- English (UK)

Payrolls Growth Seen Largely Unchanged

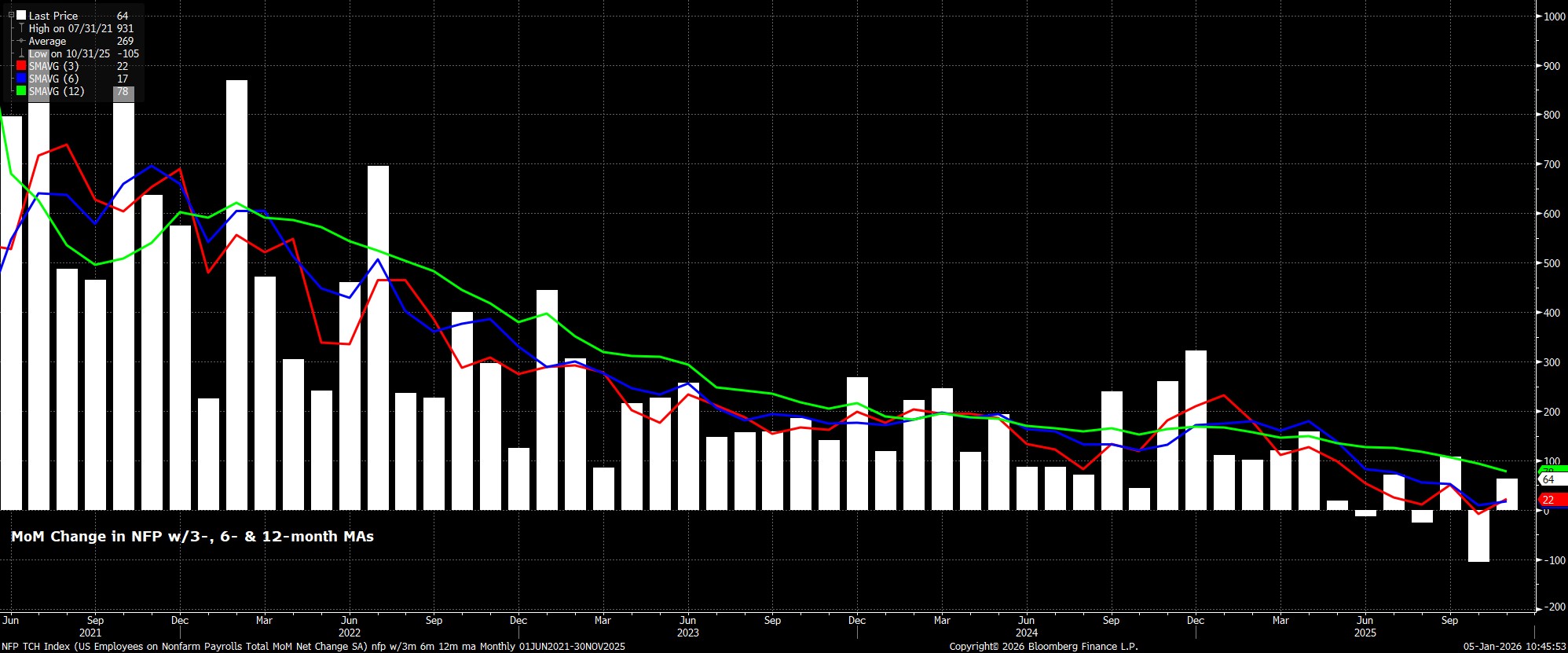

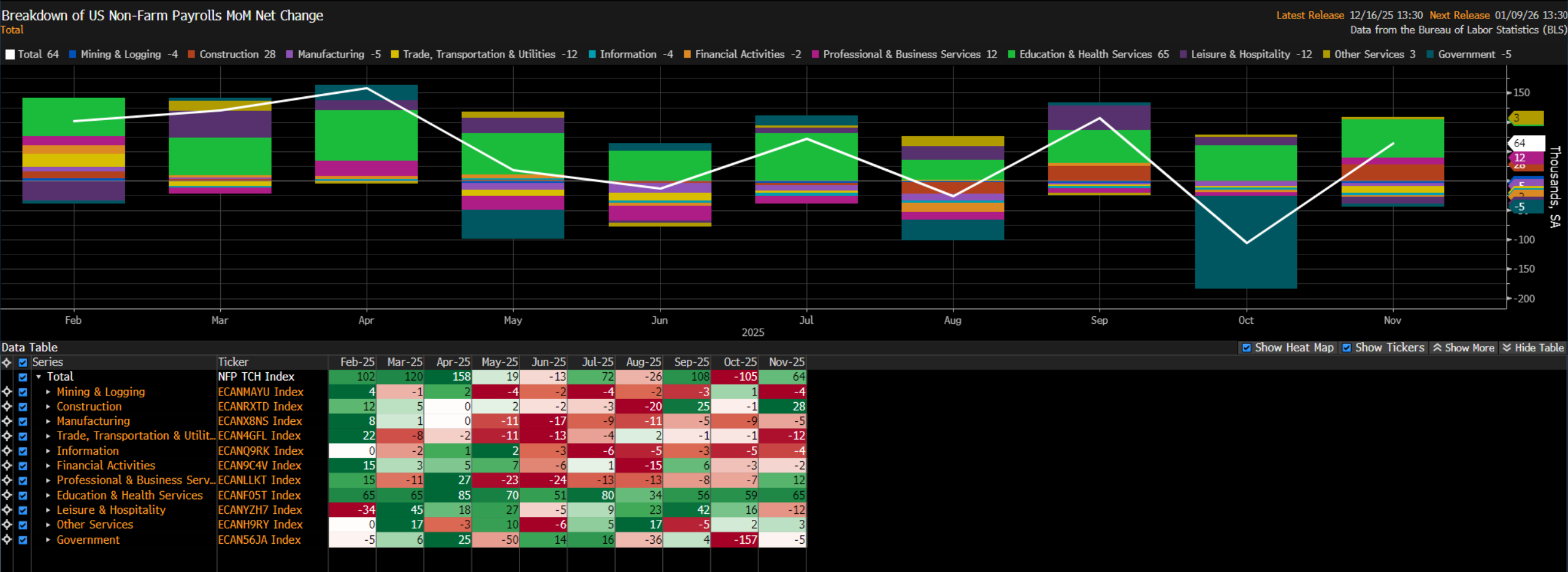

Headline nonfarm payrolls are set to have risen by +60k to round out the year, largely unchanged from the +64k pace seen in November. That said, it’s important to recall the Fed’s view, explained by Chair Powell at the December press conference, that the BLS data is likely overstating payrolls growth to the tune of around 60,000, thus meaning that a figure in line with consensus would, essentially, imply zero net job creation.

In any case, the range of estimates for the headline payrolls figure is as wide as usual, sitting between +25k and +155k, while the 2-month net revision also warrants significant attention, even if the potential for significant revisions is somewhat lower than usual, given the abnormally high survey response rate in November.

Leading Indicators Point To Upside Risks

By and large, leading indicators for the payrolls print lean in a positive direction. While neither of the ISM surveys have been released, at the time of writing, the weekly jobless claims metrics have trended in a positive direction. Initial claims, for instance, held steady between the November and December survey weeks, while continuing claims fell by a substantial 31k.

