- English (UK)

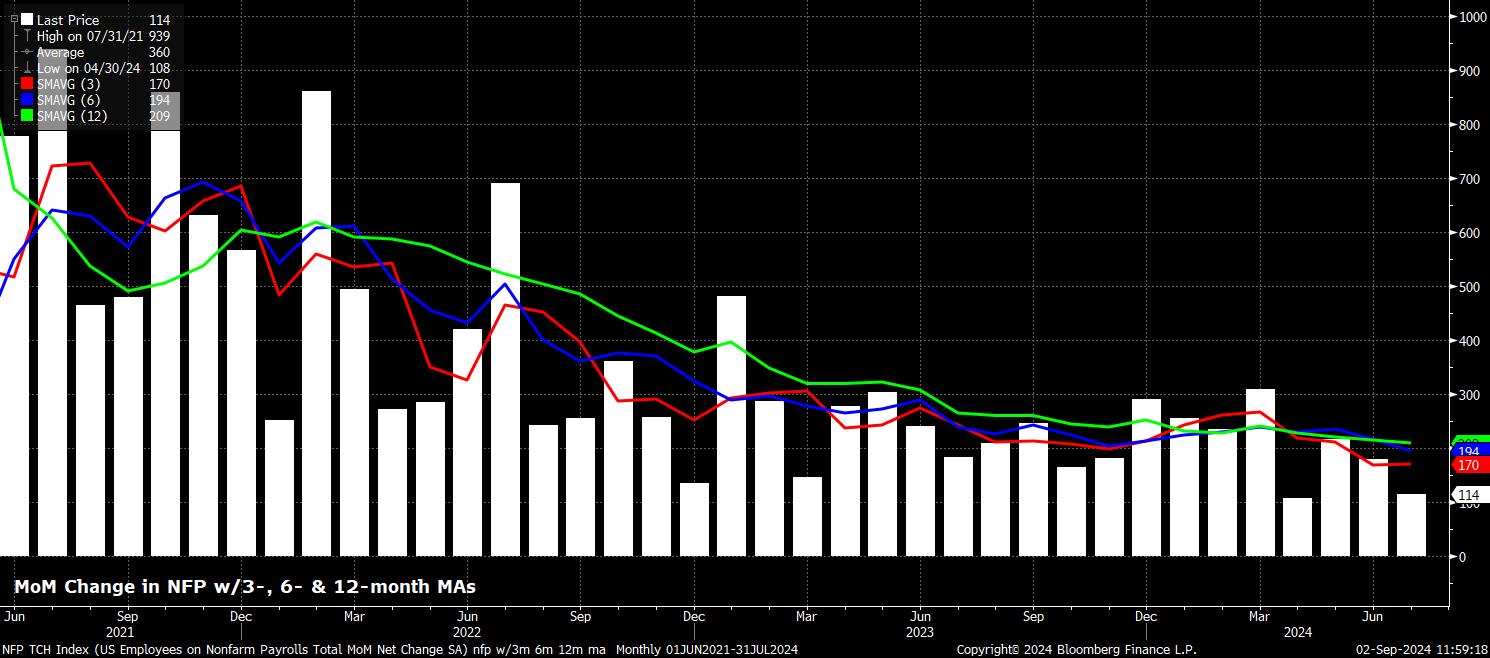

Headline nonfarm payrolls are set to have risen by +165k in August, a solid rebound from the disappointing +114k pace seen in July, which represented the weakest month of job creation since April, after the recent preliminary payrolls benchmark revision is taken into account. Such a pace, while representing a recovery from a sub-par July, would still be below the 3- and 6-month averages of job gains, which stand at +170k and +194k respectively, while also being below the breakeven pace of payrolls growth, approx. +225k, required for employment growth to keep pace with growth in the size of the labour force.

In any case, the range of estimates is, as usual, rather wide, with sell-side estimates sitting anywhere between +100k and +208k for the August print, at the time of writing.

Looking back to July’s report, a significant degree of the downside surprise was likely caused by the impact of Hurricane Beryl, which made landfall during the survey week.

