Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

- English (UK)

Nvidia stock analysis: Three trading scenarios ahead of GTC 2025

Growing uncertainty towards the US macro environment and Trump’s trade policy agenda, as well as disappointment in the company's recent guidance for Q126 gross margins, has seen the share price (on Pepperstone’s 24-hour CFDs) trade to $108.84.

However, we’re now seeing the buyers stepping up and having more of a say and supporting the price at the 3 February swing low. The current technical setup shows the price at an inflection point, and with that in mind we consider the probabilities behind the market’s next move.

3 Tactical Scenarios to Consider

Thinking tactically, we pose three key scenarios that could affect the price action and the technical picture in the near term:

1. Investors look to buy Nvidia at current levels feeling the risk vs reward trade-off has shifted and engage in tactical long positions into the GTC developers conference (on 17-20 March), knowing GTC has historically been the platform for strong buying activity.

2. The would-be buyers hold off until the overhang issues (export controls, tariff uncertainty) are better known, and with greater certainty to price future revenues and gross margins, buyers step up after the facts are known.

3. Alternatively, momentum-focused traders may look at short positions on a daily close below $114.76, with a view that the sellers are dominating, with the risk skewed towards a further decline into $101/$100.

Concerns on Trump’s Future Policy Directives Holding the Buyer’s Back

The major concern hanging over the stock, and keeping the would-be buyers away is Trump’s impending export controls to China and jurisdictions such as Singapore. While the impact Trump’s tariff policy will have on margins remains a known unknown that also impacts sentiment.

Questions around the hyperscalers (Meta, Google, Microsoft, Amazon) capex plans for 2026 and onwards linger, while increasing competition from China as an AI hub, is another factor that has impacted the share price and is well worth monitoring.

All that said, the future still looks bright for Nvidia. As we heard in the recent earnings call the Blackwell ramp is clearly evolving well and offers real confidence that the consensus estimates for gross margins and sales for the quarters ahead are perhaps conservative.

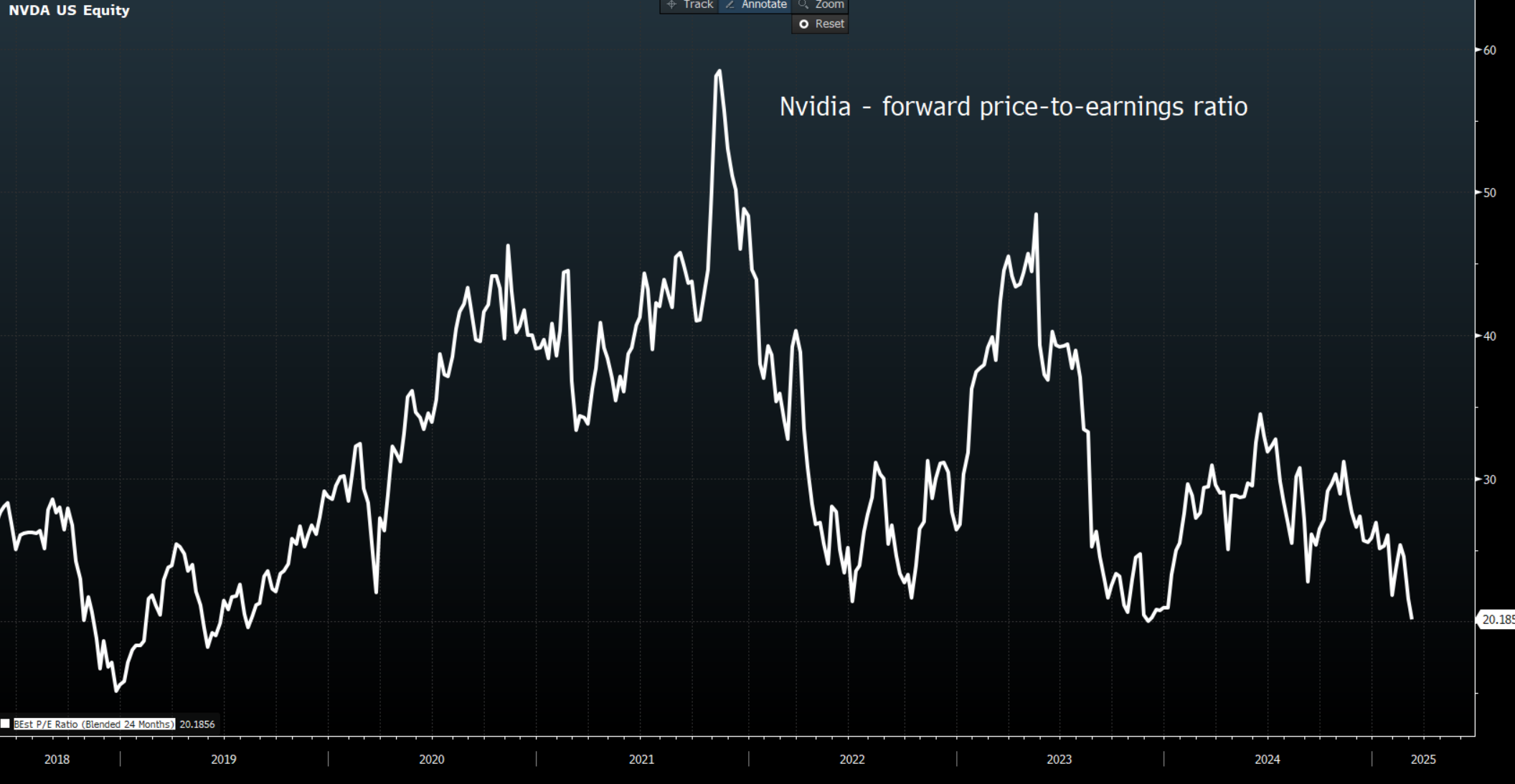

Valuation metrics have also pulled to levels that have historically marked turning points in the share price – the buyers see the stock on sale, and many consider the optimal time to make a move.

Nvidia’s GTC Conference a Historically Positive Event

Market players look to Nvidia’s GTC Conference on 17-20 March and given past form, with the share price gaining 8.1% on average through past conferences, market players may look to buy ahead of what is likely to be a wholly positive event. The GTC developers conference is the highlight of the calendar for Nvidia’s investor base, with CEO Jensen Huang and other senior personnel offering key insights into its technology roadmap and the vision for AI and the future business model.

Another factor that could catalyse an upside move in the share price is the positioning in the options market. Nvidia's 1-month put volatility is priced at a 6.6 vol premium to calls, detailing a sizeable skew in investor demand for protection from further falls in the share price.

We also see Nvidia’s 30-day realised volatility at 83% - the highest level of vol since May 2020. Subsequently, if Nvidia’s share price were to kick higher, options traders would be compelled to sell volatility and close out of their existing puts, which, in turn, would have a positive effect on the underlying share price.

The Trade?

We need to be open-minded to any of the three scenarios playing out – I personally like the tactical view of buying Nvidia into GTC, but I am cognisant that the overhang risks remain, and I would therefore cut out should the price close below $114.76. I would also argue that the consensus position from investors and money managers is to hold off until the overhang concerns are better known and when they have increased visibility to more confidently price margins and sales – once known, the prospect of a strong rally is certainly there.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.