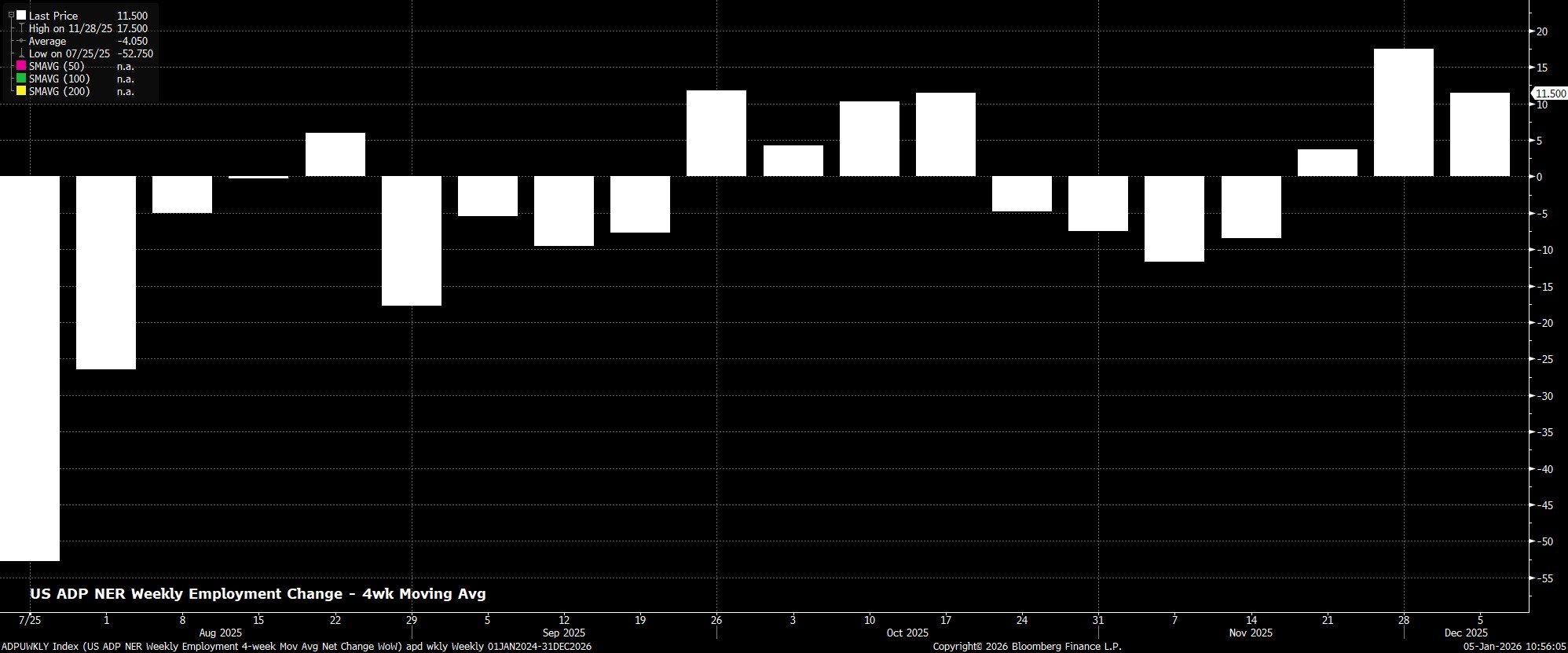

Meanwhile, although the relationship between the two has weakened of late, the NFIB’s hiring intentions survey points to a healthy – if slightly far-fetched – private payrolls gain in excess of +200k. Sticking with private payrolls, the ADP’s weekly estimate of payrolls growth pointed to an average weekly gain of +11.5k jobs in the four weeks to 5th December, the week before the BLS survey week, which would imply a monthly job gain of around +50k, roughly the midpoint of the range of estimates of the breakeven payrolls rate.

Factors To Watch

In keeping with recent months, it is assumed that government payrolls growth will remain at zero overall, not least considering the ongoing federal hiring freeze. In a similar vein, given the approx. 150k government layoffs seen in October, at the end of the deferred layoff programme, we can now assume that the majority, if not all, of the DOGE-linked layoffs have now made their way through the data.

Turning to private payrolls, there is some risk that the cold weather seen in December could depress job creation, especially in sectors such as construction, though any negative impact here should be relatively limited, considering that the worst of the weather came after the conclusion of the survey week. Speaking of sectors, though, close attention will again be paid to healthcare, with the industry having been responsible for essentially all of the job gains seen last time out.

