Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

WHERE WE STAND – I regret to inform you that I must yet again start one of these notes on the subject of tariffs. We can all hope that, one day, there might be something more interesting to talk about!

Anyway, it’s safe to say that President Trump wasn’t exactly pleased when he was informed by a journalist of the TACO – Trump Always Chickens Out – trade in the Oval Office last week. In fact, in true Trumpian fashion, the term was branded as one of the “nastiest” he’s ever heard.

At risk of doing 2+2=5, it seems from the punchy rhetoric, and actions, from Friday, that the President is rather rattled. First, we had a rambling ‘Truth Social’ post noting that China had “violated its agreement” with the US, likely due to the former’s sluggish progress on rare earth metal exports to the US. Then, there were sources reports that the US were planning a more wide-ranging imposition of sanctions on Chinese tech firms, cracking down on subsidiaries based in the US. This was, finally, followed up by an announcement that tariffs on steel and aluminium will be doubled to 50%, from 4th June. As The Donald himself said, “So much for being Mr. NICE GUY!”

Naturally, one must then question whether this changes my long-standing view that we are passed the peak of trade uncertainty. I’d argue that it doesn’t, with regards to China at least, there wasn’t really anything new in Trump’s remarks, with both nations having also shown already that they have no desire, or ability, to stomach huge tariffs on the other’s goods. The broader direction of travel remains towards trade deals being done, with all of the above being much more akin to ‘noise’ than to ‘signal’.

That said, the volume of trade ‘noise’ remains high, and uncertainty elevated. Amid that, though, incoming economic data continues to hold up very well indeed, with April’s core PCE deflator printing 2.5% YoY, providing further evidence of the immaculate disinflationary process within the US economy. Actually, if Trump wasn’t messing around with tariffs 24/7, this would be a textbook example of a ‘goldilocks’ economy – steady growth, a tight labour market, and continuing disinflationary progress. Alas, everyone is crippled by trade uncertainty instead, which should also keep the FOMC on the sidelines until the fourth quarter at the earliest.

Markets also felt a bit crippled as we moved into the weekend, with there being very little by way of notable moves for participants to get their teeth into.

Stocks on Wall Street trod water, with spoos continuing to linger around 5,900, albeit with dip buyers rapidly emerging as the aforementioned negative trade headlines crossed news wires. This aligns with my broader strategy which remains to add on weakness, so long as we trade north of the 200-day moving average, with 6k, then fresh highs, being the upside targets. All of the trade noise, particularly the legal wrangling over tariffs, is in my mind secondary to the three key factors which continue to propel the market higher – solid earnings, solid incoming economic data, and a belief that the direction of travel is towards trade deals not trade embargos.

The FX market was also rather subdued as the week came to an end, though conditions were choppy as EoM flows made a bit of a mess of proceedings. The broader theme, though, remains one of mean reversion across most of G10, demonstrating how participants seem to have relatively little conviction behind the moves that we’re seeing. The EUR is stuck in a 1.13-1.14 range, cable capped at 1.35, and USDJPY keeps being magnetised back to the 145 handle. We shall see whether this week’s busy slate of event risk (on which, more below) can break this inertia.

While FX was tranquil, FI was not, with notable gains seen at the front-end of the Treasury curve, as benchmark 2-year yields slipped to their lowest level in three weeks. Last week’s well-received 2-, 5- and 7-year supply will certainly have helped here, though fiscal concerns where showing up more at the long-end of the curve in any case. Instead, a dovish repricing of Fed policy expectations is the culprit, likely a result of that cooler PCE print, though the USD OIS curve discounting 55bp of easing by year-end does feel a touch punchy to me.

If only from a calendar perspective, I’m increasingly leaning towards the idea of just one 25bp cut this year, and would be inclined to fade this repricing here.