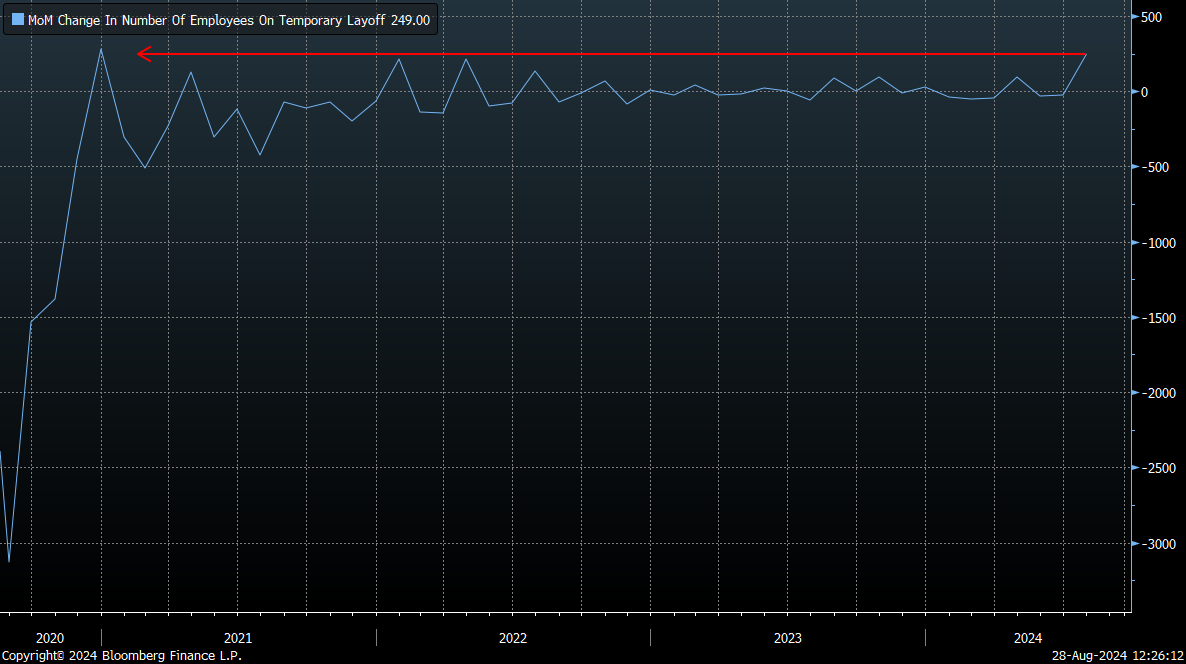

Though the BLS, officially, stated that the hurricane had “no discernible effect” on the data collected in July, this remark seemingly pertains more to the fact that data collection itself (i.e., conducting the establishment and household surveys) was not impacted by inclement weather, as opposed to meaning that the weather had no impact on overall labour market conditions. The hurricane likely subtracted somewhere between 20-30k from headline nonfarm payrolls, while July also saw temporary layoffs rise by 249k on an MoM basis, the biggest such increase since the tail end of 2020, when the economy was in the midst of the covid pandemic.

Data released since the July employment report also helps to support the idea that one-off factors contributed significantly to the worse-than-expected figures. Initial jobless claims, for example, fell by 12k between the July and August survey weeks, while continuing claims rose by 24k, although remain some way off prior cycle highs.