Earnings Pressures To Remain Subdued

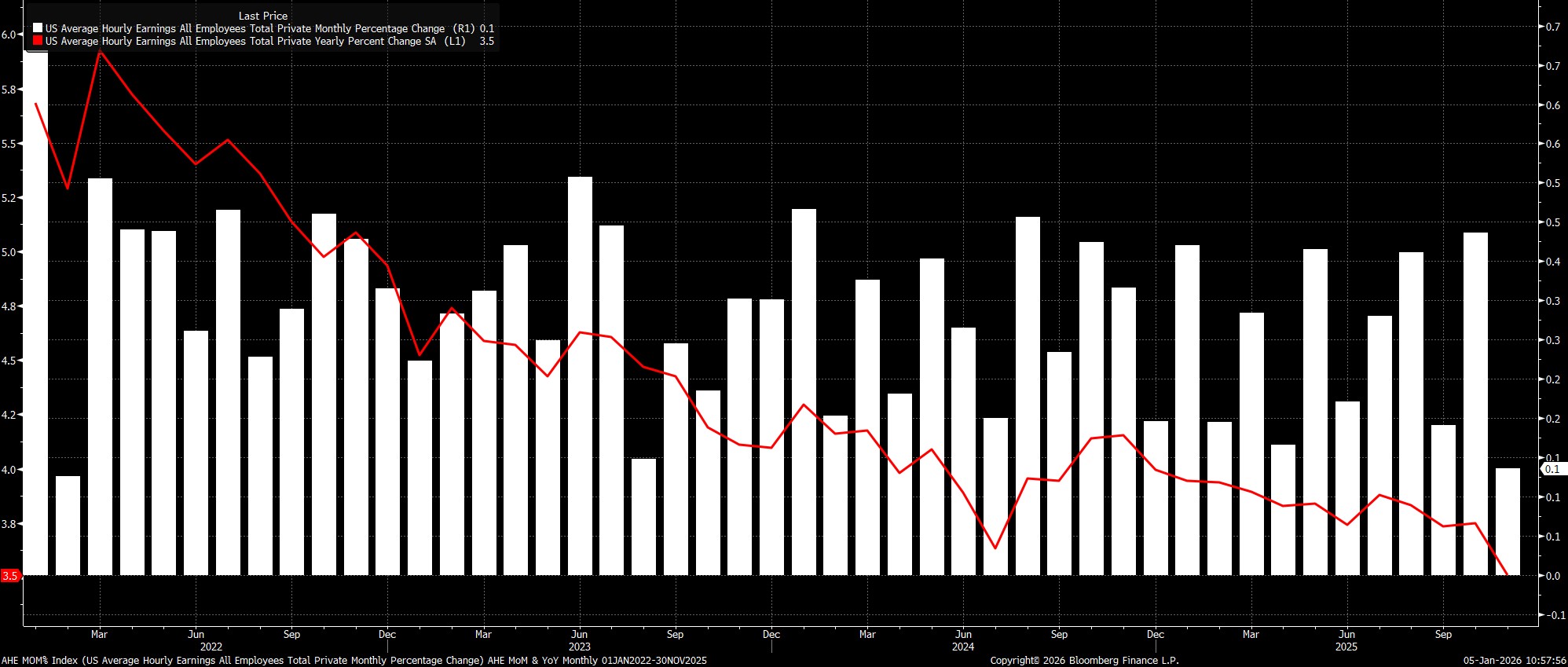

Sticking with the establishment survey, the report is likely to show earnings pressures having remained contained as the year drew to a close. Average hourly earnings are seen having risen 0.3% MoM/3.6% YoY, both being rates which would remain well within the range seen over the last six months or so.

Data in line with consensus expectations would serve to reinforce the long-standing view of Fed policymakers that the labour market is not presently a source of significant upside inflation risk, and that labour developments do not raise the risk of price pressures becoming persistent in nature.