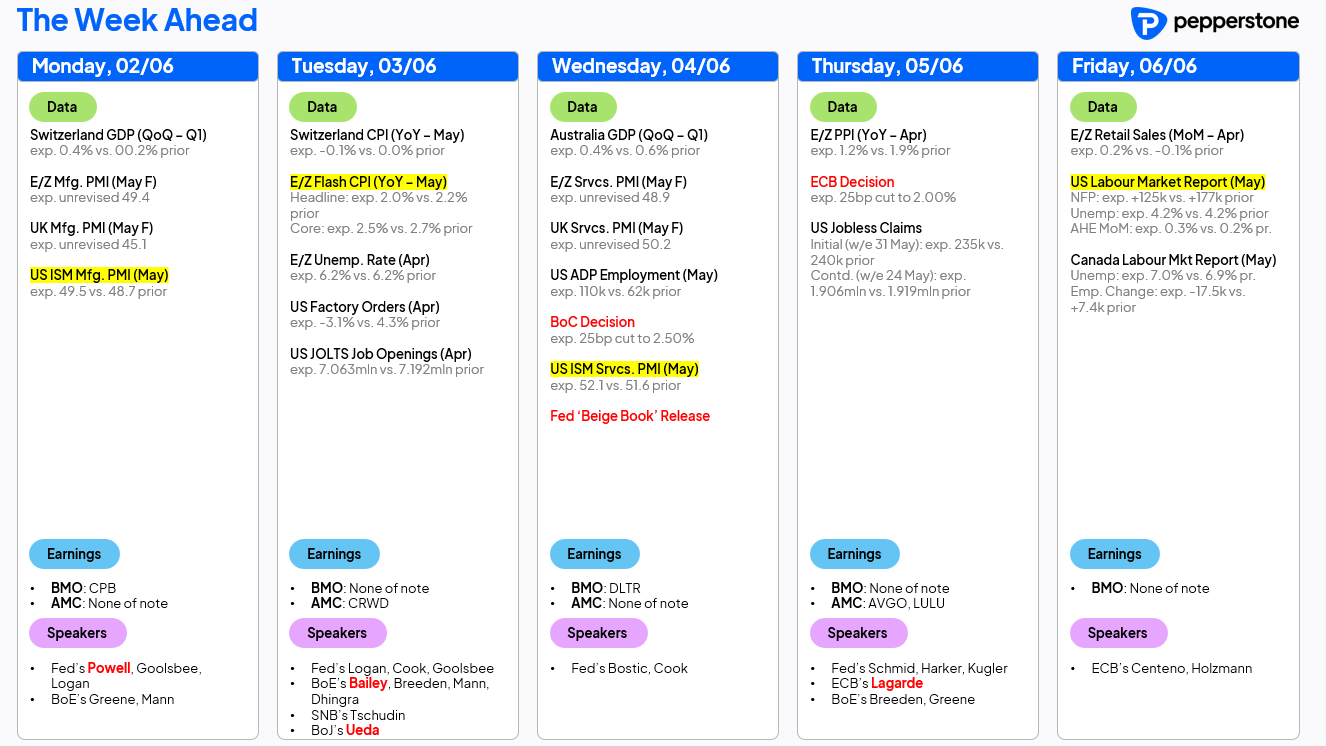

LOOK AHEAD – A busy data docket ahead this week as the new trading month gets underway; how on earth is it already June!?

Anyway, along with the usual start-of-month PMI surveys from pretty much every major economy, we also get our latest read on eurozone inflation this week, which should point to a further cooling in price pressures across the bloc. In turn, that should give the ECB all the ammunition required to deliver a 25bp cut on Thursday, lowering the deposit rate to 2.00%, and likely guiding towards further cuts in the coming months, as policymakers seek to cushion the eurozone economy from increasing downside growth risks.

Across the pond, the most notable release comes on Friday, with the latest US jobs report due. While the pace of headline nonfarm payrolls growth is set to slow, a print in line with consensus would still be just above the breakeven rate, with other metrics also set to point to the labour market remaining tight. Along with that, plenty of Fed speakers are due, including Chair Powell making some remarks this evening.

North of the border, the Bank of Canada are set to deliver a 25bp cut on Wednesday per the sell-side consensus, though CAD money markets price a 4-in-5 chance of the BoC standing pat. Clearly, a ‘live’ meeting, and the potential for some decent vol in the loonie as a result. Not wanting to be left out of this central banking bonanza, four Bank of England policymakers, including Governor Bailey, are set to testify in Parliament this week.

On the earnings front, Q1 reporting season is as good as over, with 98% of the S&P having now reported, and 78% of those having reported an upside EPS surprise, pretty much in line with the 5-year average. This week’s most notable report comes from Broadcom (AVGO) after the close on Thursday, with expectations for the print having been raised by Nvidia’s solid figures last week. Q2 earnings season, for reference, kicks off on 15th July, when the banks get us up and running once more.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.