- English (UK)

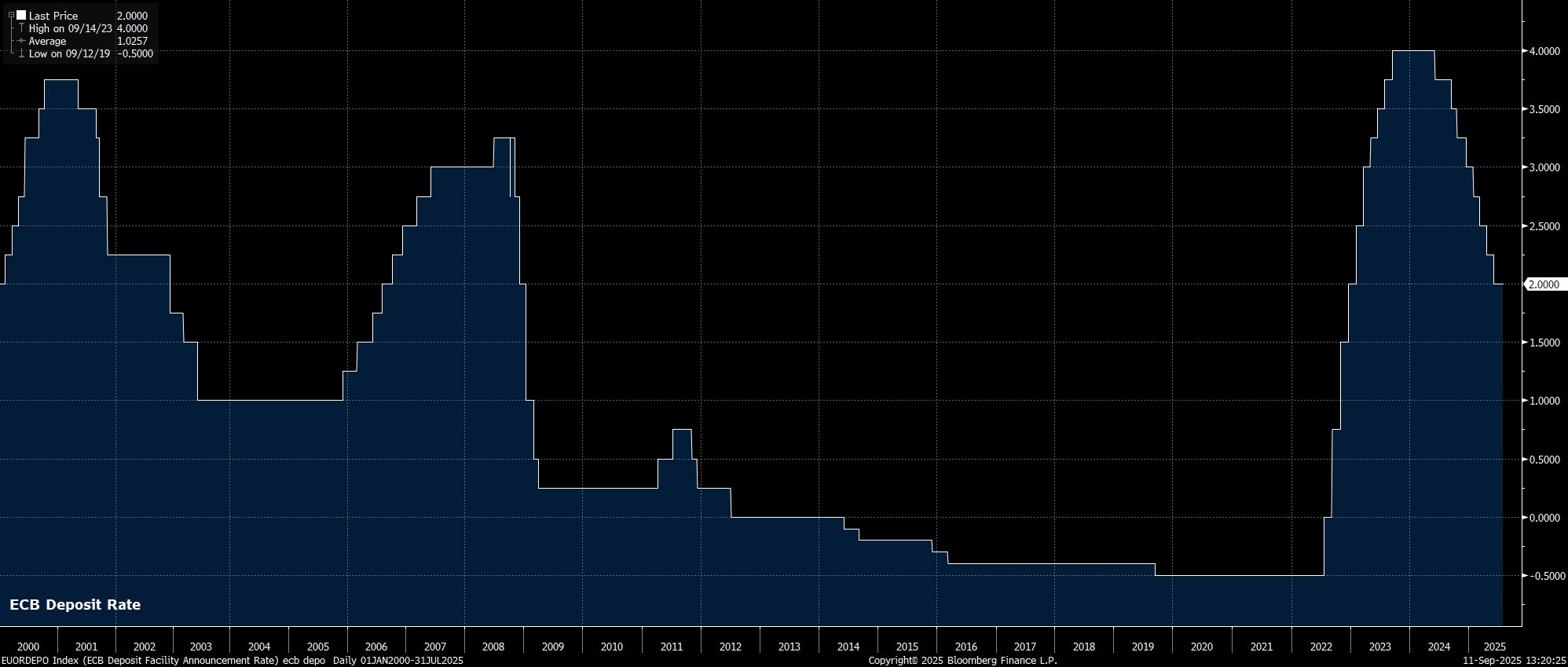

To the surprise of no market participants at all, the ECB’s Governing Council stood pat on policy at the conclusion of the September meeting, maintaining the deposit rate at 2.00% for the second meeting running. Such a move extends the ‘pause’ in the ECB’s easing cycle, which is likely now at an end, but which saw the GC deliver 200bp of easing from mid-2024 onwards.

Accompanying that decision to hold rates steady was a policy statement that, by and large, stood as a ‘carbon copy’ of that issued last time out.

Once again, policymakers noted that a ‘data-dependent’ and ‘meeting-by-meeting’ approach will continue to be taken in determining future policy decisions, while also again re-affirming that no ‘pre-commitment’ is being made to any particular rate path. This guidance, of course, is by now very familiar indeed, though still allows the GC to maintain a significant degree of optionality, even if the base case favours 2% being the terminal deposit rate this cycle.

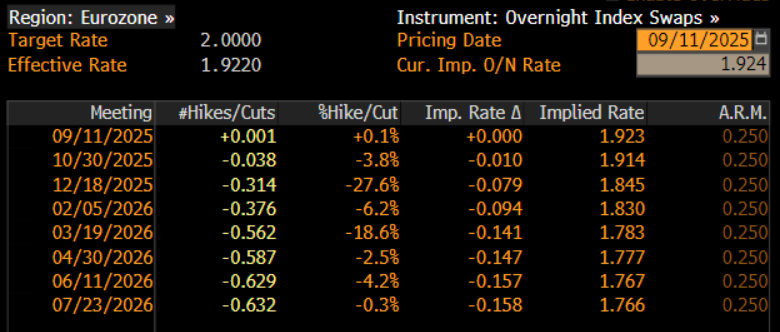

Money markets, per the EUR OIS curve, largely agree with such a view, pricing just 7bp of easing by year-end, likely a reflection of tail risk hedges, as opposed to outright bets on a more dovish policy path.