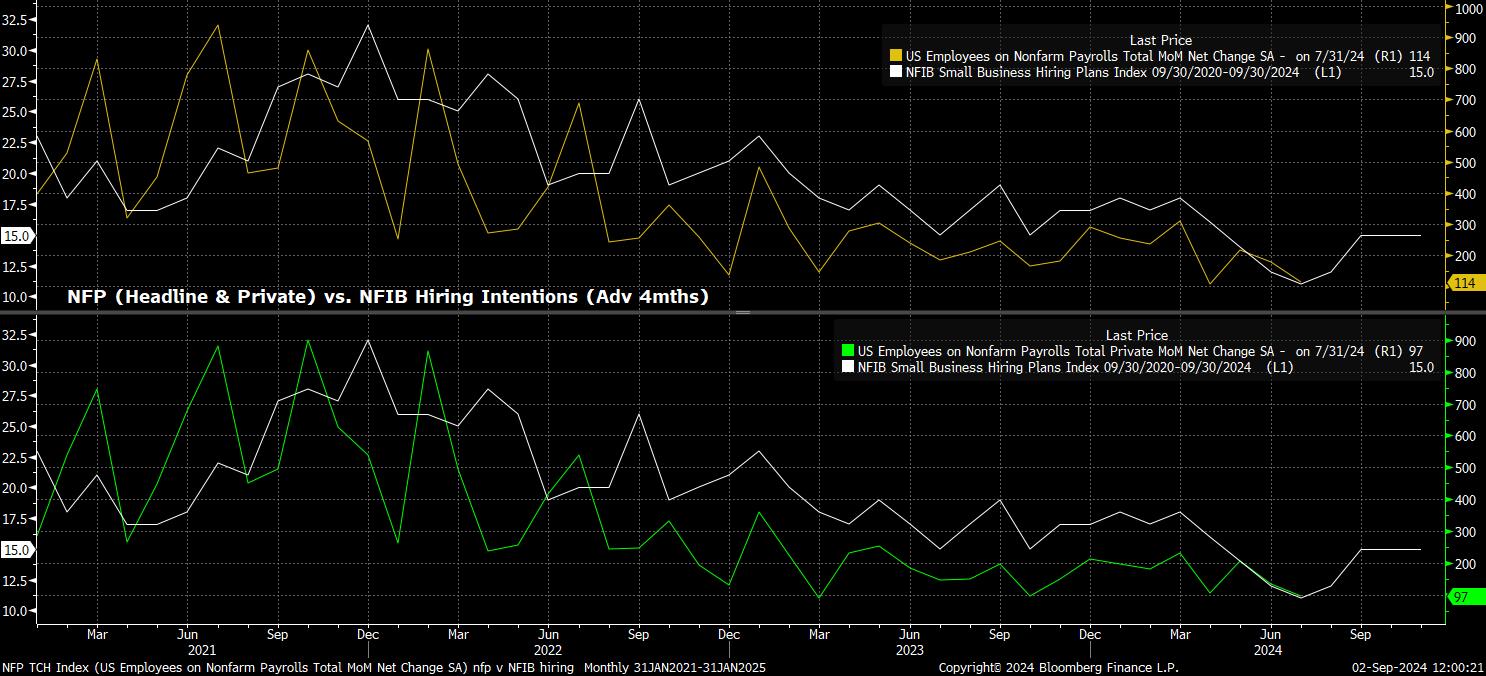

Meanwhile, the NFIB’s index of small business hiring intentions, which has been a remarkably reliable predictor of both headline, and private, payrolls growth, this cycle, pointed to hiring intentions holding steady in August, while the 3-4 month lag with headline NFP growth suggests a payrolls print around the 155k mark in Friday’s employment report. A handful of other leading indicators, such as the ISM PMI surveys, are yet to be released as of yet, being delayed due to the Labor Day holiday.

