- English (UK)

It might be a new year, but it's the same story and same narrative for the UK economy. No growth, embedded disinflation, and a rapidly weakening labour market.

The Macro Backdrop

In isolation, that suggests that the Bank of England should be adopting a considerably more dovish stance than they currently possess. With data screaming ‘get to neutral, now!’, the MPC are instead dithering, with Governor Bailey having even said last month that the Committee could slow the pace of policy easing, despite there having been no cuts at all between August and December last year.

Far from running the risk of falling behind the curve, the MPC find themselves so far away from the curve that I’d doubt whether the ‘Old Lady’ can even see it at this stage.

MPC Risking A Policy Error

This, quite clearly, sees the Bank now running the significant risk of making a grave policy mistake. While Chief Economist Pill and his colleagues fret about non-existent risks of inflation persistence, the reality is that price pressures are fading rapidly (6-month annualised CPI is at target), private sector pay growth has slowed to a level compatible with the inflation aim, while the demand side of the economy slowly but surely takes a battering, further embedding those disinflationary forces.

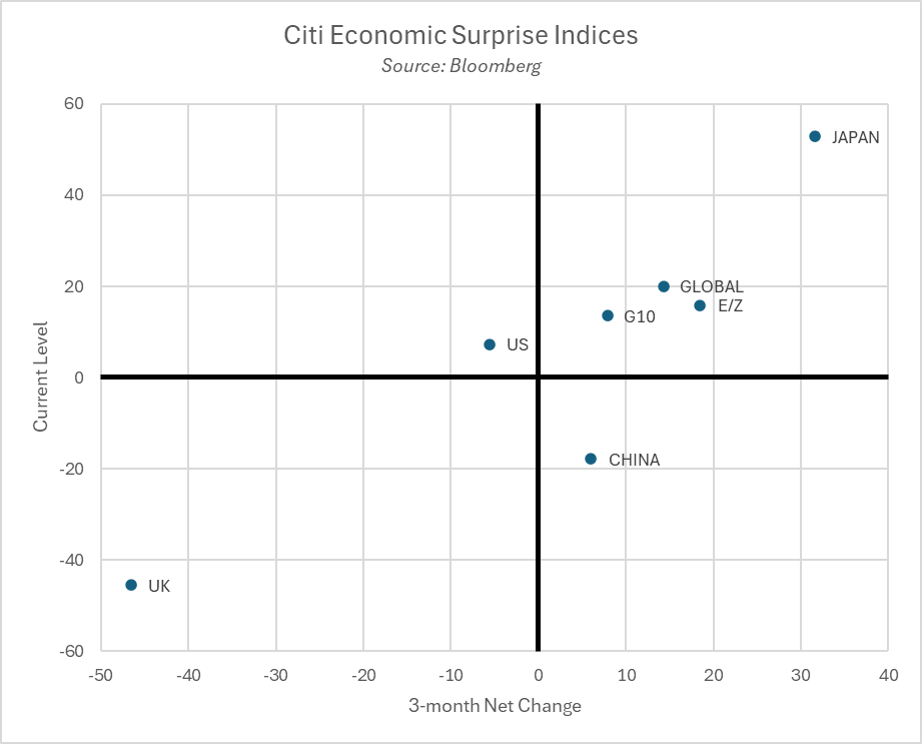

UK Compares Poorly To Peers

Perhaps the starkest illustration of all this, though, is to compare the UK’s economic performance to consensus expectations - which, it must be said, weren't exactly optimistic in the first place. Citi’s economic surprise index for the UK is deeply in negative territory, and has fallen considerably in the last quarter, implying that the magnitude of those downside economic surprises is growing greater. Worryingly, the UK is the only major economy to find itself in the ‘quadrant of doom’ on the chart. On top of that, given ongoing fiscal worries and political uncertainty, risks to growth tilt firmly to the downside.

This does, of course, bring up the age old debate between trading what one thinks a central bank should do, and what one thinks they actually will do. Naturally, only the latter should be traded, though one would imagine, given the direction of travel the UK economy is now likely to experience, that the data will force the MPC’s hand into easing faster, and further, before too long. Though February may be too early for another 25bp cut, depending on how data evolves over the next few weeks, further reductions during the course of H1 are all-but-certain.

Downside Risks For The GBP, Upside Risks For Gilts/STIRs

The market implications of that more dovish BoE outlook, with the GBP OIS curve not even fully pricing two 25bp cuts by year-end, are relatively obvious. SONIA futures for 2025 should rally, with June and September the expiries in focus, while front-end Gilts should rally further too.

In the FX space all this points to there being little-to-no reason for cable to trade with a 1.34 handle, not least considering that risks to the US economic outlook tilt in the polar opposite direction. The quid’s recent gains, then, look to be built on very shaky foundations indeed, with short cable positions hence looking increasingly attractive.

_2026-01-09_06-56-32.jpg)

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.