- English (UK)

September 2025 UK Jobs Report: Ugly Data As Material Weakness Continues

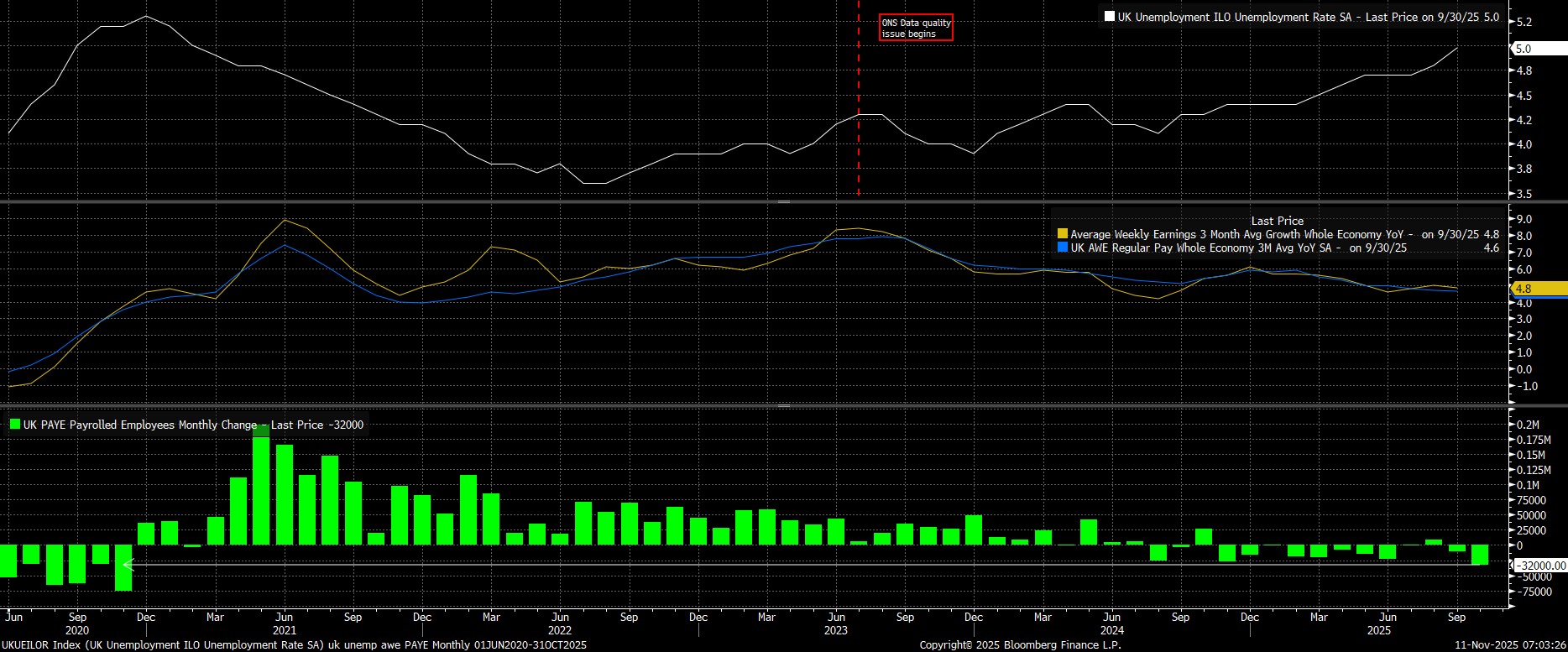

Headline unemployment rose to 5.0% in the three months to September, the highest level since February 2021, though concerns over data quality continue to plague these figures. The Bank of England, however, per the November MPR forecasts issued last week, expect unemployment to rise further in the months ahead, now expecting joblessness to peak at 5.1% in early 2026.

Meanwhile, despite slack continuing to emerge, earnings pressures persist. Overall pay rose 4.8% YoY in the three months to September, while regular pay rose by 4.6% YoY, this latter figure being the slowest pace since April 2022, but still a relatively rapid clip. Importantly, in what remains an unusual dynamic for a DM economy, earnings growth in the public sector continues to outpace that in the private sector. This does, at least, suggest a diminished risk of such a pace of earnings growth, which overall is clearly still incompatible with a return to the 2% inflation target, prompting persistent price pressures, with private earnings growth moderating once again in September, to 4.2% YoY.

Turning to the more timely HMRC PAYE payrolls metric, which pointed to payrolled employment falling by a huge 32,000 in October, not only the second straight monthly decline, but also the largest such decline since November 2020.

Taking a step back, this morning's figures point to the labour market continuing to weaken, as most had expected it would do so. Last week, the Bank of England's Monetary Policy Committee opened the door to a 25bp cut in December, not only having held Bank Rate steady via the narrowest possible 5-4 margin, but also with the removal of prior guidance around a 'careful' pace of easing moving forwards.

Hence, this morning's data is likely to do little to deter the dovish contingent on the Committee from again voting for a 25bp cut at the final meeting of the year, with my base case now being that such a reduction is delivered, with Governor Bailey joining the doves to vote through such an action. That base case, however, which would likely be followed up with another cut at the February meeting, does hinge not only on further disinflationary progress being evidenced in the upcoming October and November CPI reports, but also there being little by way of surprise, or worse inflationary policies, announced in Chancellor Reeves's late-November Budget.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.