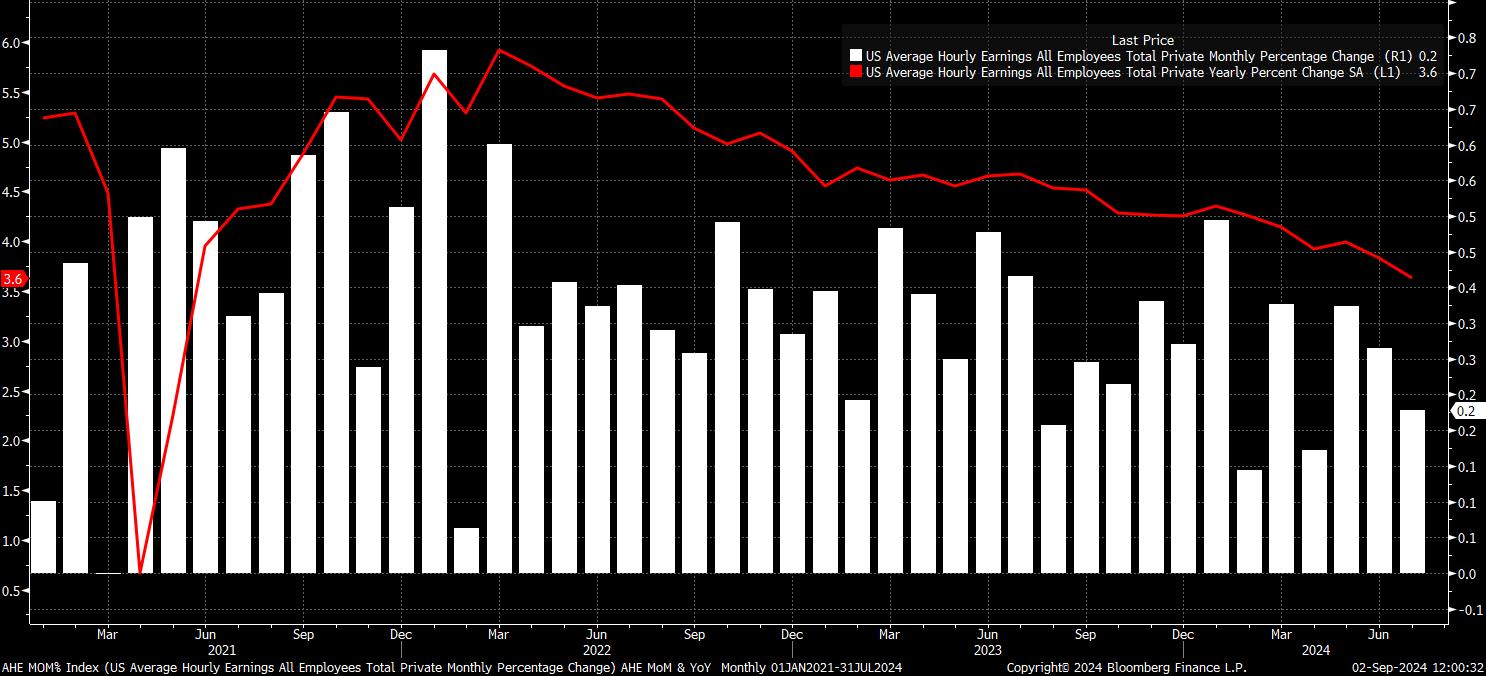

Sticking with the establishment survey, average hourly earnings are expected to have risen 0.3% MoM in August, a modest quickening from the 0.2% pace seen in July. At the same time, on an annual basis, earnings growth is also expected to tick 0.1pp higher, to 3.7% YoY.

Despite the expected uptick, neither of those prints are particularly likely to concern FOMC policymakers, with earnings pressures still contained, and the pace of real earnings growth not significant enough to cause risks of a wage-price spiral to re-emerge.

