Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73.7% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

September 2025 ECB Preview: The Cycle Is Done & Dusted

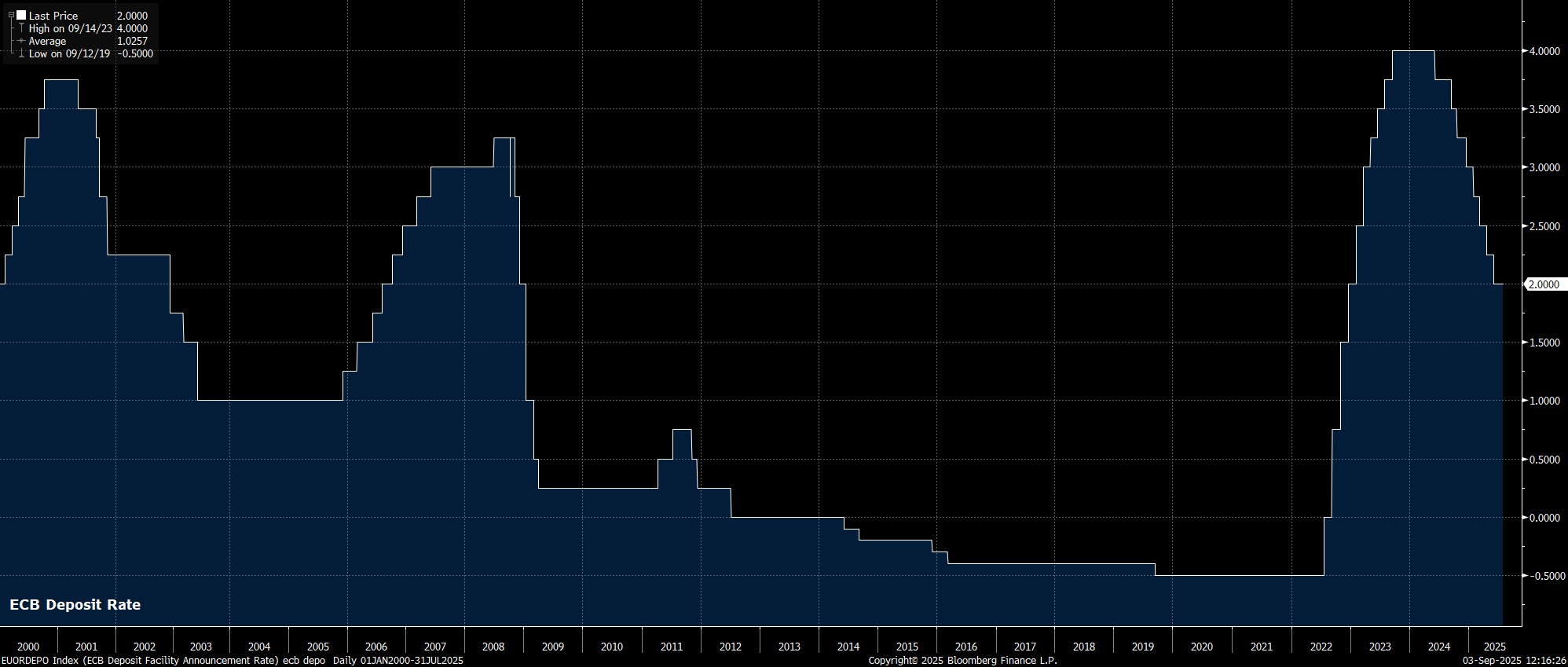

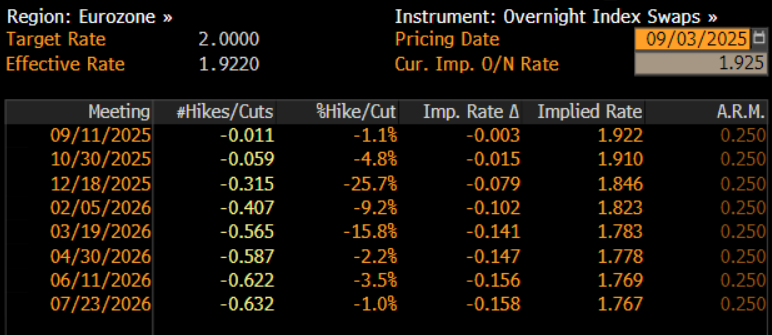

As noted, the September policy decision is likely to be a relatively straightforward affair, as the Governing Council return from their summer break. The deposit rate is almost certain to be held steady at 2.00%, with policymakers having given little by way of hints towards a need for further easing, and with money markets pricing no chance of any policy action this time out. In fact, the EUR OIS curve discounts just 10bp of easing by year-end, implying a less than even chance of another rate cut before the year is out.

Along with that decision to stand pat on rates, the accompanying policy statement is also likely to be relatively simple.

Once again, the Governing Council should repeat the guidance with which all market participants have now become incredibly familiar – namely, that policymakers will continue to adopt a ‘data-dependent’ and ‘meeting-by-meeting’ approach to future rate decisions, while also reiterating that no ‘pre-commitment’ is being made to any particular rate path.

In addition to the statement, the ECB will also release the latest round of staff macroeconomic projections at the September meeting.

