariffs.

Secondly, the more that Admin figures rant & rave about rate cuts, the higher the bar for said cuts becomes. Even if data were, at some stage, to justify further moves back towards neutral, it’s now much harder for policymakers to deliver said moves, as they seek to further prove that monetary policy is independently set.

Thirdly, a jumbo cut to the fed funds rate would actually have precisely the opposite effect that Trump Admin figures desire, as such a cut would likely lead to a significant sell-off at the long-end of the curve, amid a significant un-anchoring of inflation expectations, and a surge of capital flight out of US assets.

Still, it is objectively amusing to see all of these power hungry egomaniacs drive themselves crazy over one of the few things which they, rightly, have no control. Furthermore, the obsequious and oleaginous Lutnick has shown his chamaeleon-esque colours once more, suddenly backing rate cuts, despite having called a 50bp cut last September “a big red flag”. Surely, he wouldn’t have changed his mind just because he now has a new boss who’s boots need licking.

Anyway, while most members of the FOMC stick resolutely to a ‘wait and see’ policy approach, Governor Waller has decided to say ‘I’ll do whatever you want Mr Trump”. Waller noted on Friday that cuts could come as soon as July, and that there is ‘no reason’ to wait much longer to lower rates. At this stage, I’m an advocate of bringing back the ‘blackout’ period simply to stop this bloke from publicly auditioning for Chair Powell’s job in such a blatant fashion.

Again, for the avoidance of any doubt, Trump cannot fire Powell, and a cut before autumn still seems a very long shot indeed. My base case remains just one 25bp Fed cut this year, probably in December.

Away from all of that, Friday was a relatively dull day all told, with volumes light as most US desks took a long weekend after Juneteenth, and as focus among participants remained squarely on geopolitical events.

On that front, the weekend saw not only kinetic exchanges between Israel and Iran continue, but also the US enter the fray, with strikes on key Iranian nuclear infrastructure at Fordow, Natanz & Esfahan.

Naturally, the situation continues to require close monitoring, especially with the risk of Iranian retaliation elevated, and the potential for spill-over effects having risen.

Still, providing that crude export infrastructure remains untouched, and Iranian threats to block the Strait of Hormuz don’t come to fruition (which I really can’t imagine they will), then this all remains much more of a distraction for financial markets, than a longer-running narrative. That, to be clear, is in no way meant to diminish the tragic human impact here, on all sides, though markets are always relatively ‘cold’ when it comes to these sort of matters. There is also an argument that the weekend US intervention could well bring about a quicker end to the conflict, though that remains to be seen.

On the whole, the narrative for financial markets remains a bullish one, with both earnings and economic growth still solid, and with the direction of travel continuing to point towards trade deals being done, amid much calmer rhetoric on that front. Don’t forget TACO, either! I’d not be surprised to see news of the ‘Liberation Day’ tariff pause being extended before long. In fact, that 9th July deadline, and the June NFP print on 3rd July, are the next two big events for participants to navigate. Equities, in the meantime, should take the path of least resistance higher, with new highs still on the cards, and dips remaining buying opportunities.

In any case, the reaction to those weekend geopolitical developments has been a relatively predictable one, if also relatively contained – equity futures taking a modest look lower, crude vaulting to the upside before paring gains, gold catching a modest but short-lived bid, and some haven demand evident in the FX space too. Treasuries, meanwhile, have been pressured cross the curve, probably on the inflationary implications of higher crude prices – a move back towards 4.50% in 10s, and 5.0% in 30s, would probably excite dip buyers once again in any case.

All of these moves, clearly, are very knee-jerk in nature, and once again speak to the market’s tendency to over-react to geopolitical news flow. I wouldn’t be at all surprised if, by Friday afternoon, crude ends the week in the red, and stocks end in the green, albeit with plenty of sabre rattling taking place in the interim.

Finally, a word on the UK, after Friday brought both a chunky retail sales miss (-2.7% MoM in May), and the highest ever May borrowing figure, outside of covid. Given the reaction in the quid, and pressure in Gilts, participants are clearly, and rightly, concerned that our esteemed Chancellor has no plan to solve this issue, especially as we appear stuck in an ever-deepening doom loop of higher taxes and lower spending. No prizes for guessing what the autumn Budget might look like.

On that note, today is 9 years since the EU referendum; I’m not sure about you, but it feels like about 9 decades, given how much has happened since. Will we have a more ‘normal’ next 9 years? I won’t hold my breath.

LOOK AHEAD – Geopolitical events will remain in focus this week, with trade also on the radar, amid what is, as noted earlier, a relatively barren economic docket.