Household Survey Key For Fed Outlook

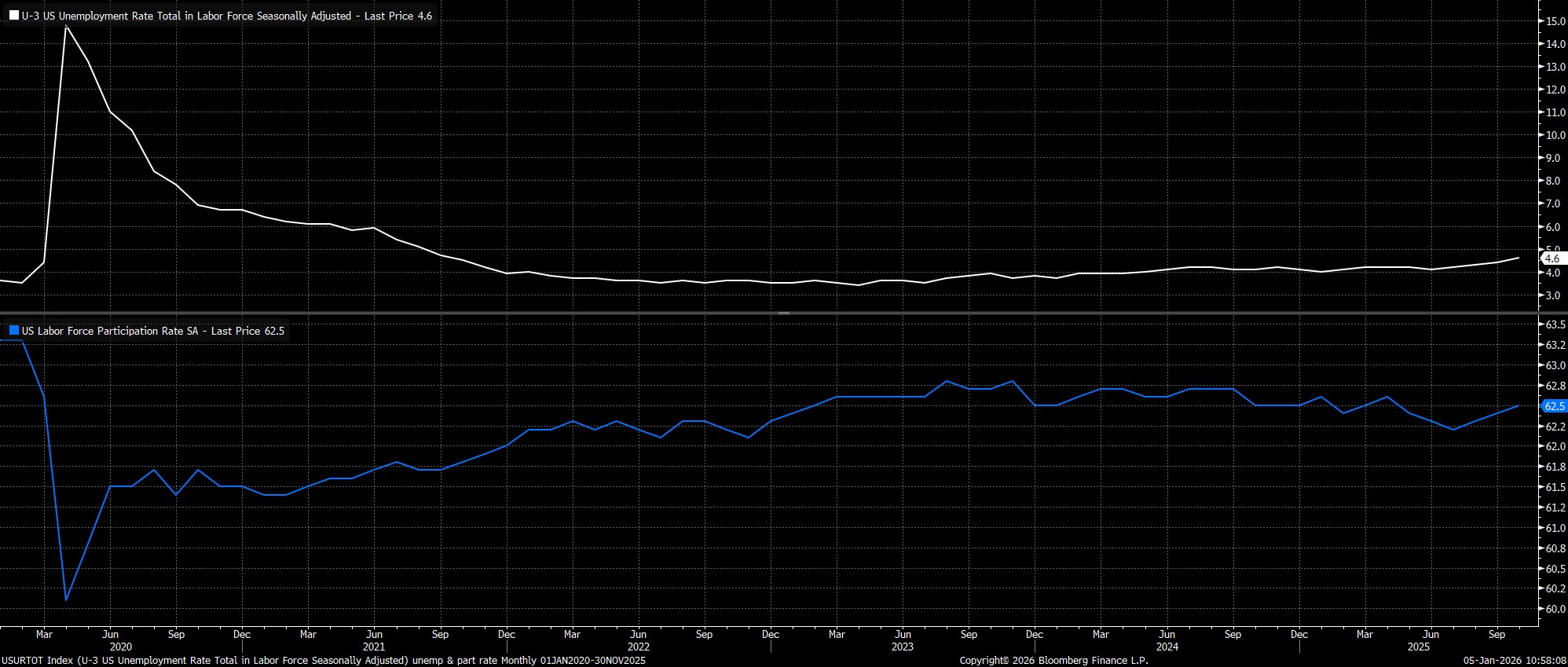

Turning to the household survey, headline unemployment is set to have declined modestly to 4.5% in December, pulling back from the 4.6% cycle high seen a month prior. Such a pullback would largely come by virtue of federal workers returning from temporary layoff at the conclusion of the government shutdown and, in any case, would likely not represent too significant a decline in joblessness, considering that the unrounded November U-3 rate stood at 4.5657%.

Meanwhile, labour force participation is expected to have moderated a touch, to 62.4%, though this would still be well within the range seen since ‘Liberation Day’ last April.

On a broader note, it’s important to recognise that the household survey is likely to play a more significant role in determining the near-term Fed policy outlook. This is largely a result of the aforementioned data quality concerns/payrolls overstatement which plagues the establishment data, though the household survey is not immune from said concerns either, not least considering falling survey response rates, along with the rapidly changing nature of the labour force. Technical factors, stemming from disruption as a result of the government shutdown, also mean the figures should be interpreted with caution.

Rate Reductions To Continue

The upcoming labour market report is unlikely to alter the direction of travel for the fed funds rate, with policymakers set to deliver further rate cuts over the course of the year ahead, seeking to return to a more neutral policy stance, in order to support the stalling employment situation.

In the short-term, however, a soft December report is likely to tilt the balance of risks in favour of the Committee delivering a fourth straight 25bp cut, at the January meeting. The USD OIS curve currently discounts a less than 20% chance of such an outcome, leaving open the scope for a significant dovish repricing of expectations in such a scenario.

On the other hand, a more robust report shan’t materially alter the direction of travel for rates, though may embolden some of the FOMC’s hawks to adopt more of a ‘wait and see’ approach, potentially pushing back the next cut until March. For the time being, however, my base case continues to favour another cut at the end of the month.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.