- English (UK)

A Traders’ Week Ahead Playbook: Themes and Risks to Navigate Global Markets

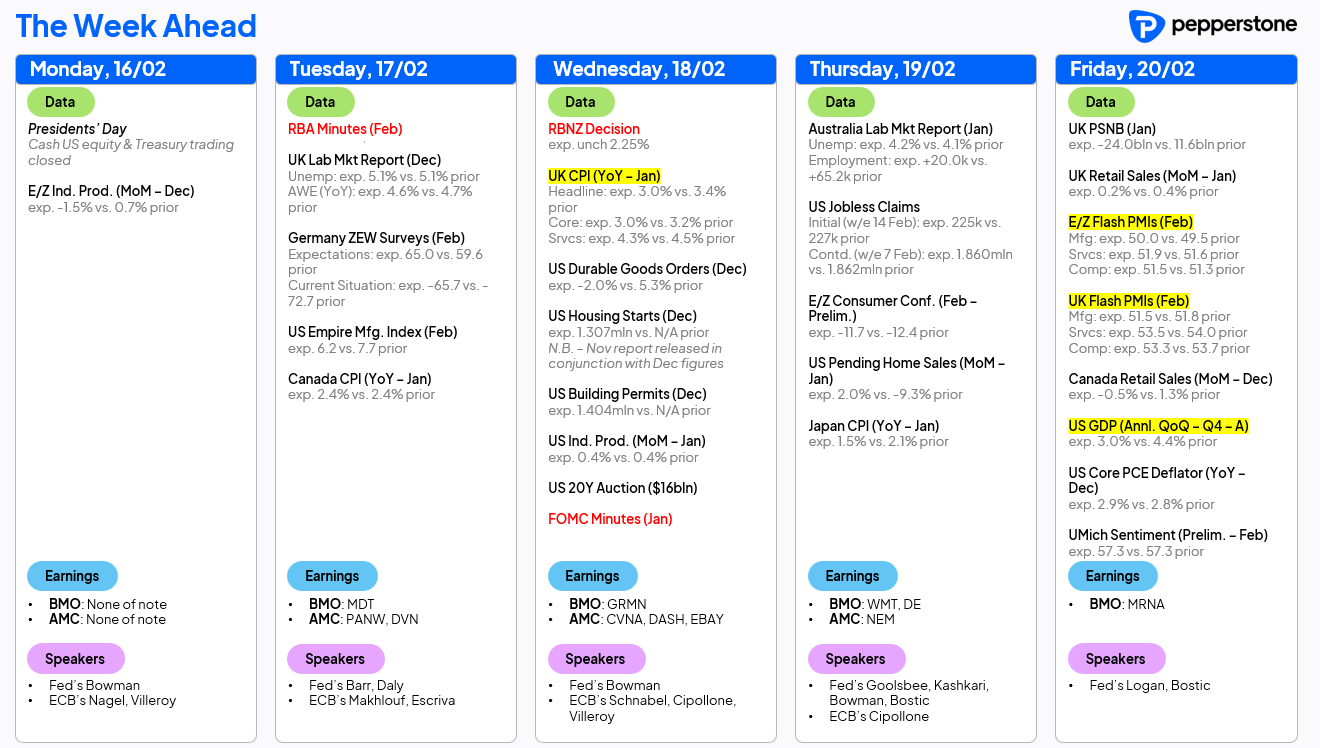

• Holiday-thinned liquidity meets heavy macro data and corporate earnings risk

• Walmart, Newmont and BHP headline the earning calendar

• Central bank expectations in the US, UK, Australia remain in focus We roll into the new trading week with traders reassessing positioning across equities, FX, bonds and commodities. Set-ups, prevailing trends, key technical levels, volatility regimes and liquidity conditions all matter, but so too does the scheduled macro and earnings calendar that can inject intraday and multi-session risk.

Liquidity Conditions and Holiday Effects

The US observes Presidents’ Day, with US cash equities and Treasuries closed today and futures trading on reduced hours. China’s Lunar New Year begins on Tuesday, which will impact mainland China and Hong Kong cash and derivatives markets through the week, and given the impact Shanghai gold futures have recently had on the CME gold futures through Asia, this could reduce gold volatility through Asian trade. UK school holidays also begin, potentially reducing participation. Whether these holiday dynamics meaningfully reduce liquidity remains to be seen, but thinner conditions can amplify price moves, particularly around event risk.