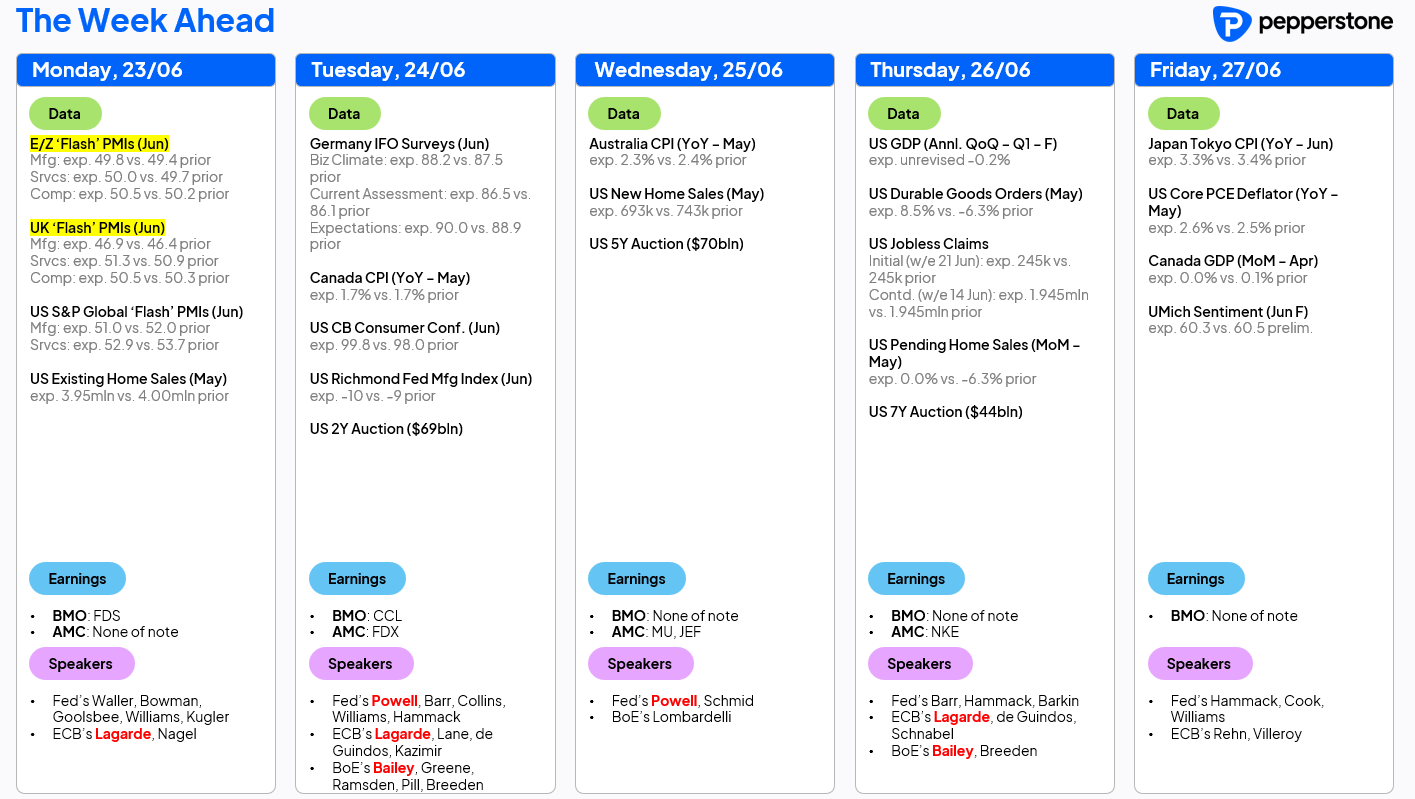

The latest round of ‘flash’ PMI surveys are due today, from pretty much every DM economy, though the utility of the surveys has diminished a fair bit recently, with the huge degree of prevailing economic uncertainty tending to skew ‘soft’ data considerably more than ‘hard’ figures. A pinch of salt, hence, is probably needed.

Besides those figures, the economic docket is lacking top-tier releases, though the latest IFO sentiment surveys out of Germany, and Friday’s US PCE figures, are worth a cursory glance at least. The weekly US jobless claims data, due Thursday, is also worth a look, with the continuing claims print pertaining to the June NFP survey week.

Elsewhere, a big week of Treasury supply awaits, with 2-, 5- and 7-year sales on deck. All should be relatively well-received, though, as appetite for debt towards the front-end and belly of the curve has remained healthy in recent weeks, despite ongoing fiscal jitters.

A big week of central bank speakers is also due, as Fed Chair Powell heads to Capitol Hill to reiterate his ‘wait and see’ stance, while we’ll also hear from ECB President Lagarde and BoE Governor Bailey, among others.

Finally, a couple of notable earnings reports await, as participants await whether FedEx will be able to deliver on expectations, and whether Nike will Just Do It.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.