- English (UK)

Traders’ Weekly Playbook: Rising Risk Appetite Into a High-Impact December

Commodity markets attract close attention with CME pricing resuming normal service and with full price discovery and liquidity in check we'll see if traders attempt to fade the move in the session ahead or join the party. The focus on XAGUSD and XAUUSD has intensified, with spot silver running red hot to new highs. Natural gas broke to new cycle highs in emphatic style, and dips look likely to be shallow and well supported as higher levels manifest. Cocoa ripped 7% higher on Friday in a move that may signal a reversal of the long-term bear trend.

The Russell 2000 put in the most impressive performance of the major equity indices, although the NAS100 and S&P 500 also performed strongly, and higher levels look more likely than not. There were clear signs that market participants added risk to portfolios while aggressively covering volatility hedges. High-short-interest stocks outperformed, with notable gains for Intel, Broadcom, and the MAG7 stocks (ex-Nvidia).

In FX, the USD closed the week lower against all major currencies, with the NZD and AUD the outperformers, with respective rates markets now seeing the next move from the RBNZ and RBA being a hike....

A Big December in Store for Markets

The risk bulls roll into December feeling positive about directional bias. As the clouds of worry that cast an ominous shadow over markets through to mid-November gently dissipate, they give way to new emotions — notably the fear of not participating and the risk of underperforming benchmark targets.

Risk managers remain highly astute to the landmines that could still derail the improving risk backdrop through December:

- The December FOMC meeting (10 Dec) — what happens if the Fed does not deliver a 25bp cut? And if they do, could it be seen as a hawkish cut? How do markets react should the latter play out, which seems like a high probability...

- Days later, we get the November NFP and CPI, which will set the tone for cyclical assets into year-end. We are also likely to get confirmation of the new Fed Chair before Christmas. While markets see Kevin Hassett as a steady pair of hands for the most important job in finance, questions remain around whether further shrinking of the Fed’s balance sheet is the right call.

- The US Supreme Court (SCOTUS) may deliver its final ruling on Trump’s use of IEEPA tariffs, and while the Administration has prepared contingency plans to pivot quickly to tariffs under Sections 122, 301, or 338, the ruling could still have market impact.

- The BoE meeting (18 Dec) is widely expected to result in a 25bp cut.

- The BoJ meeting (19 Dec) is now seen by markets as more likely than not to deliver a 25bp hike.