Along with the policy statement, the ECB also released the latest round of staff macroeconomic projections, as is usually the case at the September meeting.

On inflation, the projections were largely unchanged from last time out, though the headline HICP is now seen only at 1.9% in 2027, extending the previously forecast inflation undershoot by another year and potentially, at the margin, raising the prospect of a looser policy stance being required.

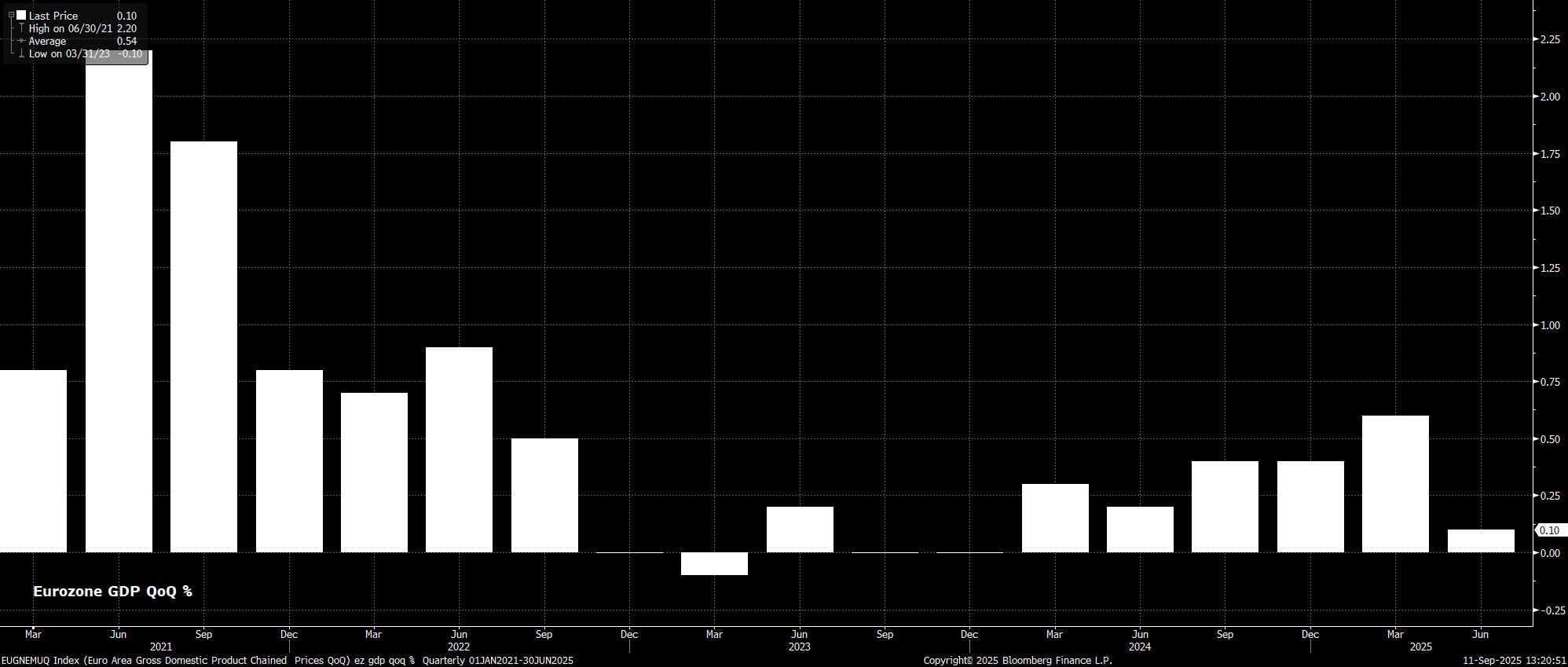

As for the growth outlook, downside risks remain present, though have diminished in light of the US-EU trade deal signed over the summer. As such, the projections now see 1.2% GDP growth this year, 0.3pp higher than the June forecast, though this seems to have pulled forward some activity from 2026, where growth expectations were nudged 0.1pp lower to 1.0%.

Reflecting on the above, and the outlook more broadly, at the post meeting press conference, President Lagarde upgraded her assessment of the economy, noting that risks to the outlook are now ‘more balanced’, and no longer ‘tilted to the downside’ as the were before the summer break. Furthermore, Lagarde reiterated that policy remains in a ‘good place’, and that inflation is ‘where we want it’, with the disinflationary process ‘over’. She also confirmed that, as expected, the decision to stand pat was ‘unanimous’.

Taking a step back, the September ECB meeting confirms that, by and large, the easing cycle in the eurozone is now done and dusted.

While policymakers have, logically, retained notable flexibility by refusing again to pre-commit to a particular rate path, any further rate reductions now seem unlikely, barring a re-escalation in trade tensions, a sudden and unexpected appreciation in the EUR, or concern that next year’s inflation undershoot may prove longer-lasting. For now, though, the base case is that the deposit rate will remain at 2.00% through to the end of next year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.