- English (UK)

NVIDIA (NVDA) Q4 26 Preview: Data Center Remains Strong, Three Key Risks to Watch

.jpg)

After the U.S. market closes on February 25, NVIDIA (NVDA) is set to release its Q4 26 earnings. Since the beginning of the year, the stock has traded sideways between $170 and $195, reflecting trader concerns over tech valuations, the sustainability of large-scale AI capex, and caution around downstream AI application profitability.

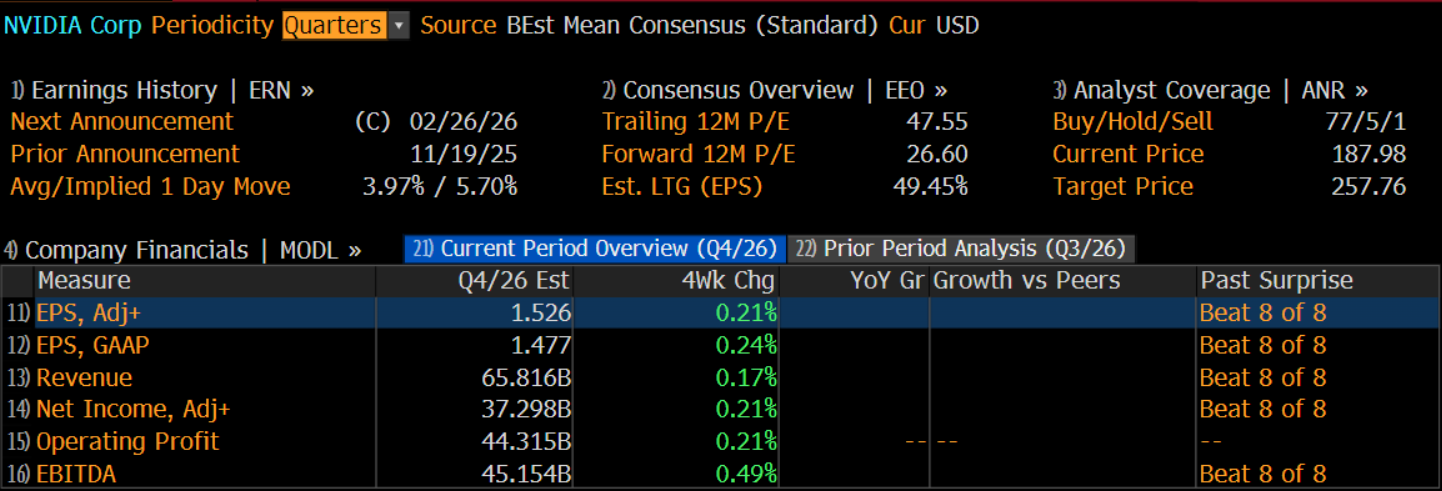

That said, Wall Street remains broadly optimistic ahead of the report. Consensus estimates call for adjusted EPS of $1.53, above the prior $1.30; revenue of approximately $65.8B, up 67.3% YoY; and gross margin expected to remain near 75%. Adjusted net income is projected around $37.3B, a 69% increase YoY. Meanwhile, Q1 revenue guidance of $71.6B signals continued growth momentum.

.png)

However, traders generally see upside as largely priced in. The focus is shifting to data center growth, Blackwell chip shipment pacing, TSMC capacity allocation, how NVIDIA’s market share will hold up against in-house chips, and prospects for China sales. Until 2027 revenue visibility becomes clearer, market sentiment remains cautious.

Data Center Business: Growth and Structural Shifts

The most critical part of this earnings report is undoubtedly NVIDIA’s data center segment—the company’s main growth engine. Even in Q3, despite Chinese export restrictions, the business still accounted for 89.8% of segment revenue, underscoring its central role in overall earnings.

Looking at the customer base, the four major AI players—Microsoft, Amazon, Google, and Meta—still account for roughly 40%-45% of data center revenue. Their combined 2026 capital expenditures are projected at $650–660B, up 60% YoY. This not only provides NVIDIA with a stable “base” but also helps explain the stock’s resilience despite elevated valuations.

Other key clients, including Tesla, Oracle, and OpenAI, as well as emerging AI model companies like Anthropic and CRWV, are also ramping up purchases. Compared with hyperscale cloud providers, these clients rely more heavily on NVIDIA’s full software ecosystem and compute solutions, contributing more to gross margin.

On the supply side, TSMC’s CoWoS packaging capacity continues to ramp, gradually easing prior bottlenecks. Against the backdrop of $500B in backlog orders, this supports sustainable delivery for Blackwell and the upcoming Rubin series chips.

It’s worth noting that although NVIDIA holds roughly 80% of the global high-end AI training market and the CUDA software ecosystem provides a strong moat due to high switching costs, the data center growth structure is quietly evolving.

Through collaborations with companies like Groq, NVIDIA is transitioning from explosive early training demand to a “training and inference parallel” model. This is expected to enhance pricing power in the inference market while supporting the company’s valuation.

Three Key Risks: Rising Competition, China Business, and Cash Flow Pressure

Despite the solid performance of its core data center business, risks remain.

First, competition is quietly intensifying. Over the past year, Google and Broadcom benefited from TPU shipments, boosting their stock prices. Although Google’s capital expenditures nearly doubled this year, most of the new budget is expected to go toward TPU and ASIC development. The increasing share of in-house solutions has objectively limited incremental demand for NVIDIA chips.

Meanwhile, Microsoft’s MAIA, Amazon’s Trainium, Meta’s MITA, and AMD’s MI450 series are all encroaching on what was once a highly concentrated high-end training market. NVIDIA remains the industry leader, but its “go-to option” status is no longer uncontested.

Second, uncertainty around the China market persists. While the U.S. has eased H200 export restrictions, approvals and actual sales in China remain uncertain. If policies loosen further, NVIDIA could gain additional revenue flexibility; otherwise, earnings resilience could be challenged.

Financial structure also warrants attention. NVIDIA’s Q3 accounts receivable reached approximately $33.4B, and inventory increased 32% QoQ. Against the narrative of “sold-out products,” rising Q4 inventory could raise questions about true demand.

Meanwhile, Q3 operating cash flow was $14.5B, significantly below net income of $19.3B, translating into a cash conversion rate of just 75%. This indicates that book profits have not yet fully converted into actual cash. Given the company’s reliance on a small number of key customers, any slowdown in their capital spending could pressure cash flow timing and quality.

Revenue Visibility is the Key Variable

Overall, strong AI capital expenditure trends, relatively clear order visibility, and a robust ecosystem moat underpin Wall Street’s moderately optimistic view for NVIDIA’s Q4 results. Short-term earnings delivery itself is not the main market concern.

However, implied volatility ahead of earnings is only about 5.7%, well below that of Meta and Amazon, suggesting that positive factors are largely priced in, and the market is not attributing extra premium to “beats.”

Post-earnings stock performance will hinge less on single-quarter numbers and more on the quality of growth. Traders are focused on whether cash flow can keep pace with profit expansion, whether demand from non-hyperscale customers can pick up the slack, whether competition from in-house chips remains manageable, whether the China market outlook improves, and whether the Rubin next-generation product ramp is clear.

If management signals continued capital spending and demand spillover during the earnings call, the stock could see a short-term boost. Conversely, if results merely “meet expectations” and guidance turns cautious, profit-taking is more likely.

Beyond the report, the March GPU Technology Conference and the cadence of new product launches could serve as the next reference points for medium-term stock movements.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.