- English (UK)

The Data Running Order

As alluded to, there will be rather a lot of data released on 16th December, thus potentially leading to a rather messy market reaction as all of the figures are digested.

First things first, the full November jobs report will be released, including both the establishment and the household survey. However, for the October report, only the establishment survey data will be released, with the BLS citing difficulties in collecting household data retroactively. This, in turn, means that there will be no unemployment or participation rate published for that month.

Meanwhile, the BLS have also noted that the November data collection period has been extended, owing to the lapse in federal funding, with the government shutdown not having ended until 14th November. Despite this, the assumption is that the BLS will continue to use the usual reference week criteria, namely collecting data that reflects the employment backdrop in the week containing the 12th of the month, this time out being w/c 10th November. For the purposes of this note, we will focus on the November data, unless explicitly stated otherwise.

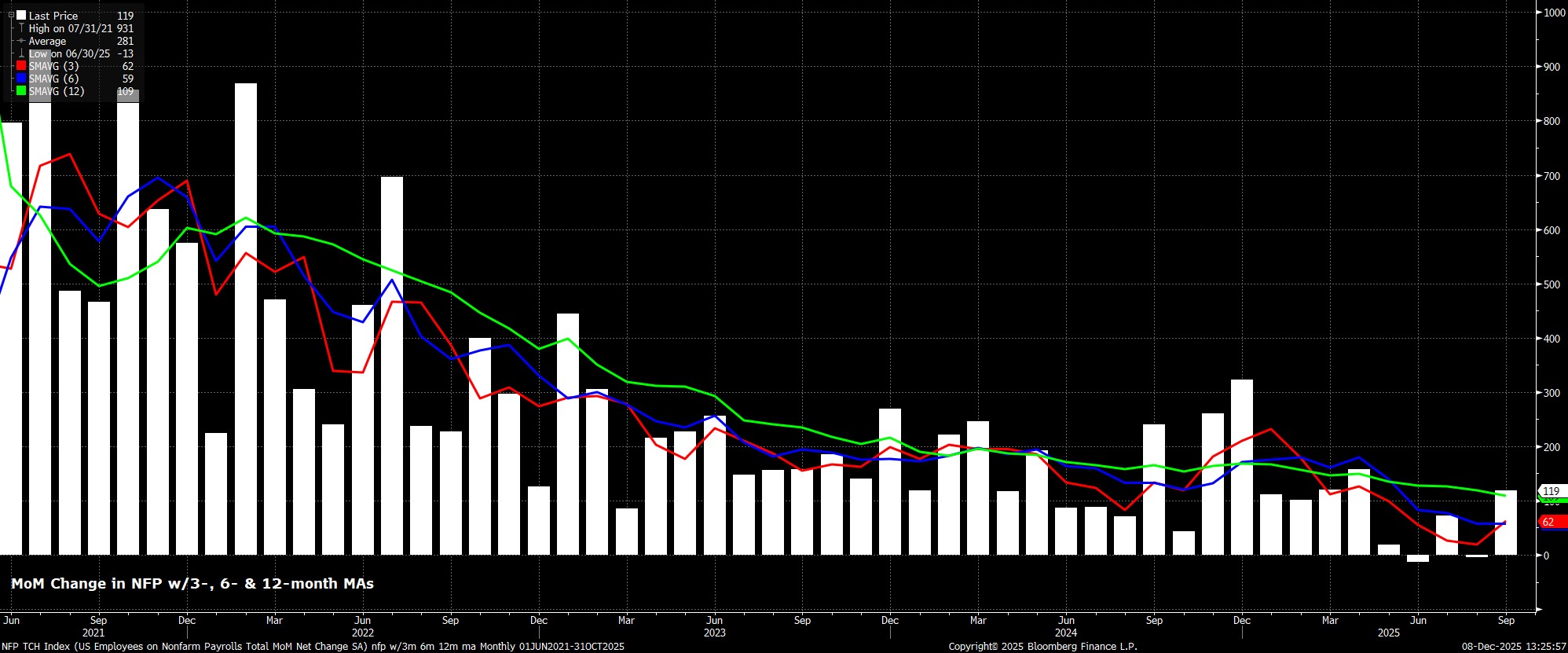

Payrolls Growth To Moderate

With housekeeping matters out of the way, we can turn to the data itself. Headline nonfarm payrolls are set to have risen by +40k last month which, while representing a fairly chunky slowdown from the +119k pace seen in September, would be near enough in line with the breakeven rate, which likely stands between 30k and 70k at the current time.

