- English (UK)

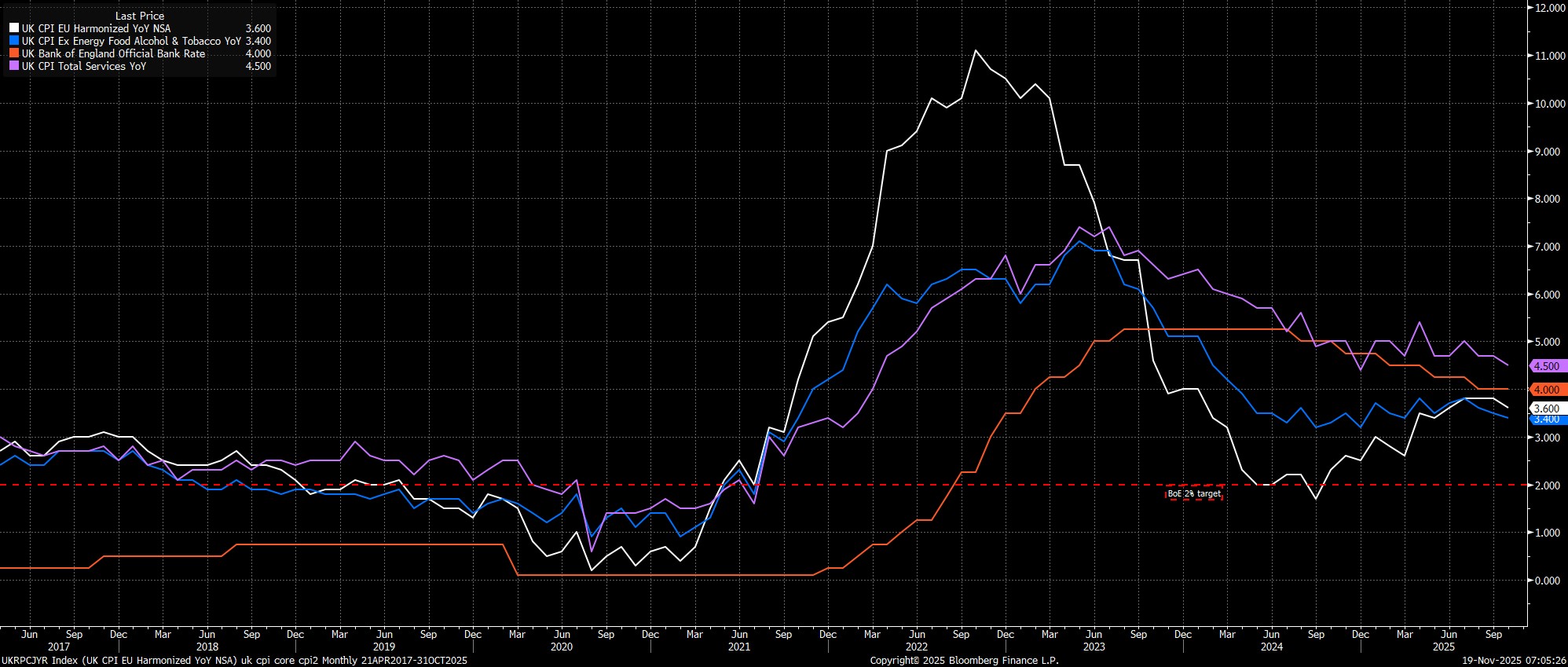

Headline prices rose 3.6% YoY last month, a touch above consensus expectations, though in line with the Bank of England's forecast as outlined in the November MPR. Meanwhile measures of underlying price pressures also pointed to conditions cooling further, with core CPI rising 3.4% YoY, the slowest pace since March, and with services prices rising 4.5% YoY, cooler than the MPC's 4.6% forecast, and the slowest rate seen this year.

As expected, a significant chunk of the disinflationary pressure at the headline level came by virtue of a favourable base effect stemming from energy prices. However, the details of the report will provide policymakers with reassurance that the risk of inflation persistence continues to subside, particularly with further easing seen in the household services category.

On the whole, this morning's data helps to reinforce the case for the Bank of England to deliver another 25bp cut at the final MPC meeting of the year, next month. Policymakers are now likely to be considerably more confident that September will indeed mark the peak for headline inflation this cycle, while the risk of price pressures proving persistent has also continued to subside, as the labour market begins to weaken at a worryingly rapid rate.

As a result, my base case remains that there is little to prevent the MPC's dovish contingent from remaining in favour of a 25bp cut at the December meeting, with Governor Bailey likely joining those doves in order to vote through such a rate reduction. In the base case, that rate cut would then be followed up with another such move at the February meeting, as policymakers pivot to support an ailing growth backdrop, providing that disinflationary progress, in line with the path outlined in the November MPR, continues to be made over the winter.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.