- English (UK)

Playbook For The June FOMC Decision

After a language shift at the May meeting, whereby further policy tightening was made conditional on incoming economic data, and with inflation (at least at a headline level) having continued to fade since, the 2-day FOMC meeting should conclude with policymakers voting to leave the target range for the fed funds rate at its present level of 5.00% - 5.25%. Markets, judging by overnight index swaps, price just a 30% chance of the Committee raising rates this month, though a more sizeable 21bps of tightening is priced by the July meeting.

Clearly, markets endorse the idea of a Fed ‘skip’, rather than May having brought an outright end to the tightening cycle. While caution must be used in drawing parallels from other G10 central banks, both the RBA and BoC have recently resumed hiking, having previously halted their respective tightening cycles; a similar move from the Fed, pausing in June to digest additional data, before raising rates again in July, seems a logical base case, particularly taking into account recent remarks in this vein from policymakers such as Governor Jefferson and voting FOMC member Harker.

With this in mind, the FOMC’s statement is likely to reiterate that further policy tightening will hinge on “the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”. Chair Powell is also likely to, again, at the post-meeting press conference, repeat his view that there will be an “ongoing assessment” as to whether policy is “sufficiently restrictive”, while likely also repeating that he sees rate cuts this year as unlikely.

Markets, over recent weeks, have repriced sharply in a hawkish direction, now pricing just 5bps worth of cuts by year-end, compared to as much as 100bps of loosening in the immediate aftermath of the Silicon Valley Bank collapse. The FOMC’s latest ‘dot plot’, released as part of the Summary of Economic Projections, is likely to broadly reflect current market pricing. The current 2023 median dot at 5.125% should be revised 25bps higher to signal a July hike, while the 2024 and 2025 dots will also likely be moved higher by the same magnitude, to indicate the same gradual pace of eventual policy easing.

In terms of the economic projections more broadly, some optimistic revisions are likely to both the Committee’s view on growth, and on the labour market. Incoming activity data has proved more resilient than previously expected, particularly in the services sector, leaving the current forecast of 0.4% GDP growth in 2023 looking rather low, particularly given the 1.3% annualised QoQ pace of expansion seen in Q1. The 2023 GDP expectation should be revised a handful of percentage points higher, though little change will likely be seen in the longer-run expectations.

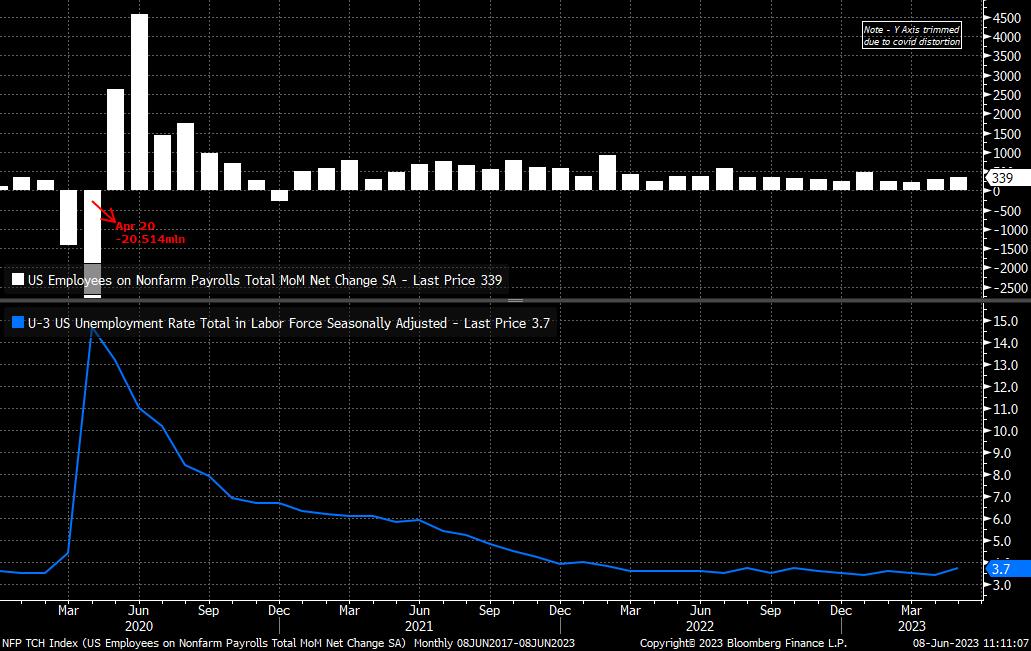

Meanwhile, the current call for unemployment to rise to 4.5% by the end of this year is also looking too pessimistic, considering both the current U-3 rate of 3.7%, and the economy having added an average of 341k jobs on a monthly basis over the last year. While anecdotal news of layoffs has been rising, particularly in the tech sector, realising the FOMC’s current forecast would require a sudden and significant deterioration in the jobs market in a very short space of time. A revision to the year-end forecast to nearer 4% seems likely, with perhaps more modest revisions to the 2024 and 2025 expectations.

Rounding out the economic forecasts, the FOMC are unlikely to significantly alter their present inflation expectations, seeing both headline and core PCE above 2% through to the end of the forecast horizon in 2025.

Turning to financial markets, and equities come into the FOMC on a positive note, though there is the significant matter of the May US CPI report due just a day prior to the Fed’s announcement, which may throw a spanner in the works. Nevertheless, with tech continuing to lead the charge higher, the S&P 500 continues to rally, with the bulls starting to flex their muscles having decisively broken north of 4,200.

To the upside, immediate resistance stands at 4,325, the high seen last August, with support coming at the 4,200 handle, before the 50-day moving average below at 4,165. While a hawkish surprise is possible, equities continue to look like a ‘buy on dips’ at this juncture.

Meanwhile, for the USD, the meet also comes at a time with the dollar index (DXY) having paused its recent rally, and begun to consolidate within a tight 103.50 – 104.50 range. These, clearly, mark out the initial levels to watch, with the 50-day MA below, and 200-day MA above, also deserving a place on traders’ radars.

_D_2023-06-08_11-08-28.jpg)

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.