- English (UK)

While swaps markets for a number of counties price a hike this week, and a risk of another in November, residual slowing in demand could feasibly result in this being a week of semantics; a week we look back at and see the last delivered rate hike, ringing the bell on an aggressive tightening cycle.

Making that call through this cycle has been for the brave or those without reputations to lose. However, the sharp decline in interest rate and bond volatility is testament to the idea that the distribution of central bank interest rates is no longer normalised (the market sees an equal chance of hikes or cuts) and is now firmly skewed towards cuts. We can look at rate cuts underway/emerging from LATAM central banks, which we see as a canary in the coal mine for G10 FX – yet, while we’re heading in that direction, unless we get a strong deceleration in demand or a strong tightening of financial conditions, then cuts in DM are a Q224 story.

What to do with the USD this week?

The US-exceptionalism story remains central and highly supportive of the USD and that won’t change this week. That said, China is improving, and sentiment is looking to turn, so if USDCNH can head to 7.2000 then I’d be more comfortable calling a USD tradeable sell-off. USD positioning is incredibly rich.

Other core themes that are front and centre:

- Crude and its march towards $100

- EURCNH – is this bear trend ready to kick on?

- Was Friday’s 1.8% decline in the NAS100 a one-day affair driven by options flow or is there more vol in store?

Can US 5yr real rates break out above 2.22% (TradingView code: TVC:US05Y-FRED:T5YIE) - will this be taken poorly by risk? - Will sentiment towards China turn more positive? Could this see AUD outperform?

- Can PMI’s in Europe turn even lower?

The marquee event risks for traders to navigate:

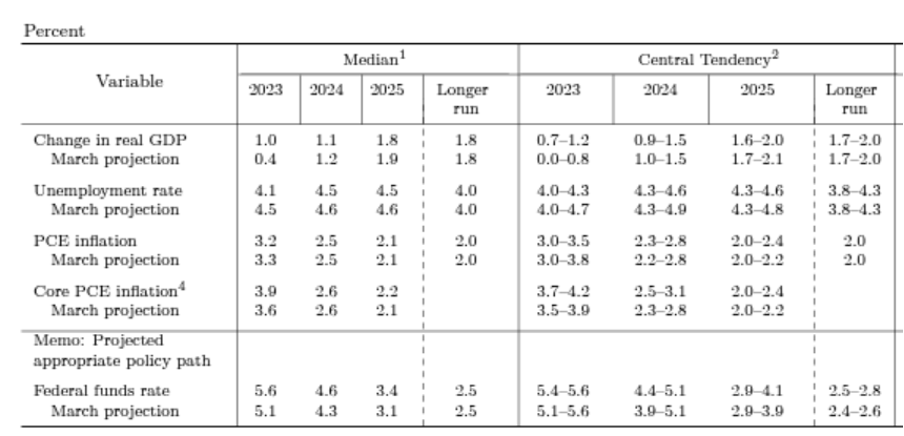

FOMC meeting (Thursday at 04:00 AEST) – In theory, the FOMC meeting should be a low-volatility affair, but it is a risk that needs to be managed. There is very little chance the Fed hike rates, so the focus should fall on the bank’s economic and fed funds projections. Counter to the actions we saw from the ECB last week, the Fed should raise its 2023 and 2024 growth forecasts, while lowering its inflation forecasts. We should see the median projection for the 2023 fed funds rate (the so-called ‘dot plot’) remaining at 5.6%, offering the bank the flexibility to hike again in November, should the data warrant it.

We should see the median 2024 fed funds projection remain at 4.6%, but there is a risk this projection/’dot’ increases by 25bp, which would cement a higher-for-longer stance. We could also see the long-run dot, currently at 2.5%, taken higher. Should the 2024 ‘dot’ be pulled higher, then we could see rate cuts for 2024 being priced out, the USD finding renewed buying interest and equity indices under pressure.

Playbook for the September FOMC decision.

Economic and dot projections from the June FOMC meeting.

BoE Meeting (Thursday 21:00 AEST) – The BoE should hike by 25bp to 5.5% with nearly all 54 economists (surveyed by Bloomberg) calling for a hike and swaps pricing this outcome at an 82% probability. This could very well mark the last hike the BoE make in the cycle. The BoE will also announce an increased pace of Quantitative Tightening from October 23 to September 2024.

GBP was one of the worst performers in our FX universe last week, with GBPUSD eying a move into 1.2300, while GBPMXN fell 3.6%, falling for 7 days in a row. GBPCAD has also had a strong move lower into 1.6750 and I favour selling rallies into 1.6820.

Playbook for the September BoE decision.

GBPCAD daily

BoJ meeting (Friday – no set time) – There is no chance of a hike from the BoJ at this stage, and after Gov Ueda clarified late last week that the bank was not looking to move away from Negative Interest Rate Policy (NIRP), one questions if this meeting will cause any movement at all in the JPY or JPN225. National CPI (due earlier at 09:30 AEST) could be more interesting, with expectations of 3% headline CPI (from 3.3%) and 3% on core CPI.

