- English (UK)

The Fed’s QT Plans Raise More Questions Than Answers

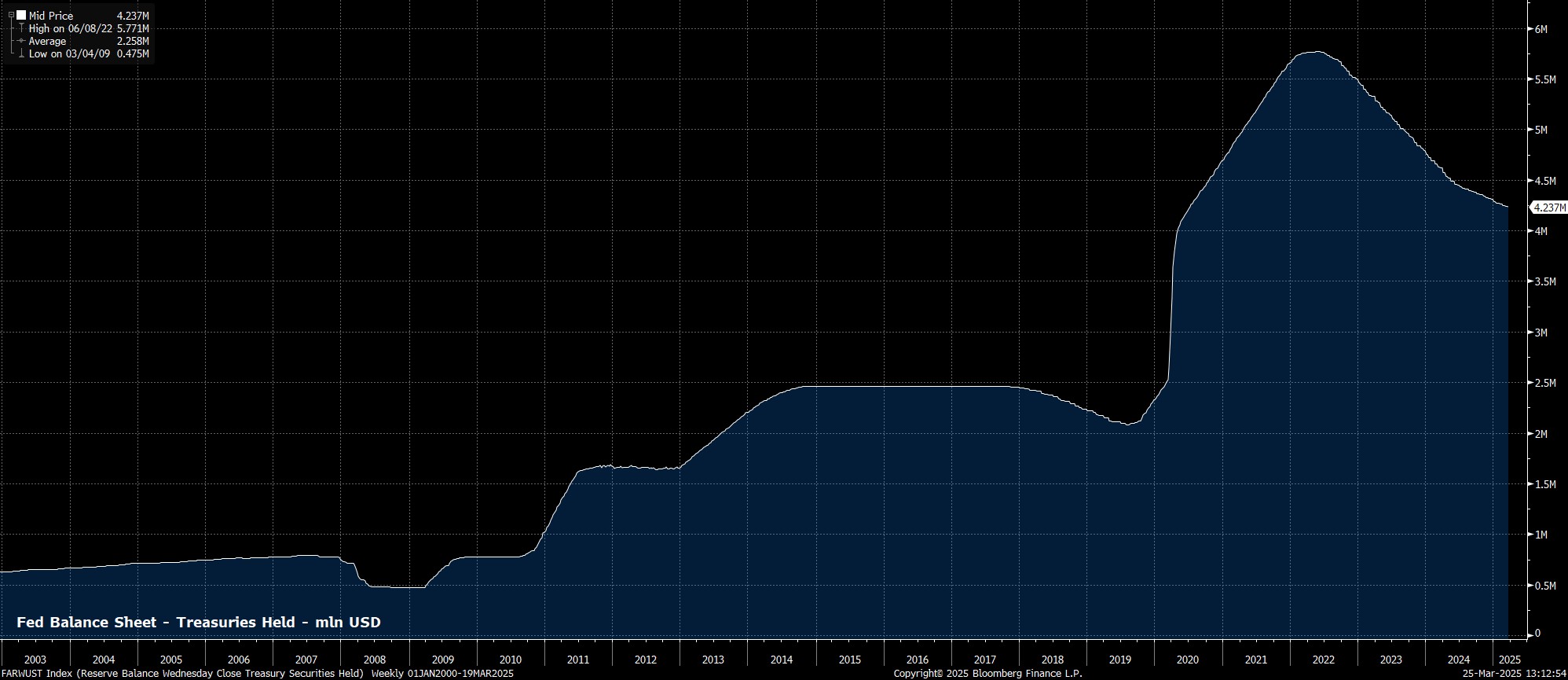

For all intents and purposes, QT is dead and buried.

Yes, the size of the Fed’s Treasury holdings will continue to shrink for some time to come, but at a rate of just $5bln per month, the pace of this will be more glacial than breakneck, especially when at one stage the Fed were letting as much as $60bln in Treasuries roll off the balance sheet every month.

That meagre pace, though, is important, from an ‘optics’ perspective if nothing else.

Firstly, it allows the Committee to maintain the narrative that balance sheet normalisation is continuing, even if in practice the rate of said normalisation is so slow as to barely be noticeable.

Secondly, maintaining such a modest pace of run-off prevents the Fed from becoming a net buyer of Treasuries, in turn avoiding a potential ‘sticky wicket’ whereby Powell & Co would have to explain why they’ve stepped back into the market, particularly at a time of notable upside inflation risk.

On that note, the framing of QT remains interesting, as policymakers seek to stress it being a ‘technical’ process, and not an explicit monetary policy measure. This seems like the FOMC trying to have their cake and eat it – you can’t claim that expanding the balance sheet provides stimulus, but that shrinking the balance sheet doesn’t tighten conditions. Hence, at the margin, the slowing of QT should at least moderate the pace at which financial conditions have recently been tightening.

Despite that, with the Fed remaining a net seller of Treasury holdings, the liquidity drain caused by balance sheet run-off looks set to continue, only at a slower pace. This isn’t, then, the ‘balance sheet put’ that I’d previously theorised, with J-Pow not riding to the rescue quite yet.

Instead, it is conceivable that the FOMC’s decision to slow the pace of balance sheet run-off may actually end up increasing policy-related uncertainty. Market participants will now be questioning a number of things – When QT will actually come to an end? Could the pace of QT be increased? What might policymakers do with MBS holdings?

Furthermore, given that the slowdown in balance sheet run-off was seemingly driven by concerns over the level of bank reserves sloshing around the US financial system, there are also questions to be asked over what constitutes an “ample” level, and at what point said reserves might become “scarce”. Again, this introduces a greater degree of uncertainty, not only as to that level, but also considering what the policy response might look like if, or indeed when, we dip below that “ample” threshold.

Putting all this together, it seems clear that, despite Chair Powell trying to brush the issue under the carpet a bit, and claim that the adjustments in question are all merely technical in nature, the QT tweak delivered last week could well prove to be bad news for risk assets.

Quite apart from being the backstop for sentiment that some, including I, had been hoping for when QT came to a close, the way in which the FOMC have handled things seems to have ended up raising more questions than answers.

For a market already being battered by a barrage of uncertainty from the Oval Office, a lack of clarity from the Eccles Building seems unlikely to do participants any favours.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.