US Macro Data and Growth Expectations

In the US, several hard data economic releases will help refine expectations for the Q1 GDP tracking rate. Market sensitivity is likely to be skewed toward personal income and spending data, core PCE inflation and potentially revisions to Q4 GDP.

With the market increasingly data dependent, any surprise in inflation or consumption could reprice Fed rate expectations and shift US yields, equity indices and the USD.

US Corporate Earnings: Walmart and Newmont in Focus

Attention is building toward Nvidia earnings next Wednesday after the market close, with Oracle estimated to report on 10 March. For this week, the US earnings calendar is lighter, but Walmart’s report on Thursday is seen as the key consumer read-through. Newmont’s earnings and outlook, also released post-market Thursday, will be closely watched by gold equity traders. Options markets are pricing an implied move -/+ 6.1 percent on earnings day, highlighting elevated risk for outsized single-stock volatility.

US Supreme Court and Tariff Risk

The US Supreme Court may provide clarity on the legality of tariffs implemented under IEEPA. Even if the court were to rule against the legality of those tariffs, revenues collected since implementation would not need to be repaid. This outcome would not sit well with import-heavy US businesses that have absorbed higher costs, but it would avoid a complex reimbursement process and preserve the improved US fiscal position. The US deficit-to-GDP ratio is currently tracking near 5.3% as of January, a strong improvement vs January 2025.

Japan: Equity Momentum, JGB Volatility and JPY Positioning

The long Japan trade was the standout macro theme last week, with the NKY225 remaining the leading equity index of 2026. Although the index consolidated below 58,000 late in the week, the risk of a renewed push toward 60,000 cannot be ruled out. Long-end JGB (Japanese govt bonds) volatility has eased, with 10-year JGBs trading a tighter range, while the 30-year JGB yield has fallen from 3.87% to 3.48%. JPY short positioning was aggressively reduced, with many traders flipping to outright bullish exposure. The JPY outperformed all G10 currencies.

AUDJPY fell by the greatest percentage last week, but the primary trend remains higher. USDJPY eyes a test of the 26 Jan low of 152.09 and a break here would open up a move into 150.00.

UK: Jobs, Inflation and Bank of England Expectations

GBP traders will focus on employment and wages data, January CPI and retail sales. The market expects softening across these releases. GBP interest rate swaps (OIS) markets currently imply a 73% probability of a 25bp rate cut at the 19 March MPC meeting, with two cuts priced by the end of 2026. Short GBP positioning has been reduced, suggesting positioning risk may now be more balanced.

Australia: RBA Minutes, Labour Data and ASX200 Earnings

In Australia, traders will digest the February RBA meeting minutes, the Q4 Wage Price Index and January employment data. Thursday’s jobs report is the key event for AUD traders, particularly ahead of next week’s monthly CPI release. Another strong labour market print, similar to December’s data, would likely see AUD OIS increase the probability of a 25bp hike at the May meeting from the currently implied 78%.

On the equity side, ASX200 reporting season remains heavy. While index-level volatility may stay contained, the risk of outsized one-day moves in individual stocks is elevated. BHP 1H26 earnings on Tuesday represent the marquee domestic release, with additional focus on earnings from JBH, TLS, RIO, RRL and WES.

New Zealand: RBNZ Meeting & Policy Outlook

The RBNZ meeting on Wednesday is expected to be orderly, implying relatively low volatility risk for NZD traders. Although the central bank is expected to hike rates later this year, NZD OIS markets currently imply virtually zero probability of a 25bphike at this meeting. The statement is expected to strike a broadly balanced tone.

Euro Area: Flash PMIs and ECB Expectations

EU flash PMIs on Thursday present volatility risk for EUR positions. While EUR OIS markets currently price the ECB on hold throughout 2026, the combination of moderating inflation and stabilising growth offers potential near-term upside for the currency.

Positioning, liquidity and event clustering define this week’s trading landscape. With holiday-thinned markets, major earnings on deck and central bank expectations in flux, traders should expect pockets of volatility and remain disciplined in sizing and risk management.

Good luck to all…

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.