Leading Indicators A Mixed Bag

Once again, given the significant delay in the data being released, participants are in possession of a considerably greater number of leading indicators for the headline payrolls print than would be typical in ‘normal’ times.

Assuming the usual reference week, initial jobless claims fell by 10k between the October and November survey weeks, while having also fallen the same amount between the September and November surveys. Continuing claims, meanwhile, fell 14k between the November and October reference weeks, though rose 27k in comparison to the September survey.

Meanwhile, the employment components of both the ISM manufacturing and services surveys rose to their highest levels since May last month, though remained in contractionary territory, at 46.0 and 48.2 respectively. The ADP private payrolls metric, however, was somewhat more downbeat, pointing to employment having fallen by 32k on the month, the fourth monthly decline this year.

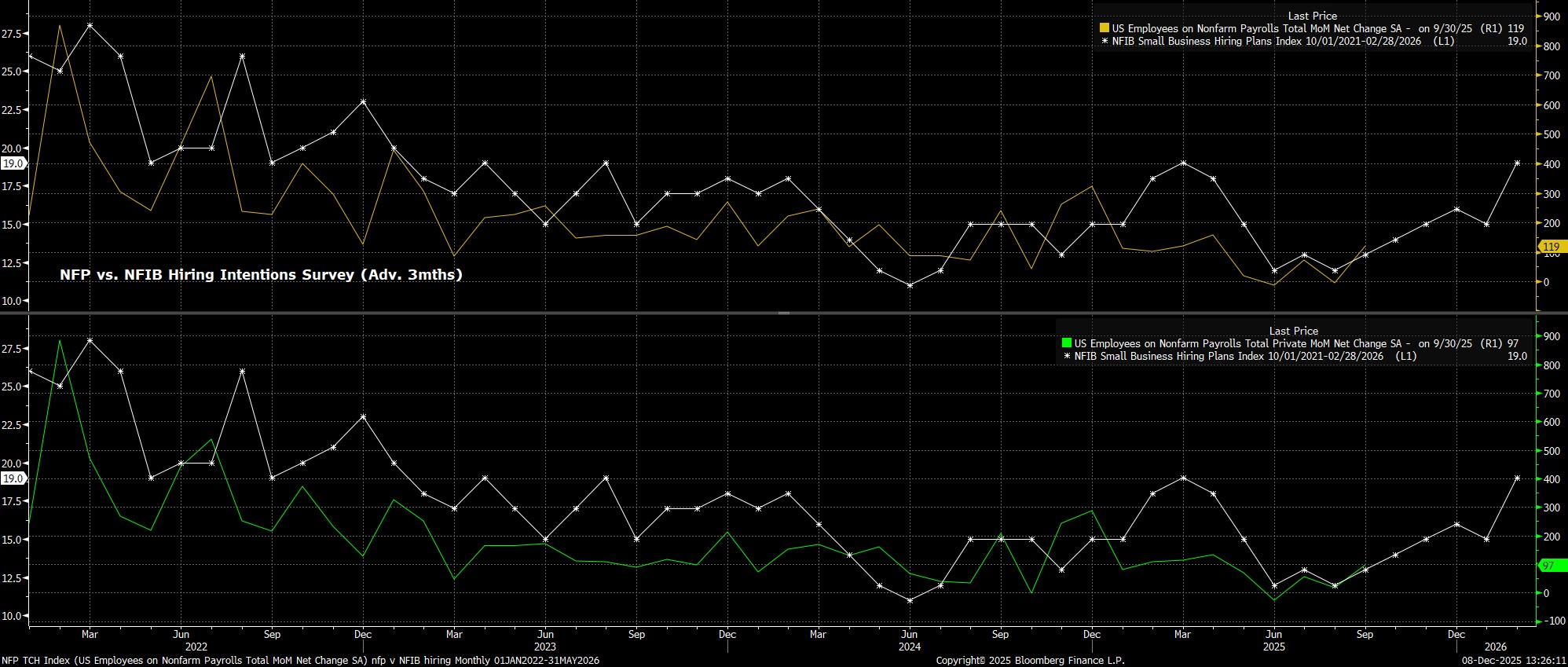

Finally, the NFIB’s hiring intentions survey remains a useful leading indicator for headline payrolls growth, and points to sizeable gains of approx. +130k in October, and +180k in November.