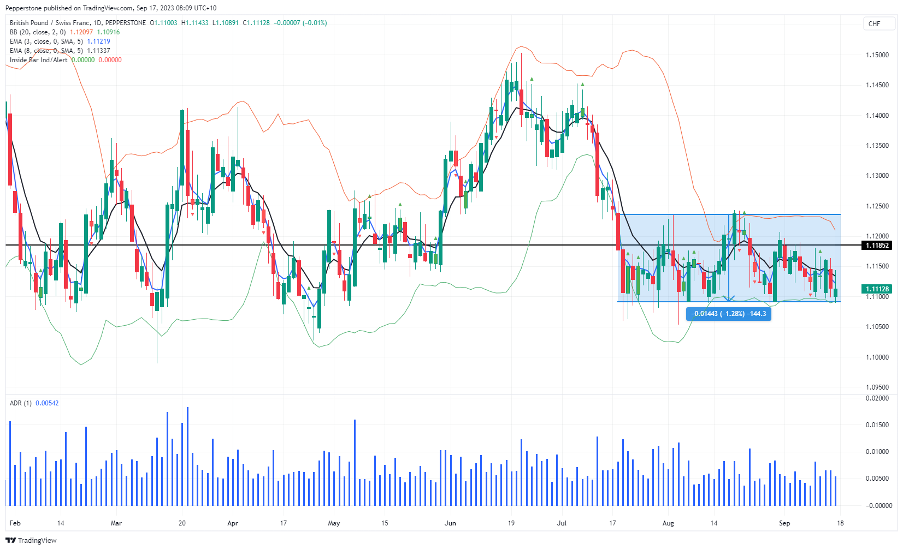

Swiss National Bank (SNB) meeting (Thursday 17:30 AEST) – The SNB should hike by 25bp to 2%, with the market pricing this outcome at 68%. CADCHF has been ripping higher of late, so I would use any dips from a 25bp hike to initiate new longs. GBPCHF tests its recent range lows of 1.1085, so one maybe due for a technical bounce off these levels, although given the event risk in both currencies it wouldn’t surprise to see a range break that holds.

GBPCHF daily

Norges Bank meeting (Thursday 18:00 AEST) – The Norwegian Central Bank should hike by 25bp, but this is fully priced and expected by the market. The Norges Bank are another central bank that could be calling it a day on hikes after this last effort. The NOK seems lost at present and missing a spark and has diverged significantly from the rally in Brent crude. NOKJPY is a case in point, where traders can look at the daily and see range trading the play.

Riksbank Meeting (Sweden) meeting (Thursday 17:30 AEST) – The Riksbank should hike by 25bp to 4% with the markets pricing a hike at 100%.

South Africa Central Bank (SARB) meeting (Thursday) – While S.A core inflation is still too high at 4.7% the SARB should leave rates unchanged at 8.25%.

CBT (Turkey) Central Bank meeting (Thursday 21:00 AEST) - expected to hike 500bp to 30%

Brazilian Central Bank (BCB) meeting (Thursday 07:30 AEST) – The BCB should cut the Selic rate by 50bp to 12.75%, although we may see some skew in the voting towards 75bp. USDBRL eyes range lows of 4.8500, and I favour BRL and MXN longs.

Other key data points that could influence

UK CPI (20 Sept 16:00 AEST) – the market looks for UK headline CPI to come in at 7.1% (from 6.8%), and core CPI to fall to 6.8% (from 6.9%). The market may put more weight on the core CPI measure, where the outcome could affect pricing for the BoE meeting a day later – it would, however, require a huge downside miss to warrant a pause at this week's BoE meeting.

UK S&P manufacturing and services PMI (22 Sept 18:30 AEST) – We saw a big downside surprise in the prior UK service PMI read, which proved to be a key influence in the liquidation of GBP longs. The market expects manufacturing PMI to come in at 43.4 (from 43.0) and service PMI at 49.0 (49.5) – if the outcome comes in below sombre expectations, the GBP could be sold hard.

EU manufacturing and services PMI (22 Sept 18:00 AEST) – expectations for EU manufacturing PMI sit at 44.0 (from 43.5) and services PMI sit at 47.7 (from 47.9). Weak numbers, especially in the service data could bring out further EUR sellers, with EURUSD currently holding the 31 May swing low of 1.0635 – a closing break here puts 1.0516 in play.

Mexico CPI (Friday 22:00 AEST) – the market eyes headline CPI at 4.48% yoy (from 4.6%) and core at 5.77% (from 5.96%). The market sees Banxico cutting rates in December, so this CPI print could play into those expectations and move the MXN,

ECB speakers – The key players on the ECB rollout this week and could move the dial – we hear from Villeroy, Lagarde, Elderson, Schnabel, Lane, Guindos.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.