- English (UK)

Nvidia Posts Impressive Earnings: Revenue, Margins, Outlook and Market Reaction

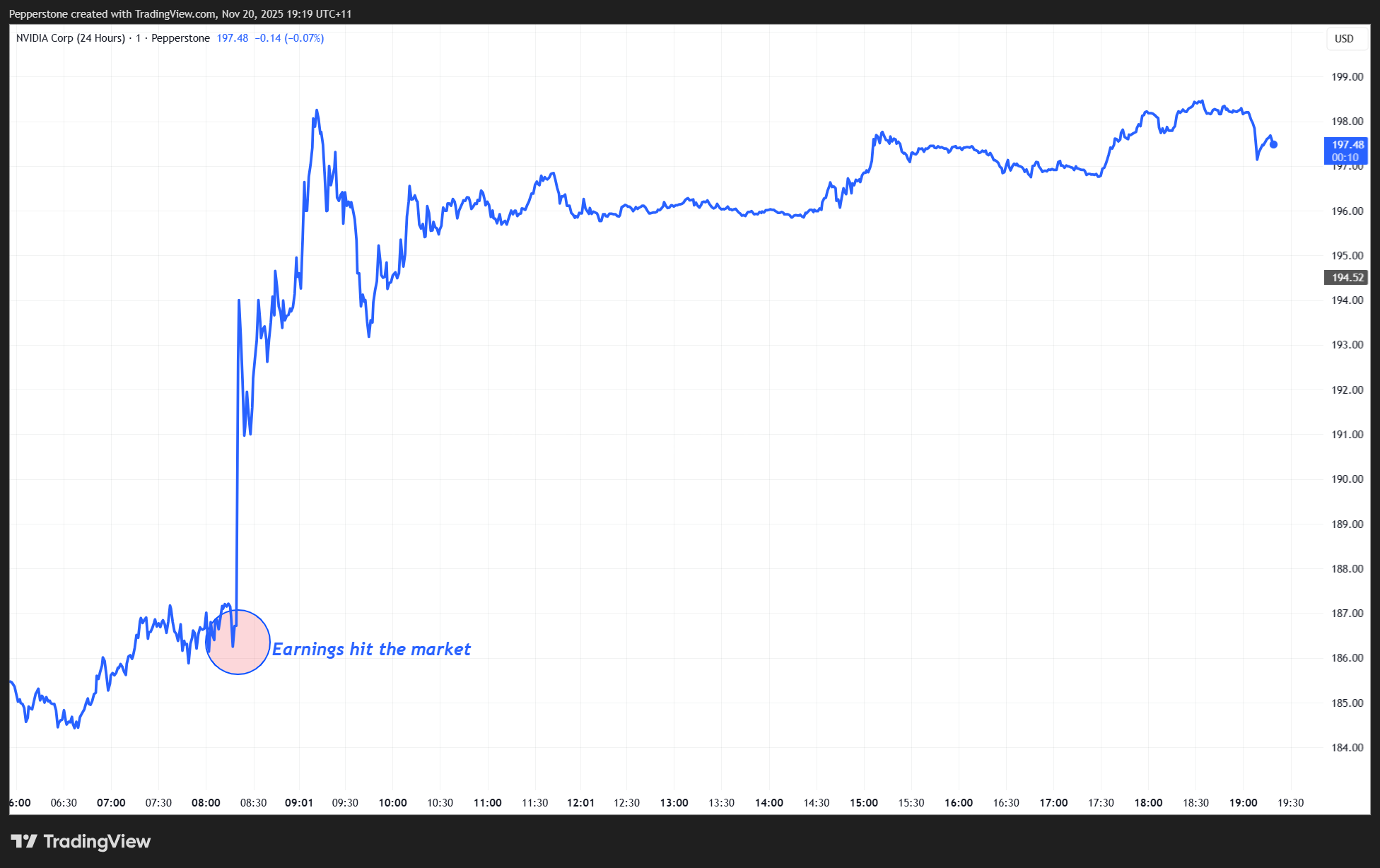

Market Reaction: Strong Gains Across NVDA, Semis, and the NASDAQ

Nvidia 24-hour CFDs rallied to a session high of $198.53 (+6.2%) following the earnings release. The positive sentiment spread quickly:

• The broader semiconductor sector strengthened

• NASDAQ 100 futures gained +1.8%

Traders are now asking whether these results are enough to reverse the recent negative sentiment surrounding AI and semiconductors—and whether Nvidia can:

• Push back above $200, and

• Re-test the all-time high of $212.11

Alternatively, some caution that the earnings rally could fade if investors sell into strength, dragging price back toward key support at $179.20.

My view: The higher-probability outcome is a run toward the all-time highs.

Key Results: Nvidia’s Q3 Earnings and Q4 Guidance

The Numbers That Have Hit Home:

• Q3 sales: $57B vs. $55.2B expected

• Q4 revenue guidance: $65B vs. $62B expected

• Q3 gross margin: 73.6% (in line)

• Q4 gross margin guidance: 75% vs. 74.7% expected

• Data-center revenue: $51.2B vs. $49.34B expected

Despite elevated expectations, Nvidia delivered a solid beat on Q3 results, and the $3B beat on Q4 revenue guidance was the standout metric driving the stock higher. With gross margins trending up and Nvidia’s flawless track record of over-delivering, the company continues to cement its position as the premier AI play across both training and inference.

