- English (UK)

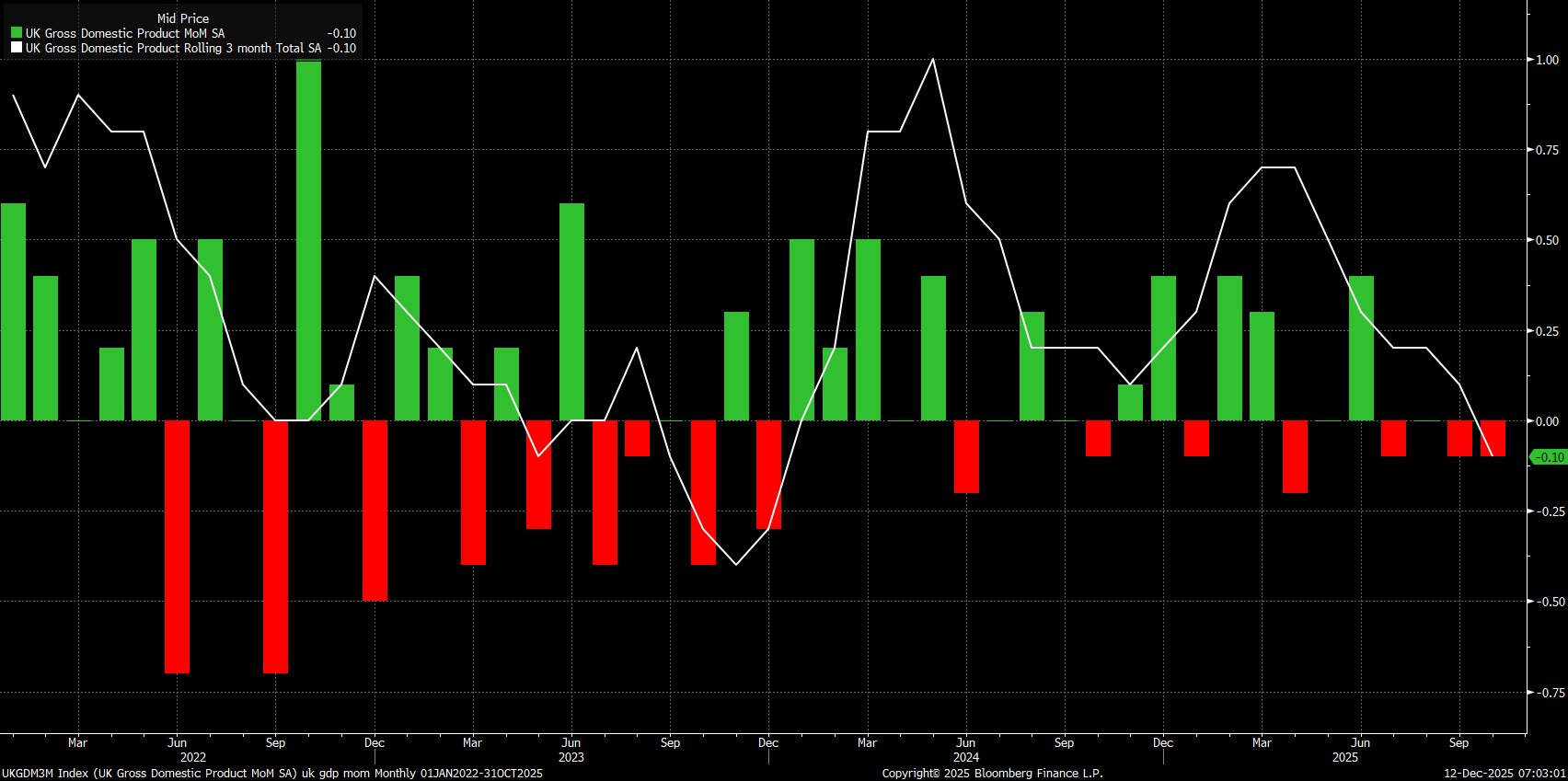

This morning's UK GDP figures pointed to the economy having unexpectedly shrunk by 0.1% MoM in October, thus marking a second straight monthly decline in overall economic output, as pre-Budget uncertainty acted as a handbrake on the economy through the autumn. Meanwhile, on a rolling 3-month basis, the economy also contracted by 0.1%, the first such contraction since the tail end of 2023.

While the Budget has now been announced, and a degree of fiscal uncertainty has lifted, it's important to recall that the Budget itself contained no measures whatsoever aimed at boosting economic growth, meaning that a recovery in economic output into year-end, and into 2026, is far from guaranteed.

Furthermore, while the October GDP data is relatively stale at this stage, more timely economic indicators having signalled a deterioration in the economic backdrop since. November's PMIs, for instance, pointed to a very modest pace of expansion in the services sector, while construction output fell at its fastest pace in over five years.

In fact, risks to the UK outlook continue to tilt firmly to the downside, not least amid the still-fragile political backdrop, but also as a greater margin of labour market slack continues to develop. That said, with headline inflation having now likely peaked at 3.8% YoY during the summer, and a disinflationary trend becoming relatively well-embedded, the Bank of England's Monetary Policy Committee remain on course to round out the year with a 25bp Bank Rate cut next Thursday.

The pace of further cuts beyond then, and particularly whether the MPC deliver another cut at the February meeting, will largely hinge on not only further disinflationary progress, in line with the November forecasts, being made, but likely also the labour market continuing to loosen, in turn further reducing the risks of price pressures becoming more persistent.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.