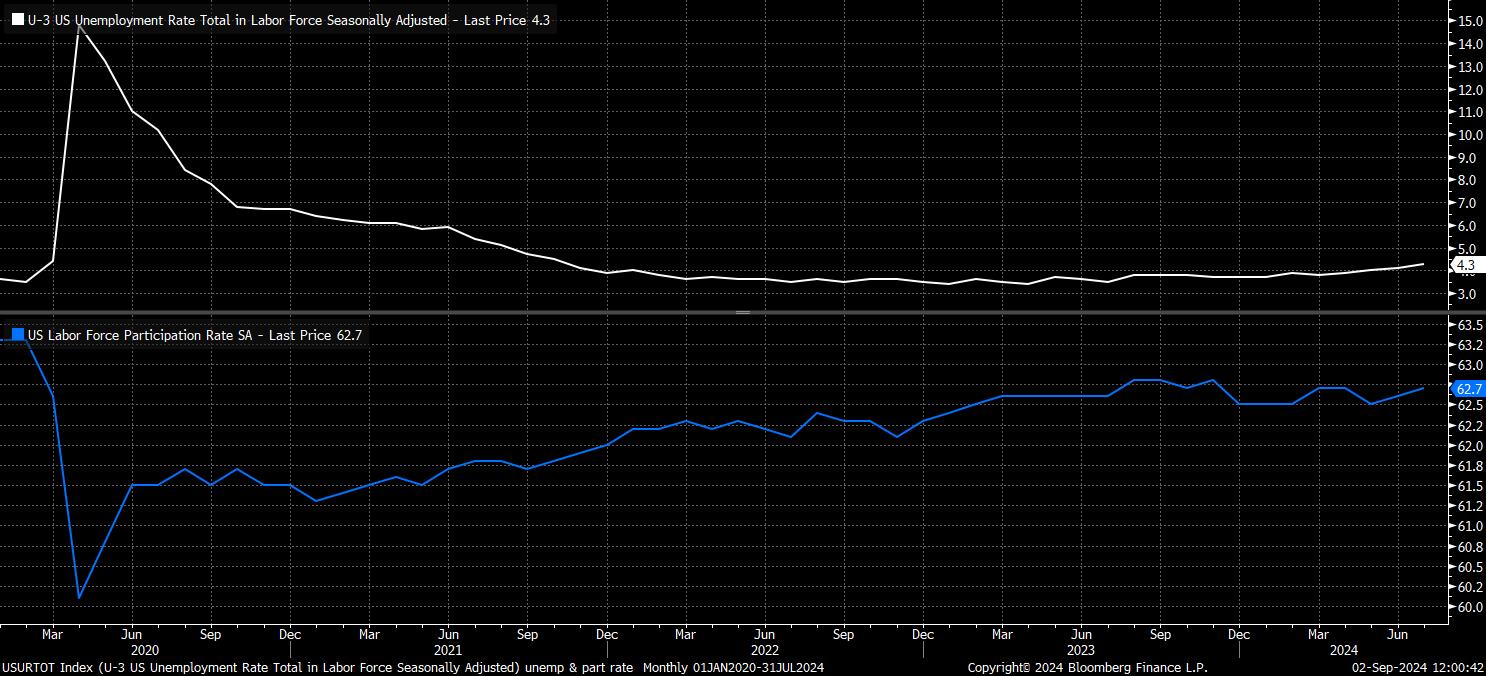

Turning to the household survey, headline unemployment is set to fall 0.1pp from the near 3-year highs seen in July, to 4.2%, though the range of estimates is also wide here, from 4.1% to 4.4%. Risks to the consensus unemployment estimate are likely tilted to the downside, owing to the aforementioned unwinding of temporary hurricane-linked layoffs.

Meanwhile, labour force participation is set to remain unchanged at 62.7%, just shy of the 62.8% cycle highs seen towards the middle of last year, and consolidating a recent rise seen during the summer months. This increase in participation is noteworthy, and also helps to further explain the recent rise in the unemployment rate, which owes not only to temporary layoffs, but also to more people entering the labour force, seeking employment.

Overall, the August jobs report will be a significant risk event for market participants to navigate, having taken on extra importance not only in the aftermath of July’s disappointing figures, but also in light of recent Fed commentary. Chair Powell, in remarks at Jackson Hole, noted that policymakers “don’t seek or welcome” a further cooling in labour market conditions, with the unemployment rate, in July, sitting 0.3pp above the FOMC’s median end-2024 forecast of 4.0%. Furthermore, labour market developments are now the primary, if not sole, determinant of the pace and magnitude of Fed policy normalisation over the short-term, with policymakers having achieved the required confidence in inflation returning towards the 2% target.

With this in mind, a softer-than-expected August report, coming hot on the heels of July’s downside surprise, would likely lead to a significant further dovish repricing of market-based rate expectations, with a 50bp September cut becoming the base case. Such a dovish repricing would be a headwind for the dollar, which has recovered some ground of late, while such dismal economic news would also likely be a negative catalyst for sentiment, with risk assets seeing a knee-jerk move lower. Any significant dips, though, remain buying opportunities, in my view, with the ‘Fed put’ still firmly in place.

That said, the overall balance of risks appears to tilt in the opposite direction, given the largely temporary nature of July’s negative employment catalysts, and the already aggressively dovish path – 100bp of cuts by year-end, 200bp by next July – discounted by the USD OIS curve.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

.png?height=420)