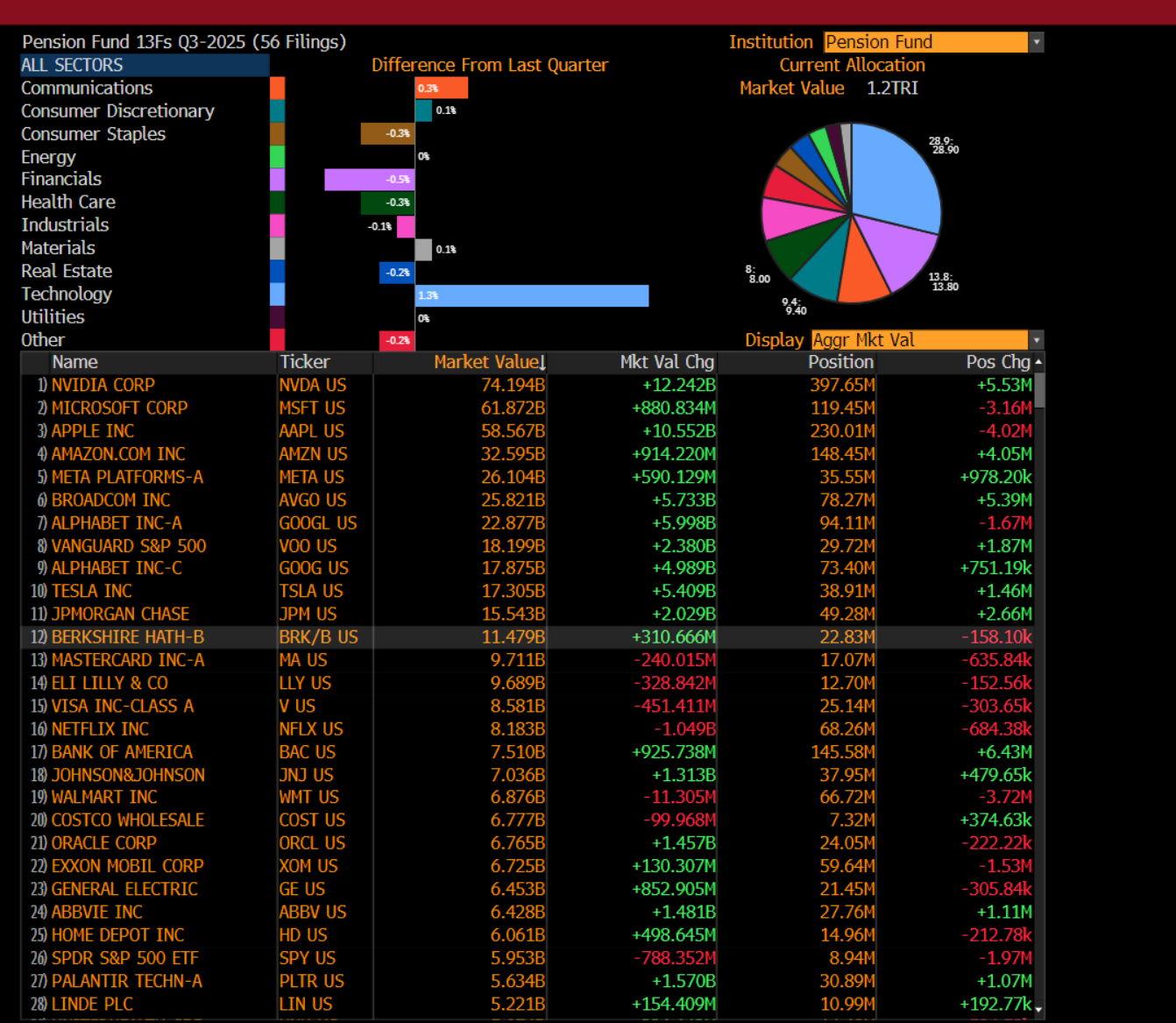

Institutional ownership remains enormous—397 million Nvidia shares are held by pension funds and asset managers, more than three times the next-largest S&P 500 holding (Microsoft). Nvidia’s 8% index weight makes it a mandated holding for many.

Explosive Demand for Blackwell Architecture

Investors weren’t only impressed by the numbers, the commentary around demand was extraordinarily bullish. As expected, CEO Jensen Huang offered a positive outlook, but the tone was particularly strong.

Key highlights from management:

• “Blackwell GPUs are sold out”

• Demand for Blackwell chips described as “off the charts”

• Blackwell is now Nvidia’s leading architecture

• Nvidia’s cloud GPUs are sold out

This messaging underscores Nvidia’s continued dominance in AI compute and the near-limitless appetite for its GPU ecosystem.

Where Nvidia Fell Slightly Short: OpEx and Free Cash Flow

A few areas came in softer than expected:

• Operating expenses: $5.0B (slightly above forecasts)

• Free cash flow: $22B vs. ~$28B expected

However, neither metric was large enough to dent sentiment, with the market focused squarely on the strength of revenue, margins, and forward demand.

Bottom Line: Nvidia Delivers Another Impressive Quarter

Nvidia exceeded expectations across the board, delivering:

• A major Q3 revenue beat

• Strong Q4 guidance

• Explosive data-center growth

• Red-hot demand for Blackwell GPUs

• Strong and rising gross margins

Despite minor softness in operating expenses and free cash flow, Nvidia remains the clear global leader in AI compute. The business is in a true “sweet spot,” and lingering concerns about an “AI bubble” have been tempered by overwhelming demand for Nvidia’s products—suggesting any meaningful risk is a post-2027 story at the earliest.

For traders, the focus now shifts to whether analysts revise earnings estimates higher, and whether the market decides to chase the move.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.