- English (UK)

Unsurprisingly, having delivered the first cut of the cycle last month, the MPC decided to hold Bank Rate steady at 5.00% at the conclusion of the September meeting, continuing the previously outlined gradual approach to removing policy restriction, and moving rates back to a more neutral setting.v

Despite holding rates steady, the MPC were again split on the appropriate course of policy action, albeit to a much lesser extent than last time around. The MPC voted 8-1 in favour of holding Bank Rate steady, with just external member Dhingra dissenting in favour of a second straight Bank Rate cut, a dissent that is broadly in line with her well-known dovish views.

Besides the vote split, and with no updated economic forecasts released this time around, focus fell largely on the accompanying policy statement.

Here, the MPC largely ‘copied and pasted’ the statement issued after the prior decision, reiterating that policy is not on any sort of pre-set course. As such, policymakers reiterated that the “appropriate degree of restrictiveness” will be decided on a meeting-by-meeting basis, and that policy will remain “restrictive for sufficiently long” in order to ensure that inflationary pressures are stamped out of the economy.

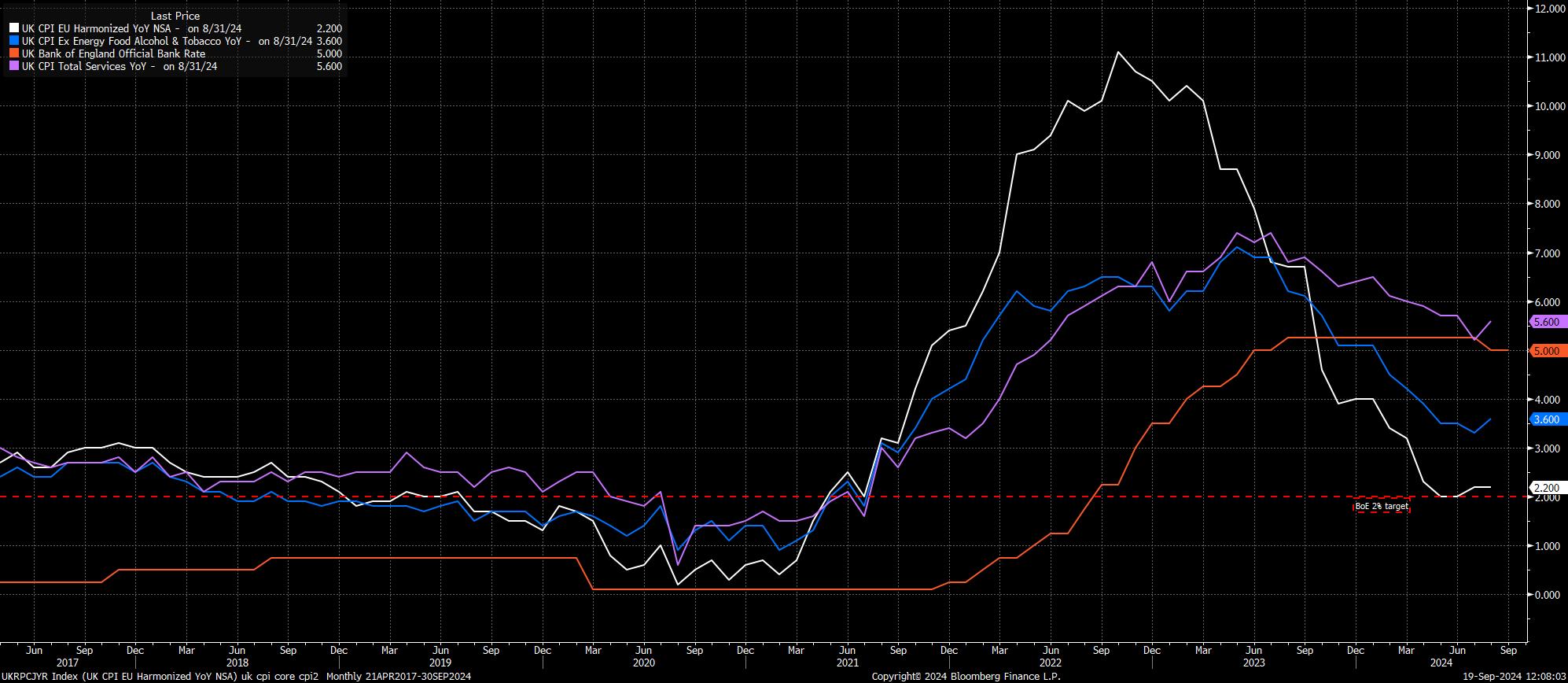

On this front, the MPC continue to focus on signs of underlying inflation persistence as the key determinant of future policy shifts. Here, recent data is likely to provide some cause for concern, with both core and services CPI metrics having ticked higher in August, to 3.6% YoY and 5.6% YoY respectively. While one-off factors, such as statistical base effects, will have adversely impacted the data, the MPC will be seeking some significant further disinflationary progress in these two metrics, sooner rather than later.