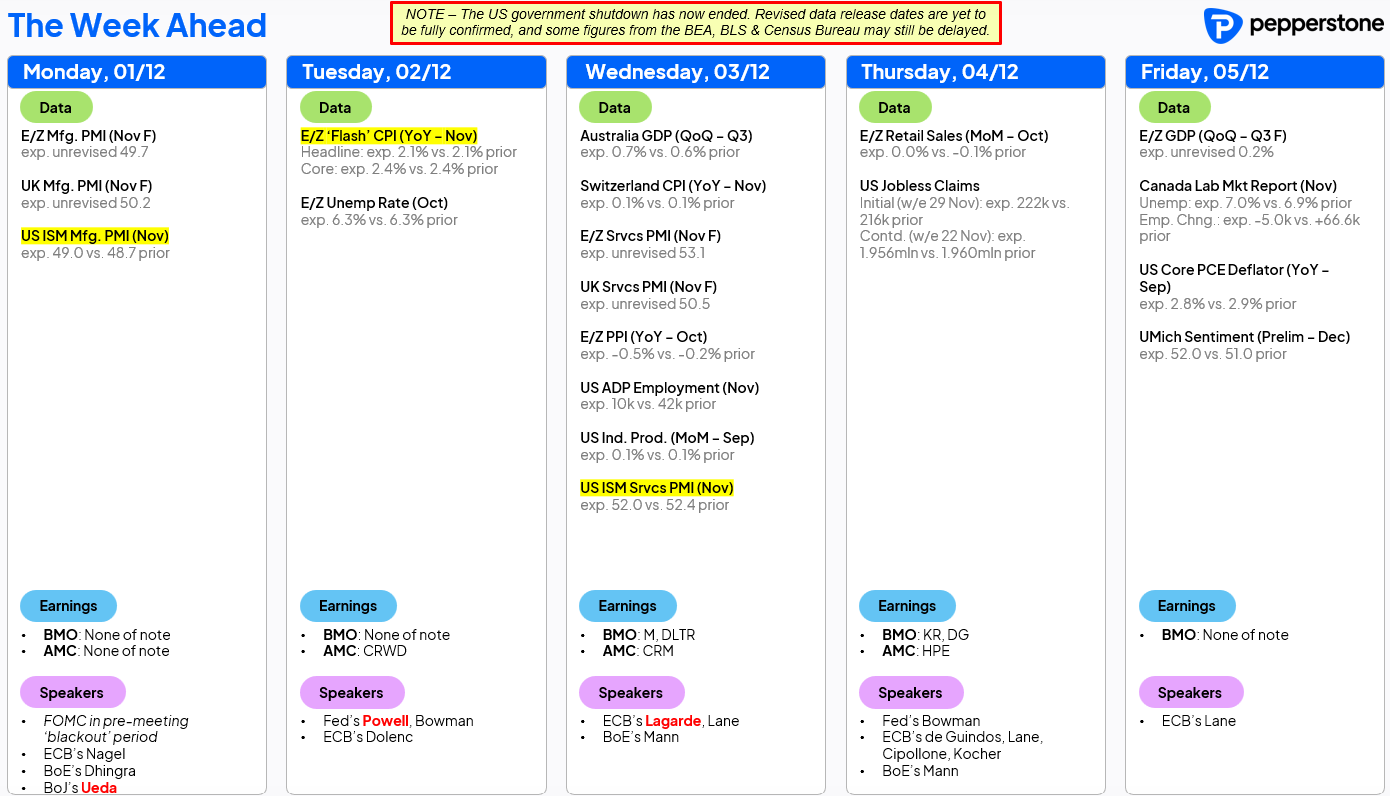

Key Data to Navigate in the Week Ahead

This slew of potentially impactful risk events is yet to play out, and our immediate focus now turns to the key landmines ahead. Fed Chair Powell will deliver a speech today at a memorial event for the late US Treasury Secretary George Shultz. Powell’s preference for a December rate cut is not yet fully known by traders, and with the Fed in a blackout period, this event does not seem an appropriate venue for policy guidance.

Today’s speech by BoJ Governor Ueda (12:05 AEDT) warrants close attention. Japanese interest-rate swaps price a 59% chance of a 25bp hike at the upcoming 19 Dec meeting, and a further 18bp of implied hikes by June 2026. Japan’s 2-year forward rates closed at 1.38%, still possibly at the low end of where terminal rates should sit. Markets will be watching whether Ueda’s guidance aligns with current pricing — and the subsequent reaction in JGBs and the JPY.

The US ISM services and manufacturing reports could generate pockets of volatility, as could US personal spending and income.

The Challenger Job Cuts series has only recently returned to traders’ radars after the October data revealed a punchy 175% increase in job cuts. Another large rise in November would galvanise expectations for a 25bp cut on 10 Dec.

Australia: Q3 GDP in Focus

In Australia, the Q3 GDP release will be the marquee data point of the week. Markets do not always show strong sensitivity to GDP prints — market participants generally live in the future, and Q3 now feels like a distant memory. However, this quarter’s print carries more significance. Following strong Q3 capex data, we look for a 40bp lift in Q3 GDP to 2.2% y/y — a level above the economy’s ‘potential’ growth rate, which would heighten the risk of price pressures. AUD interest-rate swaps price 9bp of hikes over the next 12 months and could move higher on a hotter GDP print, especially if driven by a strong rise in household consumption.

NZD: A New RBNZ Governor and Price Breakouts

For NZD traders, Anna Breman begins her tenure as the new RBNZ Governor. While data is limited this week, the NZD will attract increased attention as rates markets now see the cutting cycle as over and imply 30bp of hikes over the coming 12 months. The NZD was the best-performing major currency last week, with:

- NZDUSD +2.1% w/w, threatening a break above the regression channel drawn from the July highs

- NZDJPY at the best levels of the year

- AUDNZD eyeing a downside break of 1.1400, with 1.1300 the next level if achieved

Europe: CPI, GDP

Europe’s EU CPI and Q3 GDP fall onto the event-risk radar, although it is hard to see either materially impacting EUR interest-rate swaps pricing, given traders’ firm view that the ECB will remain on hold for an extended period. In EU equity markets, Spain’s IBEX stands out — closing higher for five consecutive days and sitting at the 82nd percentile of its 50-day high-low range.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.