Shutdown & DOGE Impacts In Focus

In addition to those leading indicators, there are other factors that bear considering. Naturally, the government shutdown is the most obvious of these, though with those employees who were placed on furlough not only receiving full back pay, but also with no permanent layoffs having taken place.

Meanwhile, on the subject of layoffs, those who accepted a deferred resignation under the DOGE initiative earlier in the year will have fallen off government payrolls at the end of September. However, while more than 150k employees took advantage of the scheme, many may have found new employment in the intervening period, or left the labour force altogether, hence the precise impact on October payrolls is difficult to quantify.

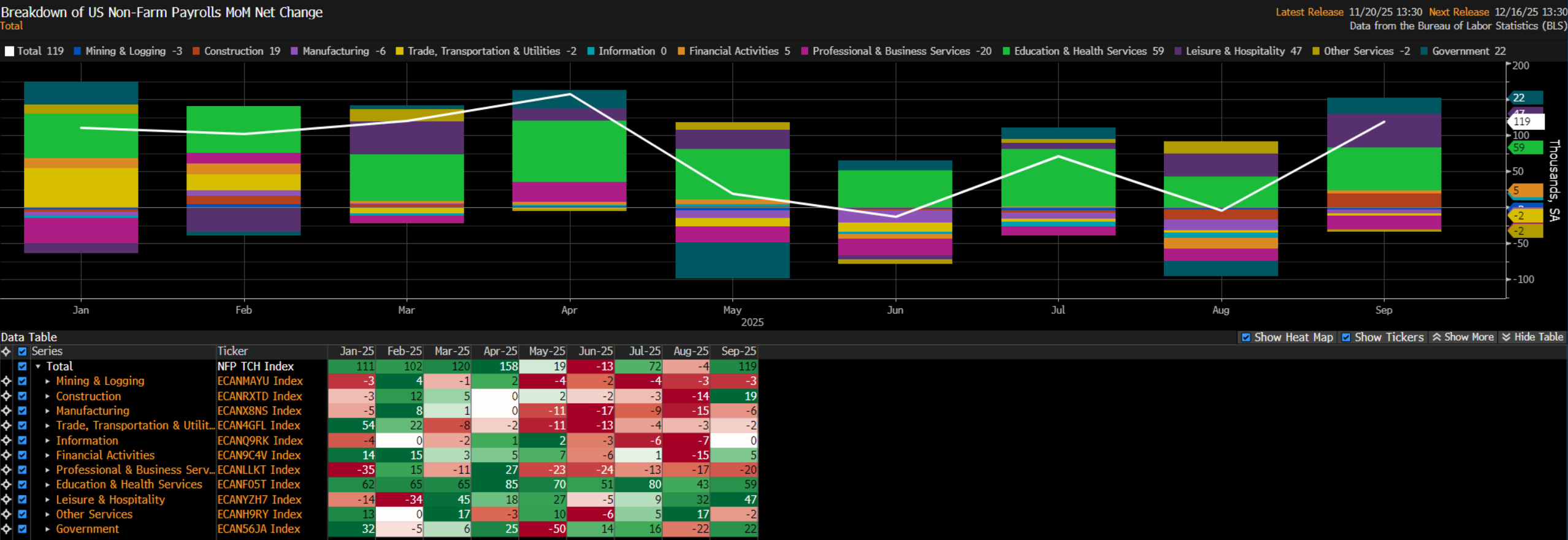

As for the November report, it will again be interesting to see whether hiring in the run-up to Thanksgiving and Christmas has boosted payrolls growth, while the composition of job gains will also remain in sharp focus, particularly with healthcare having underpinned the majority of job gains seen this year.