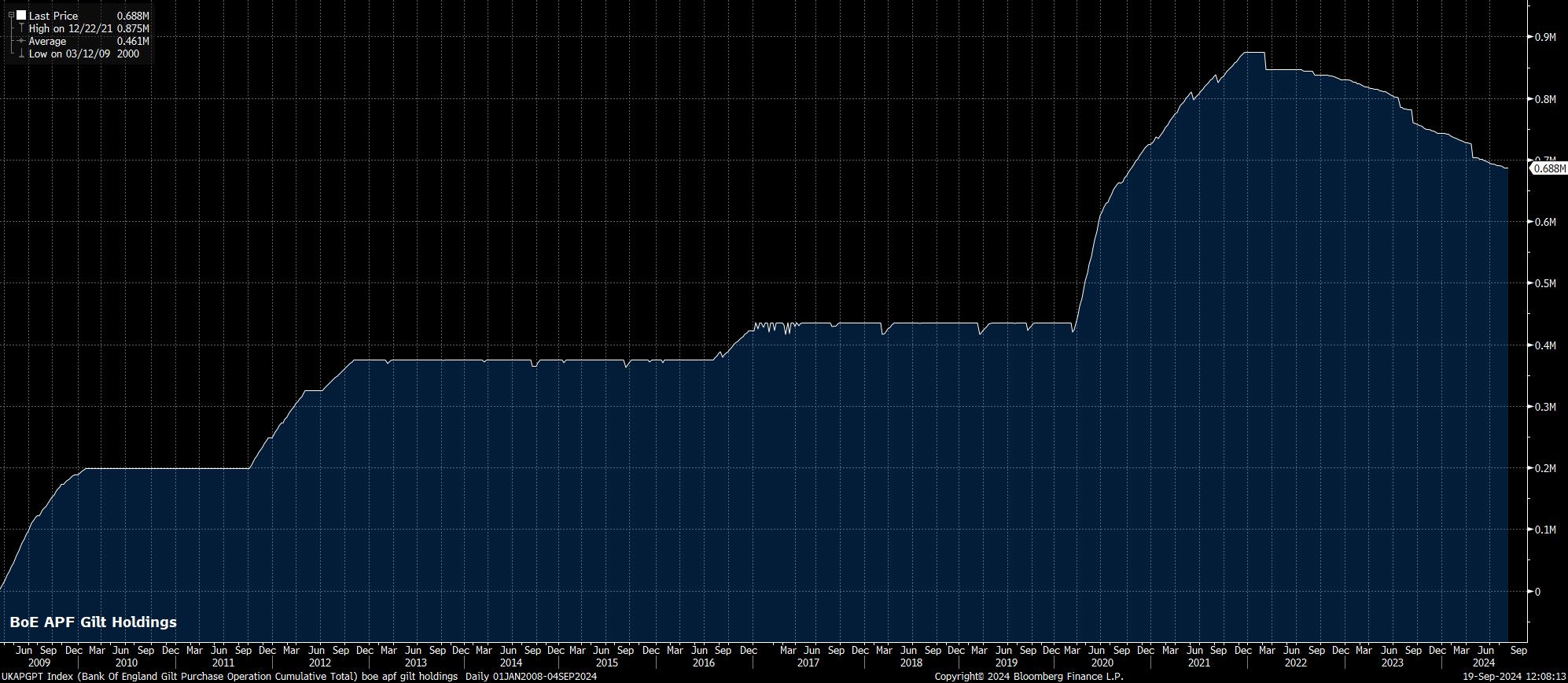

Away from the rate decision, the MPC’s annual review into the quantitative tightening process was the other main area of focus.

The MPC announced that the balance sheet would reduce by a further £100bln over the next year, in line with the current pace. This will, however, see the pace of active sales drop to £13bln, from the current £50bln, owing to the huge £87bln worth of redemptions due to take place next year.

More broadly, on the balance sheet, the BoE have a couple of issues. Firstly, ever-increasing usage of the Bank’s short-term repo facility, and rising repo rates, are warning signs of a potential funding squeeze within the economy, which shan’t be helped by today’s announcement. Furthermore, by continuing to run-down the balance sheet, at the same time as delivering Bank Rate cuts, the two principal monetary policy levers are working against each other – easing via rates, tightening via the balance sheet. One questions the sustainability of QT as the normalisation cycle progresses.

In reaction to the rate, and QT, decisions, the GBP OIS curve repriced very marginally in a hawkish direction, likely owing to the somewhat tighter than expected vote split, which consensus had seen as being 7-2. Nevertheless, the market continues to fully price a 25bp cut at the November meeting, while seeing around 46bp of cuts by year-end, just 4bp less over the rest of the year than prior to the decision.

More broadly, the GBP found buyers after the decision, albeit to a modest extent, with cable rallying north of the 1.33 figure, to fresh highs since March 2022. Gilts, in contrast, were softer across the curve, with yields from 2 – 10 years on the curve rising by around 3bp. The FTSE, meanwhile, was broadly unchanged, albeit did tick marginally lower from prior day highs.

_2024-09-19_12-10-31.jpg)

Overall, the September MPC decision is unlikely to be a game-changer for the BoE policy outlook. Once again, the Committee stressed a relatively patient approach towards further normalisation, which remains warranted given the relatively persistent nature of underlying price pressures within the UK economy. Quarterly cuts, of 25bp apiece, remain my base case for now, leaving the ‘Old Lady’ likely to deliver just one more cut this year, at the November MPC, in conjunction with the latest round of economic forecasts.

This outlook, of course, is rather more hawkish than that outlined by other G10 central banks, including the FOMC, who delivered a ‘jumbo’ 50bp cut yesterday. Consequently, the GBP is likely to remain underpinned in the medium-term, with 1.30 acting as a floor in cable for the time being.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.