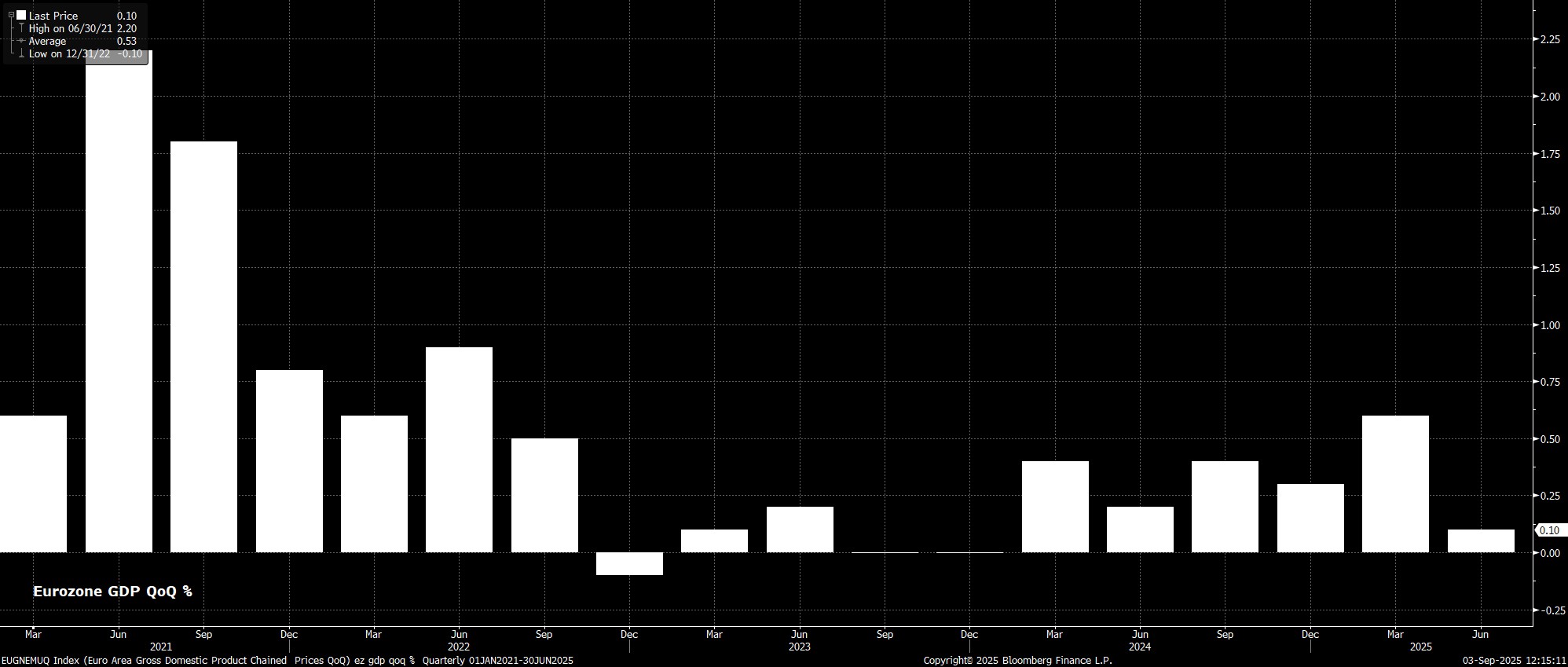

On growth, projections are likely to be broadly unchanged across the forecast horizon, again seeing GDP expanding by around 0.9% this year, and by around 1.1% next year. Since the last forecast round in December, downside risks to the economic outlook have notably diminished, not least as a result of the agreement of a US-EU trade deal, and temporary cooling in tensions between the two. Meanwhile, leading indicators of eurozone growth have also displayed a notable uptick of late, with the manufacturing PMI now back into expansionary territory for the first time in over three years, and the composite output metric at a 12-month high 51.0 in August.

Meanwhile, inflation projections are also set to be little-changed from those issued last time out, with price pressures remaining relatively contained, even as the balance of risks continues to tilt towards an undershoot of the 2% price target. The relatively stable nature of the EUR since the prior forecast round, at least on a trade-weighted basis, also supports the case for a broadly unchanged inflation profile.

As such, the latest projections will likely again point to a modest undershoot of the inflation target next year, perhaps by as much as 0.4pp, before headline CPI returns back to 2% in 2027.

That inflation undershoot, however, is unlikely to be enough to force the Governing Council into delivering another rate reduction, even if some of the GC’s more dovish members may end up pushing for such an action later in the year. In fact, it seems highly unlikely that the ECB will plump for another rate reduction at this stage, barring an unexpected re-escalation in US-EU trade tensions, and/or a further bout of EUR strength, with a move back above the $1.20 mark likely to spark a few jitters.

President Lagarde is likely to broadly stick to this theme at the post-meeting press conference, stressing once more that policy is in a ‘good place’, while reiterating the ‘data-dependent’ policy approach outlined in the statement.

Taking a step back, the September ECB meeting is likely to be one that reinforces my base case that the ECB’s easing cycle is now done and dusted, with 2% likely to be the floor for the deposit rate this cycle, and probably where rates remain through to the end of next year.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.