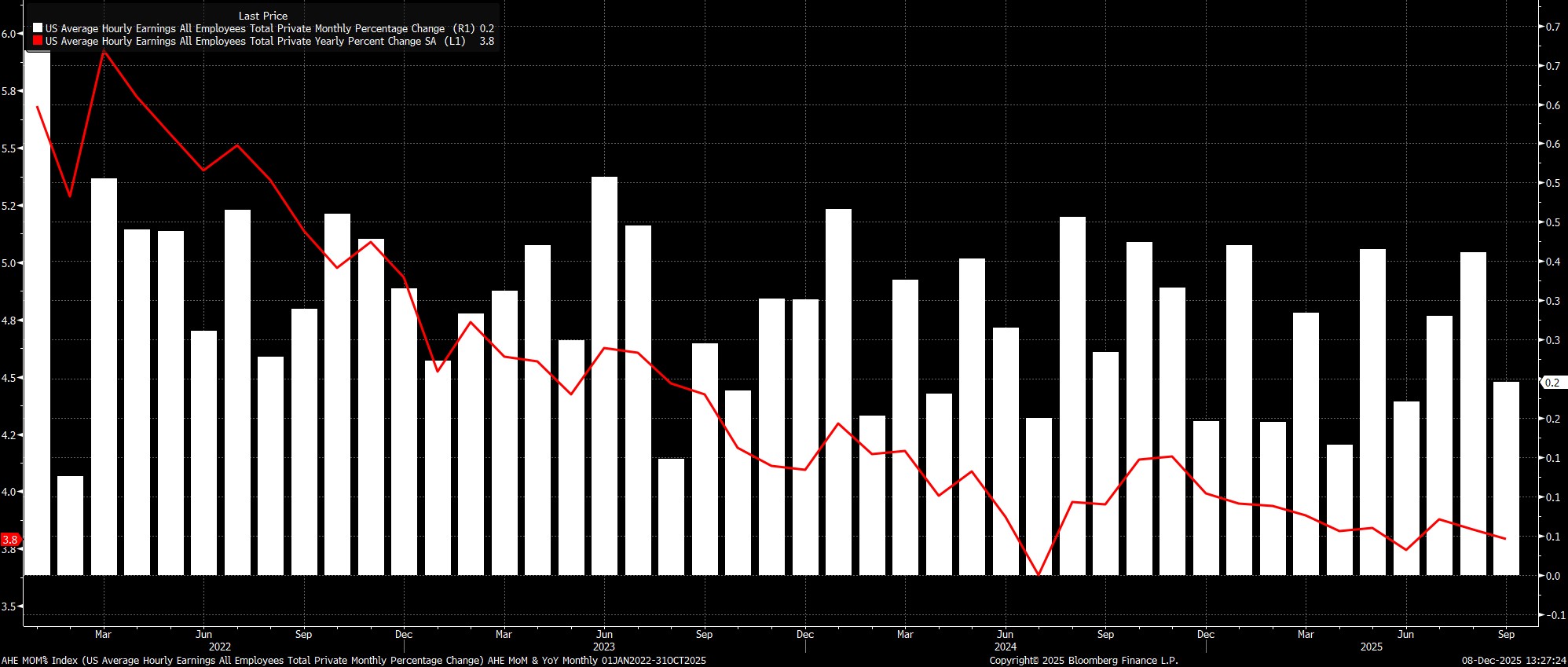

Earnings Pressures Remain Contained

Remaining with the establishment survey, the report is likely to point to earnings pressures remaining relatively contained, with average earnings seen climbing by 0.3% MoM in November, taking the YoY rate to 3.7%.

While, obviously, there is no prior to compare these figures to, data of that ilk would reinforce the FOMC’s now-familiar view that the labour market is not presently a considerable source of upside inflation risk, and is unlikely to imperil the disinflationary progress that should be made as next year progresses.

Household Survey To Show Further Slack

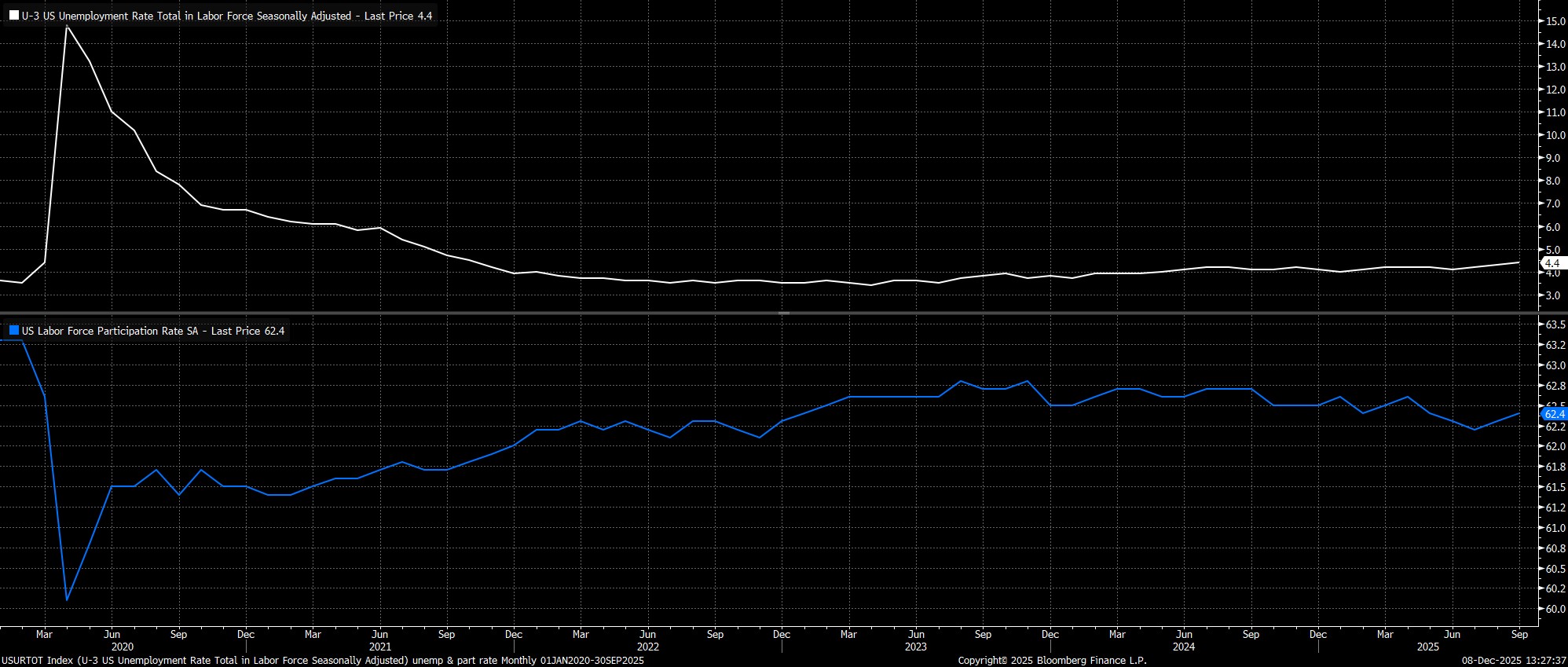

Turning to the household survey, headline unemployment rose to a fresh cycle high 4.4% in September, and is seen holding steady at that level in the November report.

However, on an unrounded basis, the U-3 rate stood at 4.4397% at the end of Q3, thus leaving a very low bar for the November figure to round up to 4.5%, which would not only be a fresh cycle high, but also be in line with the FOMC’s year-end unemployment rate forecast from the September SEP. Labour force participation, meanwhile, should remain around the 62.4% mark.

As has become typical, however, the household survey data must be taken with a ‘pinch of salt’, as the BLS continue to grapple with falling survey response rates, and the shifting composition of the labour market, largely resulting from tighter immigration enforcement.

FOMC Impact

For the FOMC, the upcoming labour market reports will not, on their own, materially alter the short-term policy outlook, not least considering that the December jobs data will also be released, in advance of the January confab.

In any case, assuming that the FOMC do indeed deliver a third straight cut at the final meeting of 2025, as is the overwhelmingly likely outcome, the Committee’s reaction function is likely to remain heavily tilted towards the employment side of the dual mandate.

Hence, barring a substantially hotter than expected slate of jobs data, the upcoming figures are unlikely to dispel the idea that the direction of travel for the fed funds rate remains lower, with the December report set to be the key determinant as to whether a fourth straight cut is delivered in January, or whether the Committee then stand pat until the March meeting.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.